With all the angst bearing down on Charles Schwab Corp., the brokerage may be worth a lot more without its bank.

That’s the thinking of JPMorgan Chase & Co. analyst Kenneth Worthington who argues Schwab shares would be valued more highly by investors if they were unencumbered by the risks around its bank following the tumult in regional lenders. In such a scenario, the stock could trade at a 20 times earning multiple or $64 per share, he said, a notable premium to Thursday’s $54 close.

“Investors see a number of risks associated with the Schwab Bank — sorting risk, bank run risk, regulatory risk, and valuation risk,” Worthington wrote in a research note Friday. “One way to address the bank risk is to de-bank.”

Worthington’s price target for Schwab in its current state stands at $85.

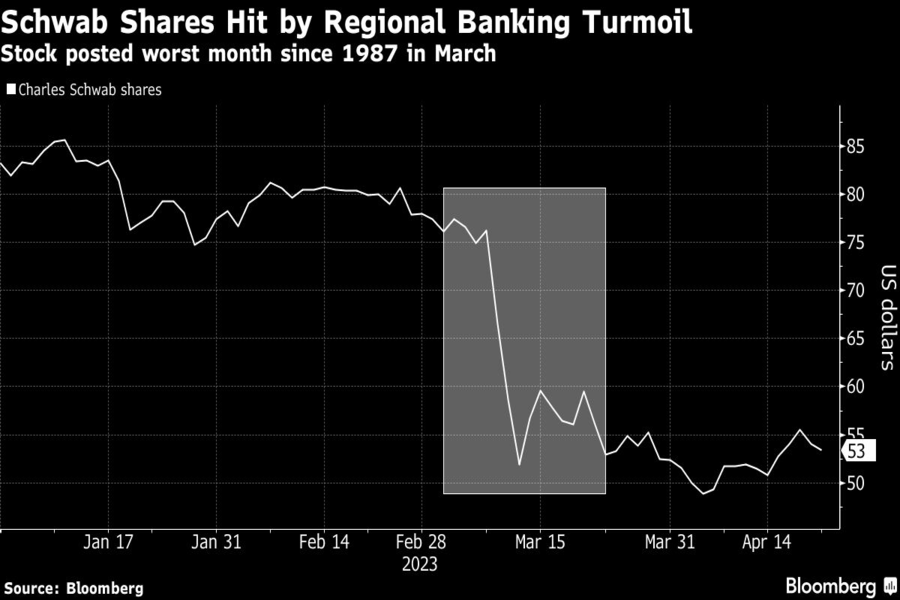

Rising concerns over pending regulatory changes and customers moving cash to higher yielding accounts in the wake of several regional bank collapses have erased more than $60 billion in market value from Schwab’s January highs.

While Schwab has the ability to weather new potentially onerous regulations, without its bank the broker could have a higher valuation even though such a divorce would dent earnings, according to Worthington.

“Schwab, as a broker that owns a bank, could theoretically de-bank, and return to operating the way it did historically, which was a focus on sweeping cash into money market funds and earning an elevated management fee rather than an even larger spread,” he wrote.

Schwab’s Chief Executive Officer Walter Bettinger told CNBC on Friday that the company respects Worthington’s view, but debanking “is not something we’re going to look at in the short run.”

While Schwab could operate without a bank, such a change would be costly and is an outcome the firm’s management would be unlikely to support, Worthington said in his note.

But Worthington, who holds the buy-equivalent recommendation and one of the highest price targets on Wall Street, says a Schwab without a bank could be worthwhile in investors’ eyes given the cash-sorting and regulatory uncertainties.

“A path toward debanking Schwab certainly feels like a last resort type of option at this juncture,” he wrote. “That said, we think it is worthwhile to consider as we think it puts a trough scenario for Schwab’s stock today.”

From outstanding individuals to innovative organizations, find out who made the final shortlist for top honors at the IN awards, now in its second year.

Cresset's Susie Cranston is expecting an economic recession, but says her $65 billion RIA sees "great opportunity" to keep investing in a down market.

“There’s a big pull to alternative investments right now because of volatility of the stock market,” Kevin Gannon, CEO of Robert A. Stanger & Co., said.

Sellers shift focus: It's not about succession anymore.

Platform being adopted by independent-minded advisors who see insurance as a core pillar of their business.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.