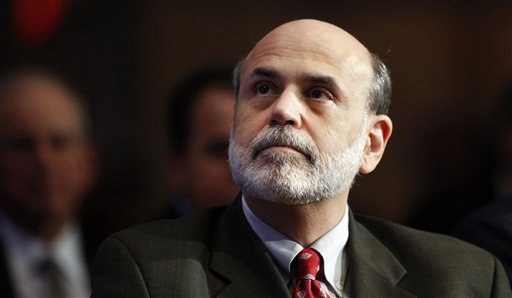

Fed head criticizes rater's proposal to reveal which funds might be bailed out during market panics

Federal Reserve Chairman Ben S. Bernanke said investor speculation over which money market mutual funds are likely to be bailed out by their parent companies during a crisis can undermine the stability of the industry that manages $2.79 trillion.

Bernanke, in a Dec. 9 letter to Anthony J. Carfang, partner in Chicago consulting firm Treasury Strategies, said market developments that reinforce speculation whether money funds may be bailed out are a “concern” and sponsor support should be addressed in the context of planned reforms of the industry.

Carfang in November criticized a proposal by Moody's Corp. that its ratings of money funds take into account the likelihood of a parent bailout in the event of losses. Bernanke, in the letter, encouraged Carfang to submit his views of the Moody's proposal to the Securities and Exchange Commission.

“I think he's saying he wants the word to get out, but he didn't want to do it directly,” Carfang said today in an interview.

Barbara Hagenbaugh, a spokeswoman for the Federal Reserve, confirmed Bernanke sent the letter and declined to comment on it.

Money market funds have come under increased scrutiny by regulators since the September 2008 collapse of the $62.5 billion Reserve Primary Fund, only the second such fund to expose investors to losses. Its closure sparked an industry wide run that helped freeze global credit markets.

The SEC this year enforced new rules that require money funds to boost holdings of cash and easy-to-sell securities, reduce their level of lower-rated debt and reveal more about what they own.

Money Fund Reform

The President's Working Group on Financial Markets, a White House advisory body of which Bernanke is a member, has examined additional proposed regulations and asked market participants to submit comments to the SEC.

Bernanke, in his letter, cited the conclusions of the working group report that “uncertainty among investors about the actual availability of discretionary support during crises may contribute to the vulnerability of money market funds to 'runs'.”

“An evolution in market conventions that might reinforce this dynamic is of concern, and I believe it is important to address sponsor support of money market funds in the broader context of reforms that can make the funds less vulnerable to runs,” Bernanke wrote to Carfang.

Carfang has called the Moody's proposal “fundamentally disruptive,” saying the ratings firm would have no objective way of gauging whether a money manager would prop up a fund in trouble. Fund prospectuses explicitly tell customers their investments are not guaranteed.

Abbas Qasim, a spokesman for Moody's, said he wasn't able to comment immediately.

The Reserve Primary Fund closed after writing down to zero $785 million in debt issued by bankrupt Lehman Brothers Holdings Inc. The fund returned about 98 percent of clients' money over the two years following its closure.

--Bloomberg News--