As short sellers target traditional green stocks being hammered by inflation, an executive at the fund management arm of Goldman Sachs Group Inc. says there’s one kind of ESG asset that has what it takes to defy such headwinds.

John Goldstein, Goldman’s global head of sustainability and impact solutions for asset and wealth management, says he and his team are looking at companies that help dull the effect of inflation by enabling a more efficient use of resources. It’s a concept enshrined in the so-called circular economy, of which waste management and recycling are key goals.

Inflation has created “a little bit of a headwind” for traditional renewables sectors, Goldstein said in an interview. As companies face rising input prices, “some of the circular economy, waste and materials themes become particularly attractive,” he said, without singling out any stocks.

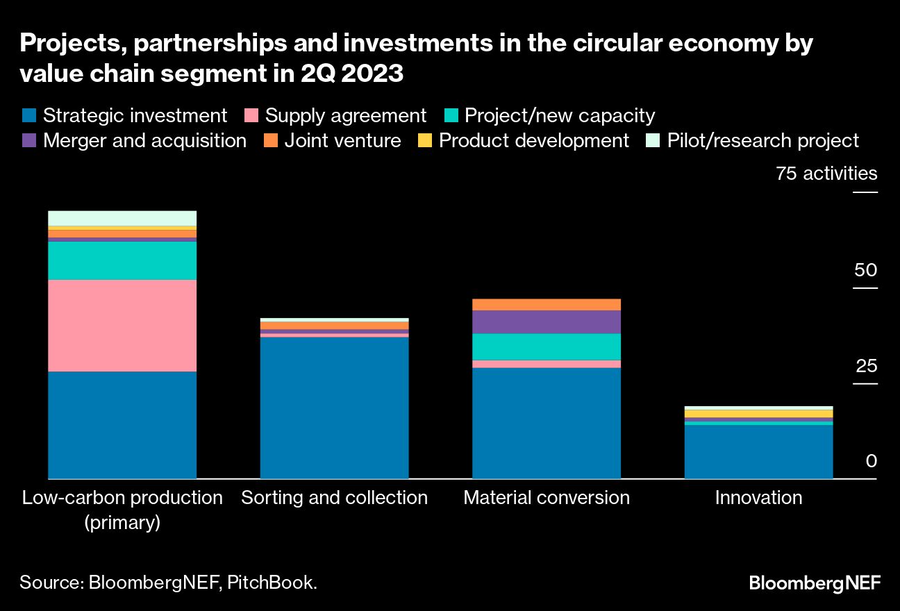

It’s the latest sign that investors are looking beyond conventional renewables as profit margins get battered by inflation and supply chain bottlenecks. And with hedge funds positioning for more pain in clean energy stocks, a growing number of asset managers say it’s time to look at what’s been dubbed the “second phase” of the energy transition.

Part of that strategy entails chasing companies with business models that “allow you to use less virgin material to create things” or “save money from day one,” Goldstein said.

Some of the world’s biggest asset managers are already building the concept of the circular economy into their fund strategies, including BlackRock Inc. Stocks it’s targeted according to data compiled by Bloomberg include Xylem Inc., which designs equipment to limit water waste, and Veolia Environnement SA, which aside from water and waste management services also provides energy management solutions.

Such investments are backed by a growing body of regulations. The European Commission, the executive arm of the European Union, has been continually updating its circular economy action plan, as expectations of greater resource management get built into the bloc’s policies.

Meanwhile, betting against traditional green stocks has morphed into a major trade, with hedge funds’ shorts contributing to significant sell-offs. The S&P Global Clean Energy Index is now on track for its worst year since 2011, having already fallen more than 28%.

Solar and wind have been some of the biggest losers. And ironically, short bets against those sectors have been fanned by record green stimulus in the U.S., which hedge funds say is feeding inflation and higher borrowing costs, ultimately making life harder for debt-reliant ESG stocks.

The benefits of circular-economy stocks against a backdrop of high inflation are “different in different sub-sectors, but it’s true with both businesses and consumers,” Goldstein said.

Overall, the fund industry has built up its exposure to the circular economy theme by a factor of more than 300 since the start of 2019, and the strategy now counts 25 funds overseeing more than $6 billion in total, according to data provided by Morningstar. Those figures don’t include impact strategies or ESG funds that aren’t focused on the theme.

In a saturated market of PE secondaries and repackaged alts, cultural assets stand out as an underutilized, experiential, and increasingly monetizable class of wealth.

However, Raymond James has had success recruiting Commonwealth advisors.

A complaint by the Social Security Administration's chief data officer alleges numbers, names, and other sensitive information were handled in a way that creates "enormous vulnerabilities."

The New Orleans-based 5th Circuit has sided the industry groups arguing the commission's short-selling rules exceeded its authority.

The deal will see the global alts giant snap up the fintech firm, which has struggled to gain traction among advisors over the years, for up to $200 million

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.