PacWest, a regional bank that was severely impacted by the banking crisis, has reached an agreement to merge with Banc of California, showing that the repercussions of Silicon Valley Bank's collapse are still ongoing.

The two California-based banks also revealed that Warburg Pincus and Centerbridge Partners would invest a combined $400 million in newly issued equity in the merged entity. Following the news, both banks saw their values rise, with PacWest seeing a jump of 34% after the close of markets.

Paul Taylor, PacWest's CEO, expressed optimism about the merger, stating, "We are clearly better together. I believe this merger will be beneficial for all of our stakeholders."

At market close on Tuesday, the combined market capitalization of both banks was just under $1.8 billion, a significant drop from the $6 billion value of PacWest alone at the beginning of 2022. This decline highlights the impact of the Federal Reserve's efforts to combat inflation, which has taken a toll on PacWest and other regional lenders.

The merger brings much-needed stability to PacWest, which, like Silicon Valley Bank, has strong connections to the California tech community, but faced challenges due to a large proportion of uninsured deposits and paper losses on its securities portfolio.

Jared Wolff, former PacWest executive and current Banc of California CEO, will continue to lead the combined company, which will operate under the Banc of California name. The deal will be completed in late 2023 or early 2024, with PacWest's shareholders owning 47% of the merged company, while Warburg and Centerbridge will own the rest.

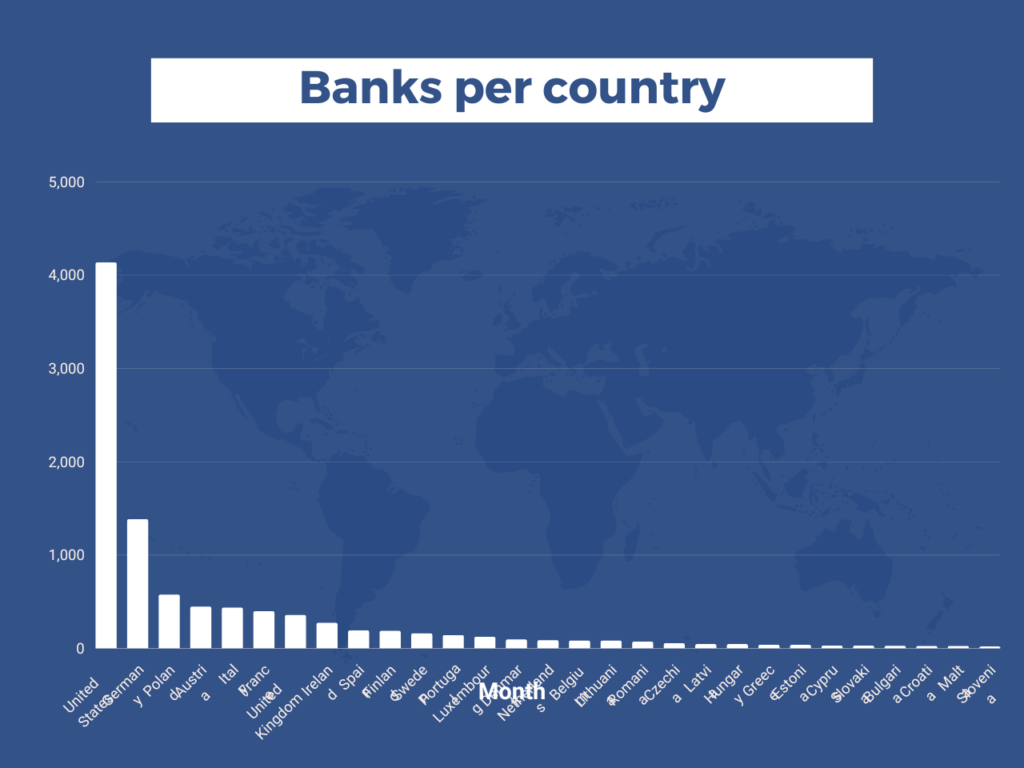

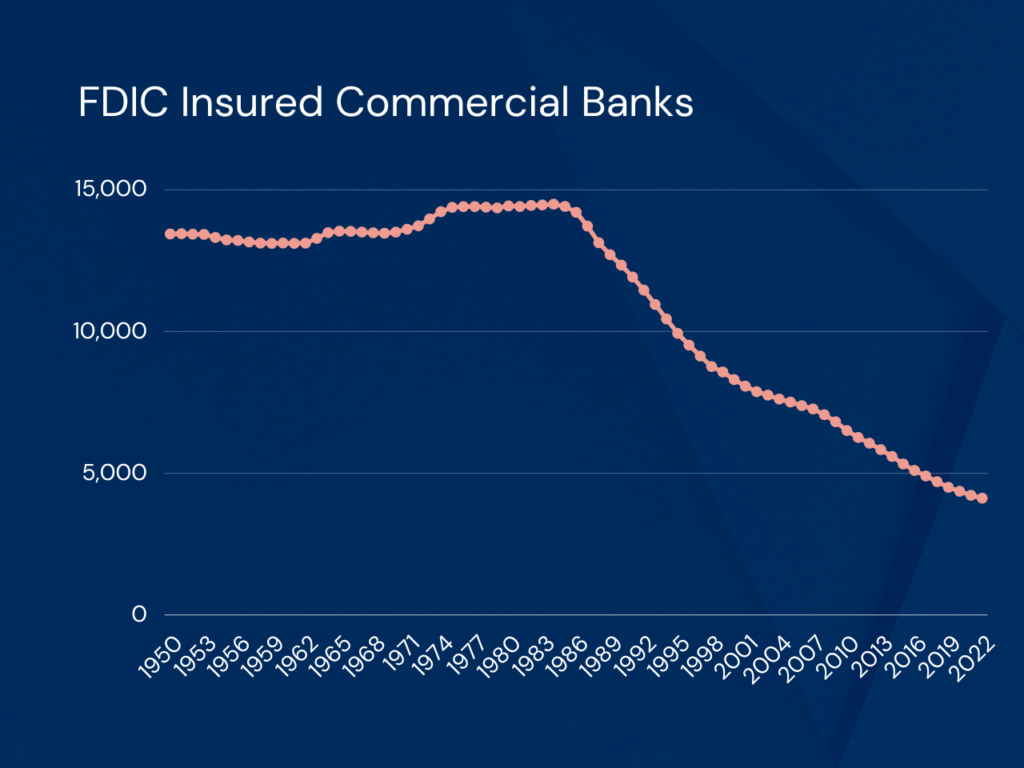

The consolidation in the U.S. banking industry has been on the rise following Silicon Valley Bank's collapse, and executives anticipate more mergers among the more than 4,000 U.S. banks.

Nomura analysts have stated that they believe only half of the country’s existing banks will survive the next decade as consolidation continues.

While previous deals involved banks that were seized by regulators, the merger between the Californian banks is a fully "open bank" transaction.

Two longtime RIA industry figures have joined the board of directors at TaxStatus, a fintech company that garners thousands of IRS data points on clients to share with advisors for improved financial planning oversight and time savings.

Sieg, 58, was head of Merrill Wealth Management, left in 2023 and returned that September to Citigroup, where he worked before being hired by Merrill Lynch in 2009.

Firms announce new recruits including wirehouse breakaways.

"QuantumRisk, by design, recognizes that these so-called "impossible" events actually happen, and it accounts for them in a way that advisors can see and plan for," Dr. Ron Piccinini told InvestmentNews.

Advisors who invest time and energy on vital projects for their practice could still be missing growth opportunities – unless they get serious about client-facing activities.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.