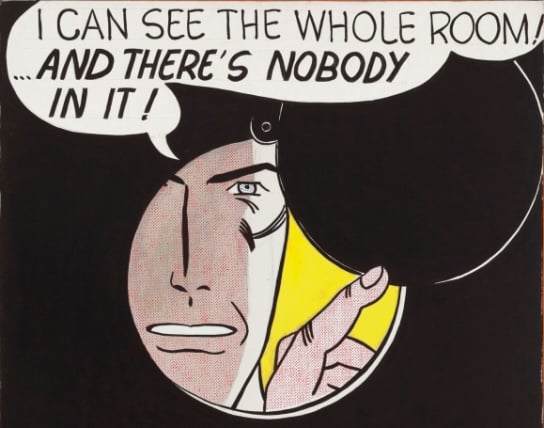

Roy Lichtenstein's 1961 painting of a man looking through a peephole sold for $43.2 million last night in New York, one of 13 records set at an auction of contemporary art by Christie's International.

As actor Leonardo DiCaprio looked on in blue jeans and blue baseball cap, the pop artist's “I Can See the Whole Room!… And There's Nobody in It!” helped London-based Christie's reach a total of $247.6 million. Records were set for Louise Bourgeois, Charles Ray, Paul McCarthy and Barbara Kruger. Andreas Gursky's $4.3 million landscape, “Rhein II,” was the most expensive photograph sold at auction.

“People would rather have art or gold instead of paper money,” collector Eli Broad said as he left the midtown salesroom after the auction.

While the sale failed to reach Christie's low estimate of $226.5 million before commissions, a rising number of guarantees helped the auction house sell 90 percent of the 91 lots offered, beating the 62 percent rate at its Impressionist and modern art sale last week.

Paris dealer Pierre Loudmer blamed “greedy sellers with optimistic estimates” for that flop. He said it was as if last night's sale was insulated from economic turmoil in Europe.

“We're just in a cloud here,” he said.

The Lichtenstein, the top lot, was one of 16 guaranteed artworks, 10 of which were backed by third parties, the auction house said. At the equivalent sale in 2010, only seven lots were guaranteed.

The sale began with 26 works from the collection of software pioneer Peter Norton, all of which sold. The group was led by McCarthy's humorous sculpture “Tomato Head (Green)” which fetched $4.6 million, four times its low estimate.

Murakami's Mushrooms

Kara Walker's sprawling 1996 frieze “African't,” made with 25 cut-paper silhouettes, went for $386,500. Takashi Murakami looked on as his cheerful sculptural mushroom ensemble, “DOB in the Strange Forest,” went for $2.8 million.

Art dealer Robert Mnuchin of L & M Arts won Glenn Ligon's 2000 black text canvas, “Untitled (Stranger in the Village #17)” for $1.2 million, quadrupling the low estimate and establishing another artist record.

The sale is part of the two-week autumn art series in New York by Christie's, Sotheby's and other auction houses that are estimated to raise more than $1.1 billion. Collectors are bidding after six months of volatility in global financial markets as European governments struggle to avert default on debts.

“People no longer care for financial products,” said Mark Vanmoerkerke, a Belgian collector. “There's a lot of doubt. This, you take it home with you.”

RELATED ITEM What the Bernard Madoff collection fetched

The Lichtenstein, from the collection of Courtney Ross, the widow of former Time Warner Chief Executive Officer Steven J. Ross, had a high estimate of $45 million. She was guaranteed an undisclosed minimum price financed by third parties. The painting was acquired at auction in 1988 for $2.1 million.

Lichtenstein's previous record of $42.6 million was set a year ago for “Ohhh. . . Alright. . .” (1964), depicting a sexy redhead on the phone.

Bourgeois's bronze spider, made in 1996, fetched $10.7 million, more than triple the low estimate.

Christie's charges buyers 25 percent of the hammer price up to $50,000, plus 20 percent from $50,000 to $1 million, and 12 percent above $1 million. Pre-sale estimates don't include the buyer's premium.

Sotheby's (BID) holds its contemporary art auction tonight.

--Bloomberg News