BlackRock Inc. became the first public asset manager to hit $10 trillion in assets, propelled by a surge in fourth-quarter flows into its exchange-traded funds.

Investors poured a net $104 billion into ETFs in the three months ended Dec. 31, the company said Friday in a statement — a record for the company.

The world’s largest asset manager also benefited from a rally in markets, with the S&P 500 climbing 11% in the latest quarter and 27% in 2021. Investors added a net $169 billion to BlackRock’s long-term investment vehicles, including ETFs and mutual funds, in the final three months of the year.

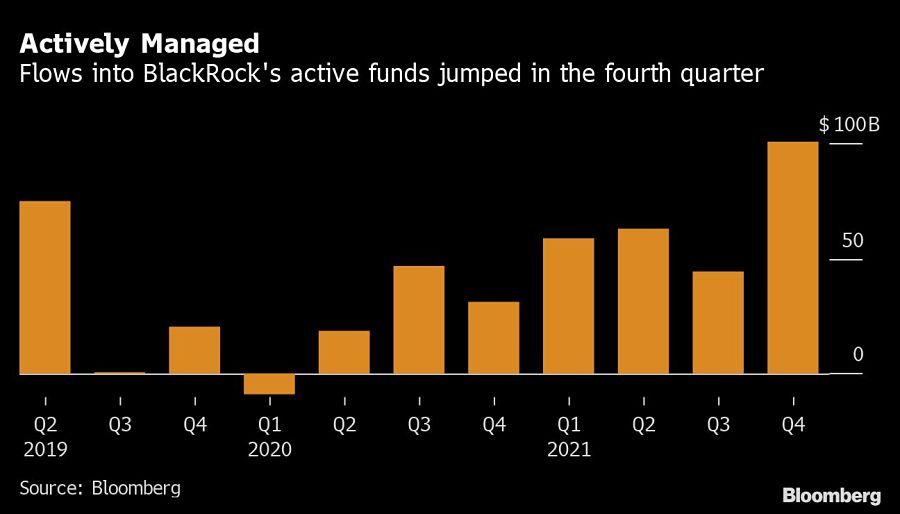

“Our business is more diversified than ever before,” Chief Executive Larry Fink said in the statement. “Active strategies, including alternatives, contributed over 60% of 2021 organic base fee growth.”

The results reinforce BlackRock’s position atop the industry, with assets under management rebounding from a dip at the end of the third quarter. The earnings come ahead of an annual letter that Fink, 69, sends to corporate leaders, laying out priorities on everything from boardroom diversity to climate change.

Actively managed funds, a style that includes ETFs and mutual funds, saw a net $101 billion in flows. BlackRock now manages $2.6 trillion in such assets. The firm’s alternatives business, which includes hedge funds, saw $5.5 billion of inflows, taking total assets to $265 billion.

Employee compensation and benefits increased $218 million from the fourth quarter of 2020, reflecting the firm’s move to increase staff pay as inflation surged in the U.S. Starting in September, base salaries rose 8% for all staff at the director level and below.

New York-based BlackRock saw adjusted earnings per share of $10.42, beating the $10.15 average estimate of analysts surveyed by Bloomberg. Revenue in the quarter was $5.11 billion, missing the $5.16 billion average estimate.

BlackRock fell short on revenue due to a decline in performance fees, according to Kyle Sanders, an analyst with Edward Jones. The shares fell 1.7% at 9:45 a.m. in New York trading to $852.50.

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.