Sentiment among U.S. equity investors has weakened this month, according to a measure of optimism from S&P Global, but their risk appetite is undeterred.

Expectations for returns in the next 30 days declined by one percentage point compared to February to a reading of negative 12% with almost half of respondents believing that the equity market will remain steady during the 30-day period.

However, looking further ahead more than half of investors think the S&P 500 will end 2024 above 5200 with 24% expecting it to reach between 5001 and 5200.

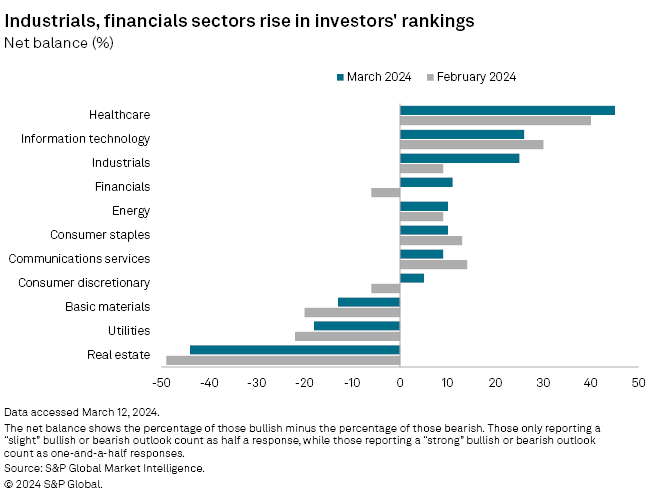

S&P Global's Investment Manager Index survey highlighted that healthcare, information technology, industrials, financials, energy, consumer staples, communication services, and consumer discretionary are all expected to perform with the first three well ahead of the rest.

"Consumer discretionary is gaining favor due to the resilience of the labor market and the broader consumer spending trend, especially in the face of likely rate cuts in 2024 and the anticipated easing in the cost of living squeeze," said Chris Williamson, executive director at S&P Global Market Intelligence.

Conversely, respondents are net bearish on basic materials, utilities, and real estate.

Risk appetite has also increased from last month, by one percentage point to 14%. This follows the trend seen since last November for rising risk tolerance among U.S. equity investors, snapped only in January 2024.

Investors’ outlook eased as expectations for a rapid pace of Fed rate cuts softened while concerns about valuations gained, but growth is still expected with the U.S. macro-economic environment and equity fundamentals among the supporting factors.

"Near-term negative sentiment seems to be based on concerns over how quickly current valuations have been achieved, so some pullback is expected before we see renewed gains before the end of the year," added Williamson.

From outstanding individuals to innovative organizations, find out who made the final shortlist for top honors at the IN awards, now in its second year.

Cresset's Susie Cranston is expecting an economic recession, but says her $65 billion RIA sees "great opportunity" to keep investing in a down market.

“There’s a big pull to alternative investments right now because of volatility of the stock market,” Kevin Gannon, CEO of Robert A. Stanger & Co., said.

Sellers shift focus: It's not about succession anymore.

Platform being adopted by independent-minded advisors who see insurance as a core pillar of their business.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.