J.P. Morgan Asset Management is throwing its hat into the rapidly expanding universe of green funds.

The JPMorgan Carbon Transition U.S. Equity exchange-traded fund (JCTR) will begin trading on the New York Stock Exchange Thursday. The firm’s first U.S. ETF focused on environmental, social and governance standards will be passively managed and track a gauge that screens the Russell 1000 Index for companies seeking to reduce their carbon footprint.

“The carbon space is something that’s particularly interesting. It’s quantifiable, it’s something that everybody can kind of put their fingers on and understand,” said Bryon Lake, head of Americas ETF at J.P. Morgan Asset. “ESG, sustainable, is coming up more and more in the client conversations that we’re having, particularly sophisticated asset allocators, and so we’re really looking to meet that need with what we think is a super compelling investment proposition.”

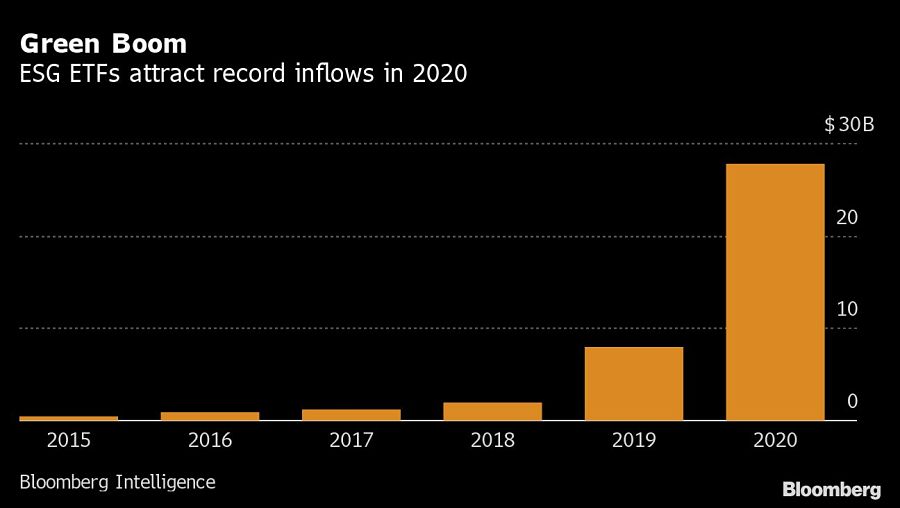

As the world grapples with the coronavirus pandemic, devastating weather and racial unrest, U.S. ESG funds have lured a record $27.9 billion worth of inflows in 2020, according to Bloomberg Intelligence data. Those ETFs currently have about $61 billion in assets.

The new fund will evaluate Russell 1000 companies based on three main criteria: emissions, resource management and risk management. All told, JCTR whittles the Russell 1000 down to roughly 200 holdings, Lake said. Its constituents are selected from companies actively seeking to reduce their carbon footprint, according to Lake.

“Instead of just going through and deleting out the worst offenders, that gets you to only part of the answer. How companies are actually managing that transition is a much more interesting and compelling answer,” Lake said. “If it’s a heavily carbon-producing company, but they’re dramatically changing their behavior -- the emissions piece and the risk management piece -- that’s what we believe is more compelling.”

As other states curb non-competes, the East Coast growth hub could soon become the most employer-friendly jurisdiction in the US.

Last summer, the two, David Gentile and Jeff Schneider, were found guilty of fraud in federal court in Brooklyn and received their sentencing today.

Early parenthood linked to lower fulfillment and fewer leadership roles, despite otherwise strong industry-wide support.

“It's the Golden Age, we're all blessed that this is where we are, what we do for a living, and that the sun is shining on the transition towards the RIA space," Creative Planning CIO Jamie Battmer said at a forum hosted by Goldman Sachs.

Strategists expect municipal bonds to best Treasuries during the four-month window from May until August, following a historical trend.

From direct lending to asset-based finance to commercial real estate debt.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.