The global economy is in a new expansion cycle and output will return to pre-coronavirus crisis levels by the fourth quarter, according to Morgan Stanley economists.

“We have greater confidence in our call for a V-shaped recovery, given recent upside surprises in growth data and policy action,” economists led by Chetan Ahya wrote in a mid-year outlook research note on June 14.

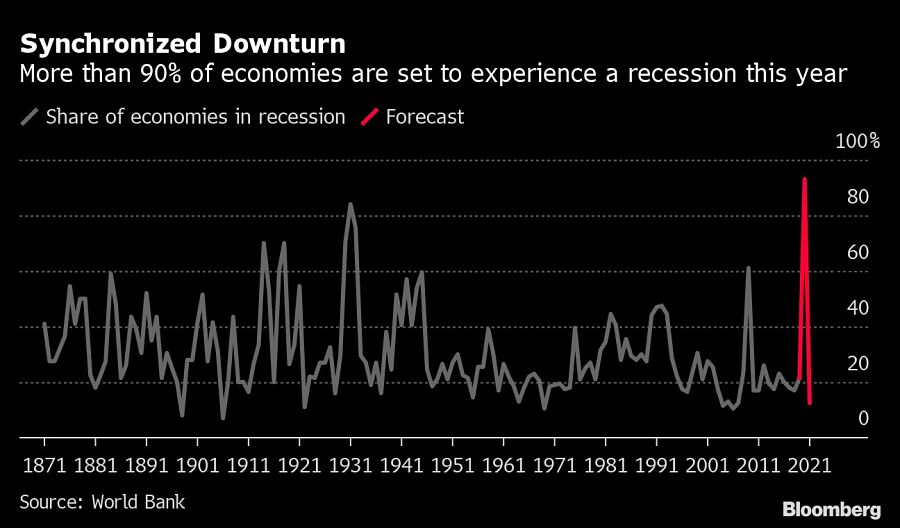

Predicting a “sharp but short” recession, the economists said they expect global GDP growth will trough at -8.6% year-on-year in the second quarter and recover to 3.0% by the first quarter of 2021.

Morgan Stanley noted three reasons the recession will be short:

Official support isn’t likely to ease anytime soon, with both central banks and finance ministries pumping money into their respective economies, according to the note.

Risks to the analysts' outlook include developments with the coronavirus and the vaccine.

“In our base case, we assume that a second wave of infections will occur by autumn, but that it will be manageable and result in selective lockdowns,” the economists wrote, citing a scenario where a vaccine is broadly available by summer of 2021.

“In contrast, we assume in our bear case that we re-enter into the strict lockdown measures implemented earlier this year, resulting in a double dip,” they wrote.

Morgan Stanley’s views contrast with more cautious outlooks by others including the International Monetary Fund, which last week warned that the global economy is recovering more slowly than expected and that there remains “profound uncertainty” around the outlook.

The recent jump in Beijing’s coronavirus cases has raised fears of a resurgence of the pandemic in China, which may slow recovery in the world’s second-largest economy. China’s vice premier said risks are high for the outbreak in Beijing to spread, according to a Xinhua report.

Economists at JPMorgan Chase & Co. led by Bruce Kasman highlighted the risk that surging debt and deficits may force governments to wind back their massive fiscal stimulus.

“This turn in fiscal policy, together with the limited steps expected from central banks, is an important factor underlying our forecast for an incomplete recovery through 2021,” the JPMorgan economists said in a note.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.