Capital Group, one of the last major holdouts to the ETF revolution, is wading in after sitting on the sidelines for over a decade.

The company is launching six actively managed exchange-traded funds that are set to debut on the New York Stock Exchange Thursday. One will focus on fixed income, three will invest primarily in U.S. equities, and two will be devoted to global stocks. The funds’ expense ratios range from 0.33% to 0.54%.

The move marks a shift for the Los Angeles-based company, which had over $2.7 trillion in assets as of December and is the last major money-management firm to launch its first ETF.

But Holly Framsted, Capital Group’s director of ETFs, said the active ETF space doesn’t yet have a “standout winner” and Capital Group will fill a void by providing funds that can sit at the core of an investor’s portfolio.

“I actually don’t think we’re that late,” said Framsted. “We’ve seen a lot of niche products come to market that really aren’t serving those core needs of our clients.”

The launch is the culmination of a months-long effort by Capital Group, which filed regulatory documents for the ETFs in August.

It signals that Capital Group is seeking to directly challenge rivals like Vanguard Group Inc. and BlackRock Inc. by making the case that an active fund can be at the center of a portfolio, rather than a complement, according to Bloomberg Intelligence’s Eric Balchunas, who tracks the ETF industry. He said most of the flows into active funds go into ETFs that have highly concentrated, thematic strategies, like Cathie Wood’s Ark funds.

“Going through the mutual fund world to the ETF world is a little bit like going from a country club into the Amazon jungle,” he said. “You have to sell to these very picky cost-obsessed advisers. You have to battle Vanguard who has basically everything now for under five basis points. And then you have to sort of sell against these shiny objects like Ark and Bitcoin.”

Capital Group’s Framsted said that before the Securities and Exchange Commission’s 2019 regulatory changes a lot of advantages of ETFs were constrained to index or passive funds, with the new regime since opening an opportunity for active strategies.

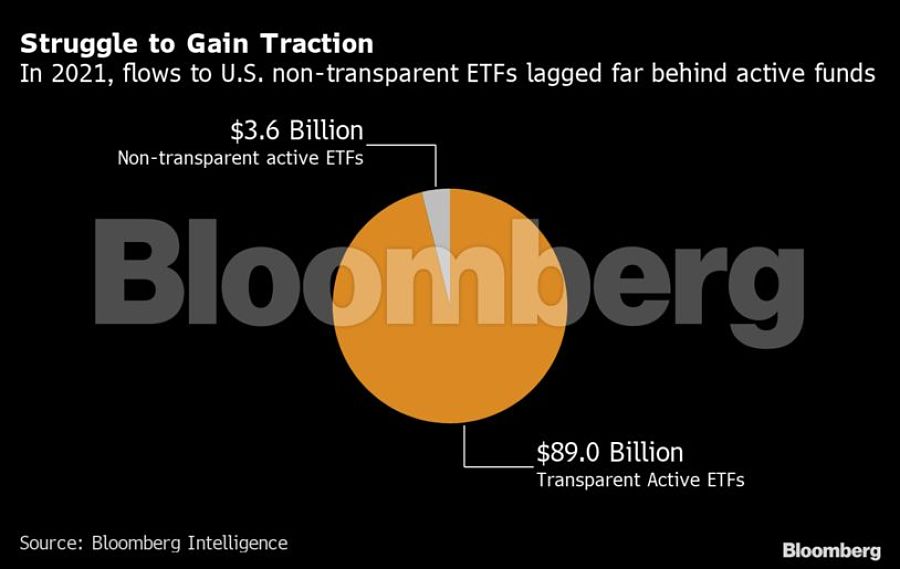

As so-called fully transparent ETFs, all the holdings of each Capital Group fund will be revealed each day. Other mutual fund giants like Fidelity and T. Rowe Price Group Inc. have entered the ETF market using active non-transparent funds, only to see those struggle to gain traction.

“Unlike some of its peers’ active equity ETFs, Capital Group’s offerings will be fully transparent and have the flexibility to invest outside of the U.S., which should help the ETFs differentiate from benchmark based funds,” said Todd Rosenbluth, an ETF analyst at CFRA who anticipates Capital Group will become a “top-tier ETF provider” in the next few years.

Framsted said at the moment, Capital Group is not planning on converting any of its mutual funds into ETFs.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.