Inflation expectations among U.S. consumers over the medium term rose to the highest level on record in the Federal Reserve Bank of New York’s surveys, according to the latest edition published Monday.

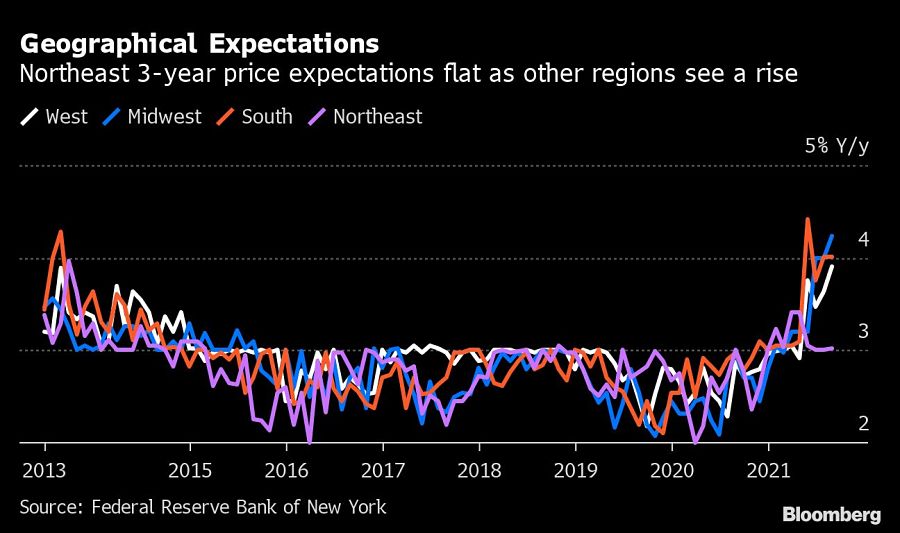

Consumers said they expect inflation at 4% over the next three years, up 0.3 percentage point from a month earlier.

The median expectation for the inflation rate in a year’s time also rose by 0.3 percentage point to 5.2% in August, the tenth consecutive monthly increase and a new high in the series, which goes back to 2013.

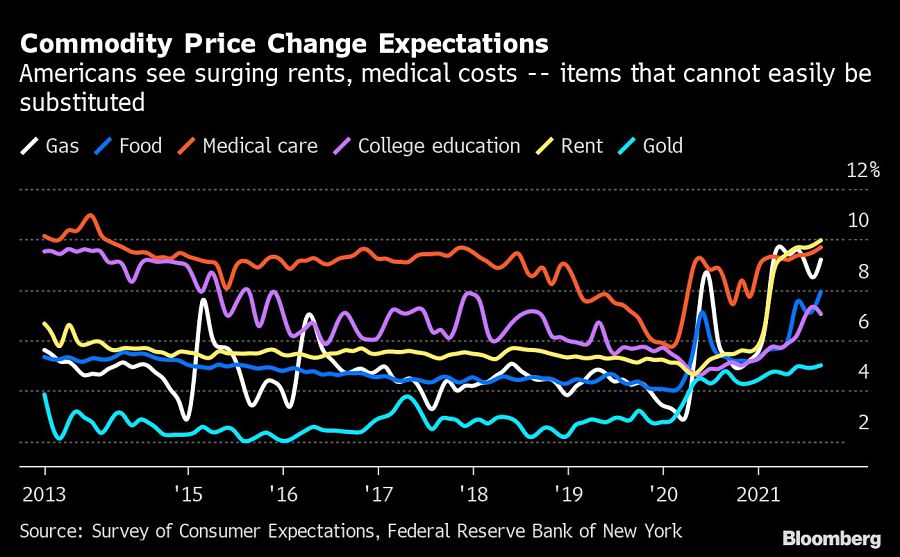

The Fed survey showed that Americans are expecting higher rates of price increases for items like rent and food that make up a big chunk of the consumer price basket and can’t easily be substituted.

Economists surveyed by Bloomberg expect slightly lower rates of inflation. The latest poll, published on Sept. 10, forecast an average increase in prices of 4.3% this year and 3% in 2022.

Meanwhile, expectations that wages will keep pace with the acceleration in prices are starting to cool. The median one-year-ahead expectation for earnings growth dropped 0.4 percentage point to 2.5%, with respondents over the age of 40 largely driving the decline.

Still, overall expectations for household incomes rose by 0.1 percentage point to 3%, a new series high.

President meets with ‘highly overrated globalist’ at the White House.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.