Are your clients willing to trade returns for impact? There’s a fair chance they will, according to new research from a global asset manager.

Forty percent of U.S. respondents to the seventh impact investing survey from American Century Investments said they would sacrifice higher returns if their investments were making an impact, rising 4% from the previous iteration of the study.

This puts American respondents above those in the U.K. (33%), Germany (31%), and Australia (29%) in this regard, but behind those in Singapore (47%). Across all countries polled, 67% of participants said they would sacrifice up to 10% of returns, most saying 6-10% would be their preference, but few would be willing to lose 16% or more.

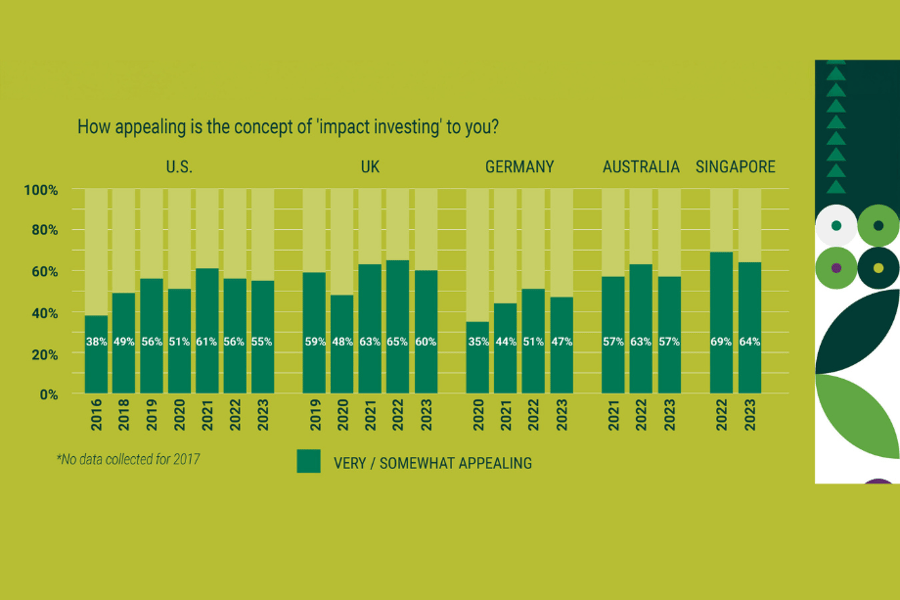

But the report also found that interest in impact investing is declining across all markets included, although the U.S. saw the smallest decrease (-1%) while Australia saw the largest (-6%). While baby boomers’ interest has declined the most at -8% with Gen X at -5%, there is disparity among younger cohorts with millennials holding relatively steady at -1% but Gen Zs showing a -7% decrease.

There has also been a change in the driving cause behind impact investing. Healthcare has surpassed environment as the top concern overall.

In the U.S., greenwashing and the sustainability backlash both influenced interest in impact investing at higher levels than the prior year.

"In its earliest forms, impact investing often accepted lower expected returns to have a bigger impact, but our impact investment strategies emphasize sustainability-related attributes or outcomes in addition to delivering a financial return,” said Sarah Bratton Hughes, senior vice president and head of sustainable investing for American Century Investments. “Identifying impact-related factors that could affect a company's ability to stay competitive over the long term has the potential to add to returns. A willingness to give up as much as 10% of an expected return shows that impact investors expect to earn competitive returns and are making rational choices to realize an impact emphasis in addition to a financial return."

"QuantumRisk, by design, recognizes that these so-called “impossible” events actually happen, and it accounts for them in a way that advisors can see and plan for," Dr. Ron Piccinini told InvestmentNews.

Advisors who invest time and energy on vital projects for their practice could still be missing growth opportunities – unless they get serious about client-facing activities.

The policy research institution calculates thousands in tax cuts for Washington, Wyoming, and Massachusetts residents on average, with milder reductions for those dwelling in wealth hotspots.

Yieldstreet real estate funds turned out to be far riskier than some clients believed them to be, according to CNBC.

The race to 100 transactions ended a month early this year, with April standing out as the most active month on record for RIA dealmaking.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.