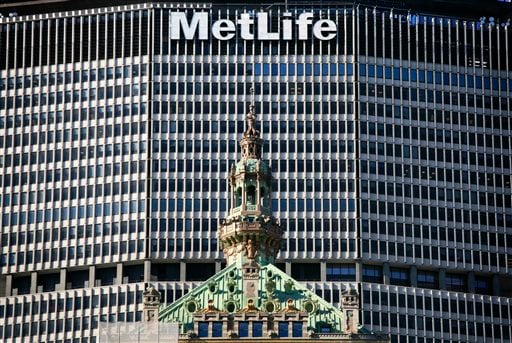

U.S. life insurers, a group led by MetLife Inc. and Prudential Financial Inc., would be prohibited from retaining death benefits without specific consent of clients, under a proposal today by state legislators.

U.S. life insurers, a group led by MetLife Inc. and Prudential Financial Inc., would be prohibited from retaining death benefits without specific consent of clients, under a proposal today by state legislators.

The proposed legislation “guarantees that life insurance consumers and beneficiaries will be fully protected during their greatest times of need,” according to an e-mailed statement today from the Robert Damron, a Kentucky representative and president of the National Conference of Insurance Legislators. The bill would bar insurers from using retained-asset accounts “as a default method of paying death benefits and require that beneficiaries opt-in to allow use of such accounts.”

Insurers have drawn fire from state and national officials since Bloomberg Markets reported last month that carriers profit by holding and investing $28 billion owed to beneficiaries. In July, New York Attorney General Andrew Cuomo opened a fraud probe into the accounts. Yesterday, the Federal Deposit Insurance Corp. announced a review of whether life insurers misled accountholders about guarantees.

“Legislators will be prepared to move on this” in time for states to consider the new rules in 2011, Damron said.

Life insurers settle death claims by issuing IOUs. Beneficiaries get interest-bearing accounts while insurers hold the funds and accrue investment income. Newark, New Jersey-based Prudential said in a statement today that the “vast majority” of survivors benefit from the service.

Prudential Statement

“Retained-asset accounts, which for nearly two decades have provided a safe place for life-insurance beneficiaries to hold their money, have in recent days come under a great deal of criticism that is needlessly inflammatory and flat-out wrong,” Prudential said.

Insurance companies lack a federal regulator. Oversight is carried out by state commissioners according to rules enacted by their legislatures. The National Association of Insurance Commissioners, the regulator group that helps propose policy, called an Aug. 15 meeting at its conference in Seattle to begin a review of retained-asset accounts.

“For more than a year now we have been urging the NAIC to work together with other state officials toward needed reform,” Damron said. The proposed legislation, which NCOIL calls a Beneficiaries’ Bill of Rights, should be used as “a focal point for any measure” developed by the NAIC, Damron said.