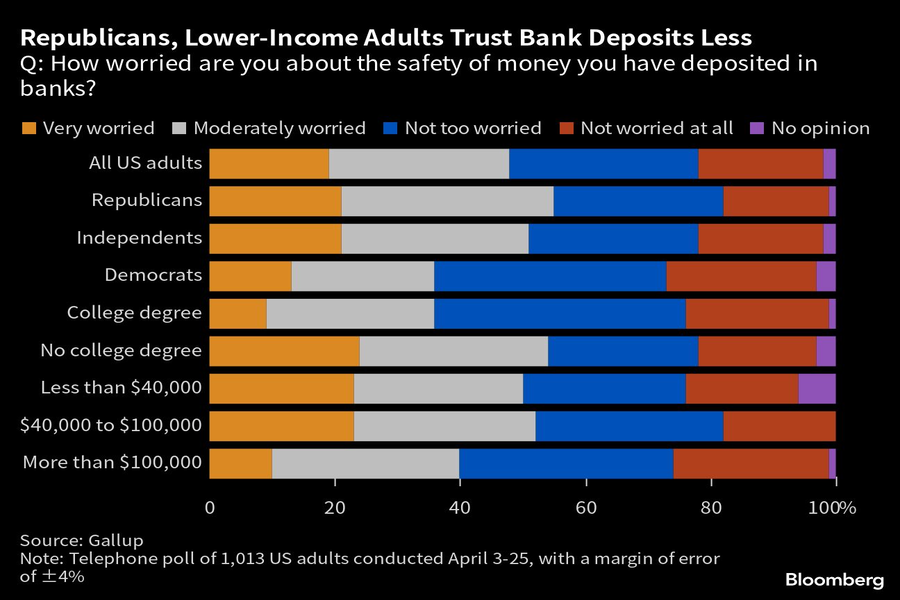

Almost half of U.S. adults say they’re worried about the safety of their deposits in banks and other financial institutions — levels of concern as high or higher than during the 2008 financial crisis.

A Gallup poll released Wednesday shows 48% of Americans are very or moderately worried about their money following the worst spate of bank failures in 15 years. Only 20% say they’re not worried at all.

Levels of concern break somewhat among party lines, with 55% of Republicans saying they’re worried about their deposits, compared to 36% of Democrats. That’s nearly a mirror image of the partisan split during the financial crisis when Republican President George W. Bush was in office.

“The same dynamic was in play, but with a Republican in the White House the views were reversed almost exactly,” said Megan Brenan, senior editor of U.S. polls for Gallup. “We know that economic views are largely shaped by politics these days.”

Worries are also significantly higher among those without a college degree and those who make less than $100,000 — even though Federal Deposit Insurance Corp. guarantees deposits up to $250,000.

The telephone survey of 1,013 U.S. adults was conducted April 3 to April 25 — following the failures of Silicon Valley Bank and Signature Bank the previous month but before the collapse of First Republic Bank last week. The margin of error is plus or minus 4 percentage points.

By listening for what truly matters and where clients want to make a difference, advisors can avoid politics and help build more personal strategies.

JPMorgan and RBC have also welcomed ex-UBS advisors in Texas, while Steward Partners and SpirePoint make new additions in the Sun Belt.

Counsel representing Lisa Cook argued the president's pattern of publicly blasting the Fed calls the foundation for her firing into question.

The two firms violated the Advisers Act and Reg BI by making misleading statements and failing to disclose conflicts to retail and retirement plan investors, according to the regulator.

Elsewhere, two breakaway teams from Morgan Stanley and Merrill unite to form a $2 billion RIA, while a Texas-based independent merges with a Bay Area advisory practice.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.