Lawyer for Picard claims Sterling Partners priced policies to cover investments with Ponzi king; 'define fraud'

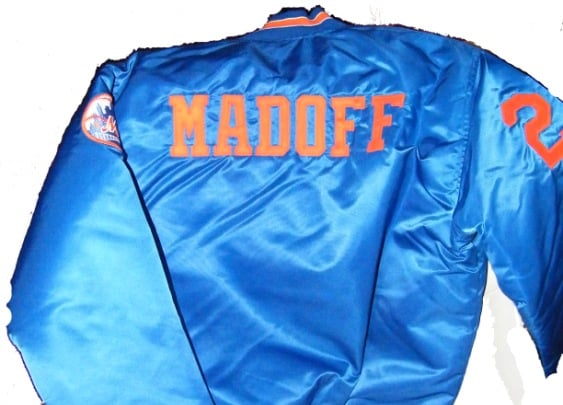

A lawyer for the trustee liquidating the estate of Bernard L. Madoff said Mets owners Fred Wilpon, Saul Katz and the Sterling Equities Inc. partners “refuse to return” $300 million in “other people's money” received from the jailed con man.

Trustee Irving Picard's lawyer, David Sheehan, made the statement yesterday as part of a move to persuade a bankruptcy judge not to dismiss Picard's $1 billion lawsuit against the Mets owners. In addition to $300 million in what he called “fictitious profits,” the trustee is seeking the return of their principal invested with Madoff.

Picard said in a bankruptcy court filing he had evidence that the Sterling partners were “well aware” that Madoff may have been fraudulent, including handwritten notes by one partner, Arthur Friedman, that they were “shopping” for fraud insurance to protect their Madoff investments.

A note from Friedman to Wilpon and Katz, dated Feb. 26, 2001, with “Madoff insurance” in the subject line, said Friedman had been referred by American Securities, another Madoff investor, to an agent at Frank Crystal & Co., according to a copy included in Picard's filing.

The fraud policy had a $500,000 deductible and cost 30 cents per $100, he wrote.

“The cost per $1.0 M = $3,000. If we were to insure $200.0M the cost would be $600,000.”

Scrawled at the bottom of the note was, “How to define fraud. get Robt Duran here.”

Friedman again explored fraud insurance, with insurance broker Robert Duran of Frank Crystal, after a Barron's article questioning Madoff's investment strategy circulated among the Sterling partners, Picard said.

The Sterling partners, who had $400 million with Madoff at the time, told Picard their inquiries about fraud insurance were irrelevant as they never bought any, according to Picard's filing.

The court filing “recklessly rehashes the same fictitious claims” from the trustee, Sterling said yesterday in a statement. “He has no evidence, and no witnesses, to support his baseless claims.”

Picard said his case against Sterling and its partners stems from a bankruptcy-law concept of good faith. The concept doesn't require that those sued acted illegally or knew they were dealing with a Ponzi scheme, he said.

“Under bankruptcy law, a defendant did not act in good faith if what it knew about BLMIS gave it a reason to inquire further, but instead it turned a blind eye and continued to take money from an enterprise it should have known might be a fraud,” he said in a statement. Bernard L. Madoff Investment Securities LLC was Madoff's investment firm.

Asking a judge in March to dismiss the Picard suit, the Sterling partners said they weren't professional investors and saw no warning signs.

Picard's calculation that the Sterling partners and companies made $300 million in false profit from the Ponzi scheme ignored their Madoff accounts that had net losses, they said. After losses, Sterling's fake profit was about $150 million over 25 years, according to the filing.

According to Picard, Peter Stamos, who ran the Sterling Stamos hedge fund and was part of the Mets owners' inner circle, “repeatedly warned” that Madoff's results were “too good to be true.”

The trustee ignored Stamos's testimony under oath that he assumed Madoff was “honorable” and a “legend” in the hedge fund industry, Sterling said in its filing. According to Sterling, Picard cited an e-mail that referred to Madoff as a “scam,” although Stamos had testified that he couldn't recall ever describing Madoff that way.

In yesterday's filing, Picard cited additional e-mails from Stamos and reiterated his claims that the Mets owners should have suspected Madoff's fraud. He deemed it “implausible” that the owners and operators of a baseball franchise, a sports entertainment network and real estate properties, “are unsophisticated investors who were duped by a trusted friend.”