BlackRock Inc.’s climate pledge is already paying off.

An exchange-traded fund from the New York-based money manager has attracted more than $600 million this week, despite only starting trading on Friday, data compiled by Bloomberg show. That’s the best debut for any U.S. ETF this year, and a sign BlackRock isn’t the only one that sees climate change as a defining factor in companies’ long-term prospects.

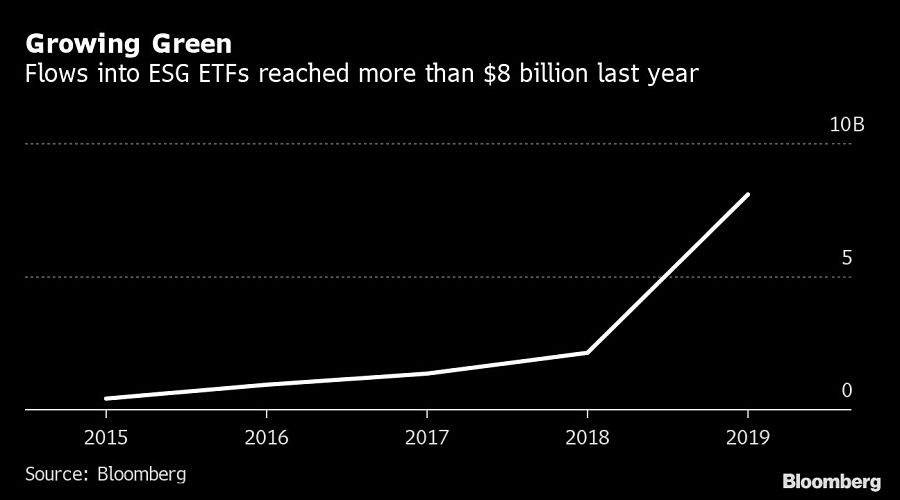

Investing in companies that care about environmental, social and governance issues is finally catching on after years of sluggish growth. While only a small drop in the $4.5 trillion U.S. ETF market, sustainable funds added more than $8 billion in 2019 and their assets recently topped $20 billion. BlackRock runs multiple funds that stand to benefit from this shift, and has said that it will look to double its sustainable ETF offerings to 150.

“This is likely just the beginning of the wave of money going into ESG ETFs,” said Todd Rosenbluth, CFRA Research’s New York-based director of ETF research. “It will become more mainstream, and as these products gain scale, they’ll hit the radar for the wealth management market.”

In a press release Wednesday, BlackRock said Finnish pension insurer Ilmarinen had invested $600 million Tuesday in the fund, the iShares ESG MSCI EM Leaders ETF (LDEM).

Ilmarinen had poured cash into two similar ETFs shortly after they began trading last year. As of Sept. 30, the Helsinki-based company had more than $3 billion invested across the iShares ESG MSCI USA Leaders ETF and the Xtrackers MSCI USA ESG Leaders Equity ETF, data compiled by Bloomberg show.

LDEM tracks the MSCI EM Extended ESG Leaders 5% Issuer Capped Index, which contains large and mid-cap emerging-market stocks that meet high ESG credentials.

It’s not the only new ESG fund this year. Last week, Direxion started an ETF that allows investors to bet against companies that score low on certain ESG criteria. The strategy shorts the worst offenders, while upping its exposure to those with the best ratings.

President meets with ‘highly overrated globalist’ at the White House.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.