Direct indexing is a hot topic in the investment management industry. But for every proponent shouting the benefits of direct indexing from the rooftops, there are also detractors. Having managed clients’ direct indexing assets for the last decade, here are some common criticisms — and my thoughts on them.

1. Direct indexing is a fad. It’s the latest product Wall Street is trying to push onto advisors and investors. Direct indexing isn’t a gimmick or about gaming the system. It’s meant to help advisors more precisely tailor a portfolio to a client’s unique circumstances. Financial and nonfinancial capital can be incorporated into an investor’s program. Tax objectives can be factored in when constructing exposure. And personal values can be reflected in a portfolio in ways other investment solutions fall short.

Customizing portfolios to meet a client's specific investment, tax, and risk goals is a timeless approach. Therefore, offering direct indexing can benefit clients, as personalized financial products and services become increasingly popular.

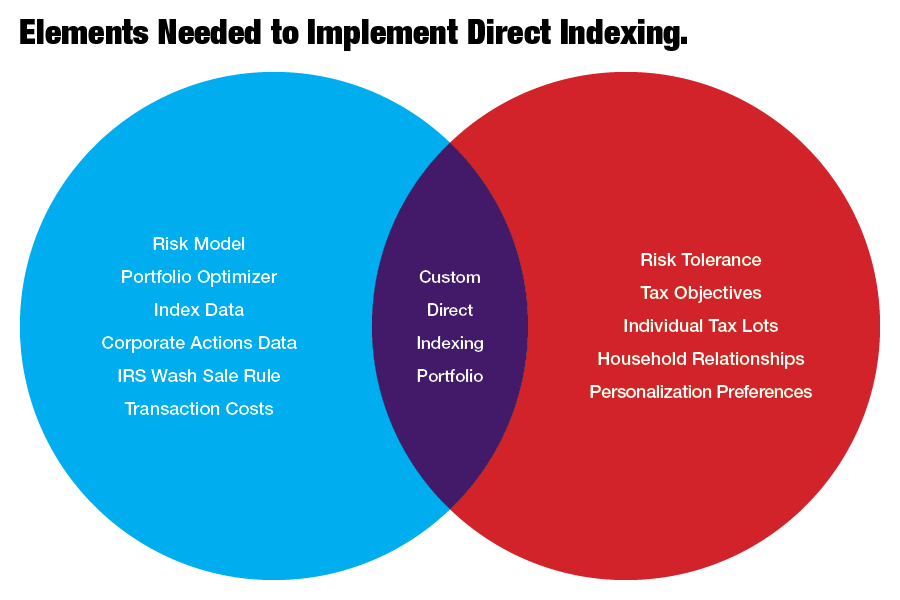

2. Direct indexing is too complicated. Like other investment strategies, direct indexing's mechanics can be complex. The basic premise, however, is simple. A portfolio is constructed to track the performance of a client’s chosen benchmark on a pretax basis — while adding value on an after-tax basis. The portfolio can be tailored to suit each client’s views and preferences.

When creating and managing a direct indexing portfolio, advisors should find a scalable and innovative technology provider to make the process less complex and more accessible for clients.

That said, providers can do more to increase understanding of direct indexing and close the education gap between advisors and their clients, whether through compelling reporting or intuitive tools and workflows.

3. You need to be rich to do this. Recently, direct indexing investment management was only available to the wealthy and institutions due to the high cost of managing and maintaining separately managed accounts, the preferred vehicle for holding securities under a direct indexing approach.

Today’s technology makes it feasible for advisors to offer personalized SMAs to individual investors — and it’s scalable. Fees and account minimums have moved decidedly down-market, so mainstream investors can take advantage of what direct indexing offers.

4. My clients won’t get any benefit from direct indexing or tax-loss harvesting. Direct indexing isn’t for everyone. Investors with smaller balances of taxable assets will benefit more from investing via tax-efficient, low-cost alternatives like ETFs or mutual funds. Likewise, investors who are primarily invested in tax-deferred or tax-exempt accounts — or who otherwise don’t have any realized gains in their portfolios — can’t take advantage of the potential tax benefits offered by direct indexing.

5. I already do this on my own for my clients. Advisors who implement a direct indexing approach for their clients treat it as a year-end exercise (maybe quarterly). That’s understandable in a way because, on their own, the process isn’t easy or scalable.

Partnering with a provider is crucial. In this scenario, direct indexing can be done year-round, automatically, while freeing the advisor’s time to focus on the client relationship.

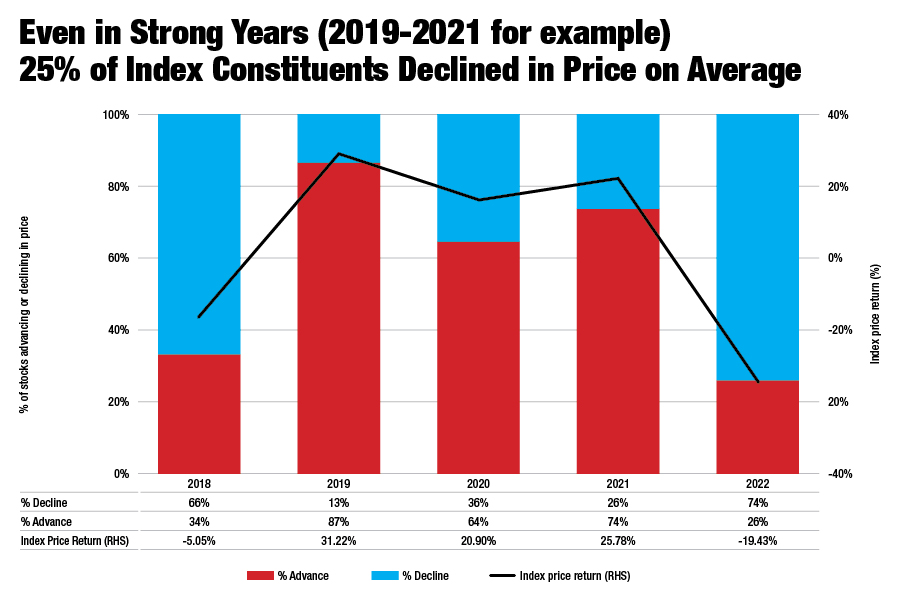

6. Direct indexing only works in certain market conditions. False, unless all the stocks in your client’s chosen benchmark move upwards in unison. Does volatility, both at the index and individual stock levels, help? Absolutely. Are there more losses to be had when the benchmark is declining? Certainly. However, a direct indexing approach helps in every market environment, although the potential tax benefits may diminish.

Source: Bloomberg. Annual price return of the Morningstar US Market Index. 2018-2022.

7. Aren’t you just driving down the cost basis of my portfolio? This happens once a portfolio becomes mature and appreciated. Years of selling high-cost lots from the portfolio means the low-cost tax lots remain. Then, it becomes difficult to realize losses.

Certain strategies can freshen up a portfolio. One example is contributing cash to the portfolio, which increases the basis. Another is gifting highly appreciated tax lots out of the portfolio.

How often does a client fund a portfolio and remain inactive? Maybe a basket of stocks is inherited and must be transitioned. Tax-loss harvesting and gain deferral can enhance value by reducing taxes. Realizing a loss can be equally beneficial as avoiding a realized gain.

8. Direct indexing requires too much trading. That’s a fair critique. However, portfolio turnover and trading in direct indexing serve two purposes:

Not all turnover is bad, especially when it is motivated by the unique investment, tax and risk objectives of a client.

9. Tax season will be too complicated. While the 1099 tax form for your direct index portfolio seems endless, everything is maintained electronically by the custodian. As long as you work with a reputable custodian, all that matters is the first page. I strongly recommend working with a qualified tax professional, as well.

10. What’s the big deal? Just pay your taxes. Investors don’t have to be in the highest tax bracket for taxes to be one of the largest costs they face. That’s why it’s critical to maximize your clients’ after-tax wealth. We’re only left with whatever we don’t pay in taxes. A direct indexing approach looks to potentially keep money invested in the portfolio and compounding over time — instead of being paid out in taxes.

While not the final word on direct indexing and its criticisms, some of this is valid and requires further attention from practitioners across the industry. A direct indexing approach may not be the best fit for everyone, but it's here to stay. No other options offer a perfectly tailored portfolio for the client’s goals.

Remember that ETFs and mutual funds faced criticism in their infancy, but early adopters saw them for what they are and will be: tools that help investors reach their goals. The early adopters of a more modern approach to direct indexing are probably in for the same treatment.

Andy Kunzweiler is portfolio manager for direct indexing at Morningstar Wealth.

MyVest and Vestmark have also unveiled strategic partnerships aimed at helping advisors and RIAs bring personalization to more clients.

Wealth management unit sees inflows of $23 billion.

Deal will give US investment bank a foothold in lucrative European market.

New report examines the impact that the initiative has had on philanthropy.

Few feel confident that they will meet their retirement goals.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.