Charles Schwab Corp.’s clients are pulling cash out of the firm’s low-interest-rate bank accounts at twice the rate that Morgan Stanley expected, prompting the firm’s analyst to yank his buy-equivalent rating on Schwab for the first time since he began covering the brokerage stock seven years ago.

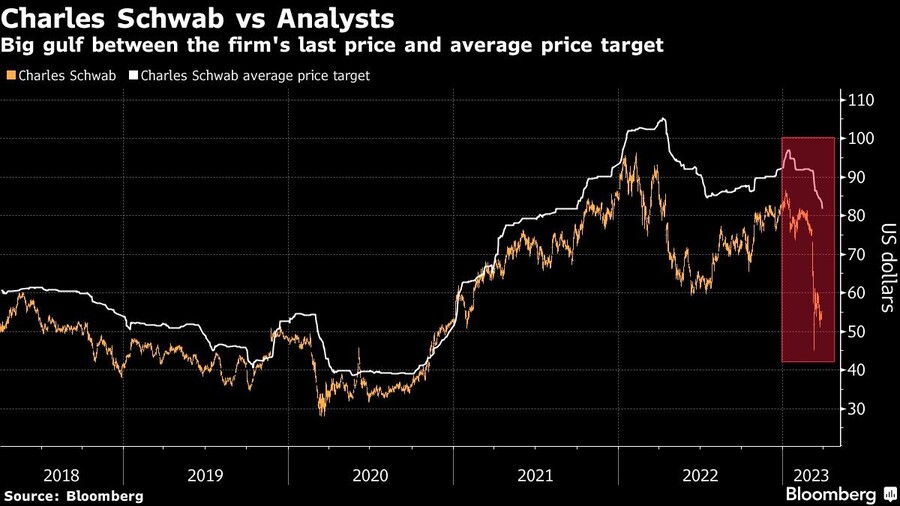

Client money is moving from so-called sweep accounts into money market funds at a rate of $20 billion a month, analyst Michael Cyprys wrote in a report Thursday cutting the stock to equal-weight from overweight. He reduced his target for the share price over the next year to $68 from $99. Schwab’s shares, which have fallen 29% this month, slipped 2.1% to $54.05 in premarket trading.

“While clients aren’t leaving and SCHW has other sources of liquidity, earnings face more pressure than we had expected,” Cyprys wrote, lowering his forecast for profit this year and next by 30%.

The downgrade reflects the heightened risk that analysts see in financial companies like Schwab, which is struggling with some of the same forces that hammered the now-collapsed Silicon Valley Bank. Schwab invested in long-term bonds at a period of record-low interest rates and is now sitting on losses on those investments after the Federal Reserve jacked up rates.

Depositors, meanwhile, are pulling money from bank accounts in search of higher yields, depriving companies like Schwab of cheap funding and raising concern that it will have to sell bonds at a loss to cover outflows.

Schwab last week assured clients and investors that it has plenty of liquidity to meet withdrawals of bank deposits. It’s misleading to focus on paper losses, the Westlake, Texas-based firm said.

Cyprys had had an overweight rating on the stock since he began covering it in 2016. His lower price target is still 23% above Wednesday’s closing price of $55.21. He has less confidence around the timing of an improvement in the situation, he wrote. Prospects for the Fed to pause in its series of rate increases, or to cut rates, “look highly debatable,” he said.

From outstanding individuals to innovative organizations, find out who made the final shortlist for top honors at the IN awards, now in its second year.

Cresset's Susie Cranston is expecting an economic recession, but says her $65 billion RIA sees "great opportunity" to keep investing in a down market.

“There’s a big pull to alternative investments right now because of volatility of the stock market,” Kevin Gannon, CEO of Robert A. Stanger & Co., said.

Sellers shift focus: It's not about succession anymore.

Platform being adopted by independent-minded advisors who see insurance as a core pillar of their business.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.