Kestra Private Wealth Services, the hybrid RIA subsidiary of Kestra Financial, has augmented its reach in the Northeast with breakaway team from Merrill Lynch.

On Wednesday, the Austin, Texas-based firm announced the addition of Attain Wealth Partners to its platform. The team, based in Zanesville, Ohio, brings $500 million in client assets and is led by co-founders Shakir Kaka and David Weinberg.

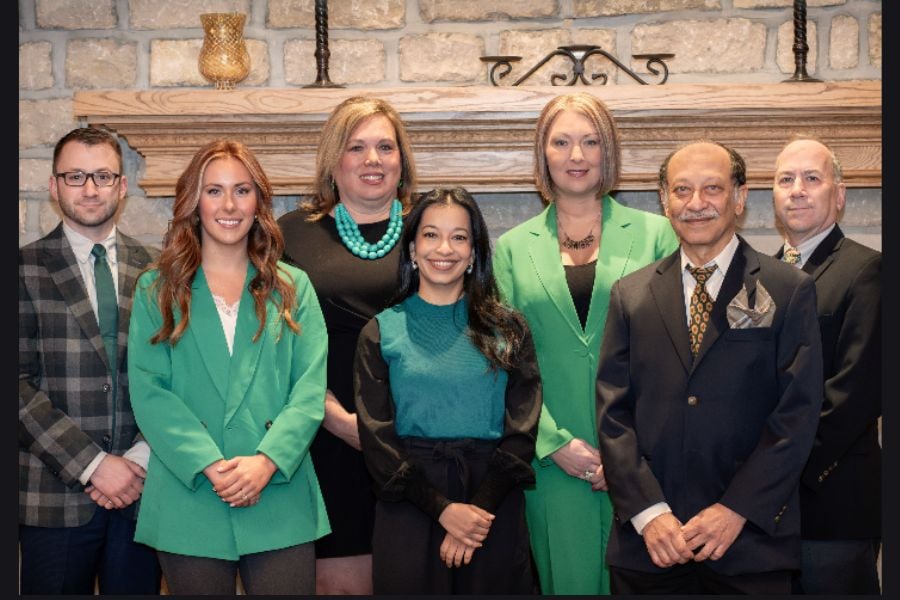

Attain Wealth Partners, founded by Kaka and Weinberg, includes five additional team members: wealth advisors Bridget Tetak, Ross Weinberg, Sierra Brown, Nazneen Kaka, and administrative partner Anissa Judd. The team collectively offers over 40 years of experience in wealth management, having previously been associated with Merrill Lynch Wealth Management.

Specializing in portfolio management, retirement strategies, risk management, and estate strategies, Attain Wealth Partners provides services to ultra-high-net-worth individuals. Their approach emphasizes personalized client service to help clients achieve long-term financial goals.

“When going independent, our primary focus was to join a firm that understands our financial goals and holds the highest standards of client service, allowing us to focus on what matters most – our clients,” said Shakir Kaka, co-founder and wealth advisor at Attain Wealth Partners, whose record of two decades in the industry also includes a stop at Northwestern Mutual.

“Joining Kestra PWS allows us to develop trust and stronger, long-term relationships with our clients, working alongside like-minded partners who believe in our mission and goals,” Kaka said.

With the partnership, Attain Wealth Partners becomes the latest group to join Kestra PWS’s platform for independent financial professionals, including a full-service support model that’s helped over 125 financial professionals and more than 50 single- and multi-team offices across the country transition to independence.

The new group has chosen Fidelity NFS as the custodian for its clients’ assets.

“We understand the value of an entrepreneurial spirit, and helping our partners achieve their goals is the core of how we power their independence,” said Rob Bartenstein, senior managing director and CEO of Kestra PWS.

The transaction with Attain Wealth Partners builds on Kestra PWS’s March move to partner with Borger Financial Services, a $600 million multigenerational firm based in New York City.

Plus, a $400 million Commonwealth team departs to launch an independent family-run RIA in the East Bay area.

The collaboration will focus initially on strategies within collective investment trusts in DC plans, with plans to expand to other retirement-focused private investment solutions.

“I respectfully request that all recruiters for other BDs discontinue their efforts to contact me," writes Thomas Bartholomew.

Wealth tech veteran Aaron Klein speaks out against the "misery" of client meetings, why advisors' communication skills don't always help, and AI's potential to make bad meetings "100 times better."

The proposed $120 million settlement would close the book on a legal challenge alleging the Wall Street banks failed to disclose crucial conflicts of interest to investors.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.