A multitrillion-dollar beast is prowling Wall Street, making huge market moves that few can see coming -- and the beast is getting bigger.

Known as model portfolio investing, it’s a booming corner of money management in which the likes of BlackRock Inc., Vanguard Group and Charles Schwab Corp. bundle funds into ready-made strategies.

It has been around for years, but in an era of fee wars and exchange-traded funds, its popularity is exploding. So much cash is now invested that model adjustments are thought to be behind multiple record ETF flows. BlackRock, the world’s largest asset manager, describes model portfolios as “crucial” to its growth strategy.

“We’re seeing about a billion dollars per month coming in from models constructed and managed by BlackRock,” said Armando Senra, head of iShares Americas at the firm. Given how many of its peers are also in the business, that’s “just a small portion of our total model flows,” he said.

No one is sure exactly how much cash is now following these templates, but financial technology company Broadridge Financial Solutions Inc. estimates it had grown to $3 trillion by the end of the first quarter. A significant chunk is in ETFs, which form the building blocks of the new generation of portfolios.

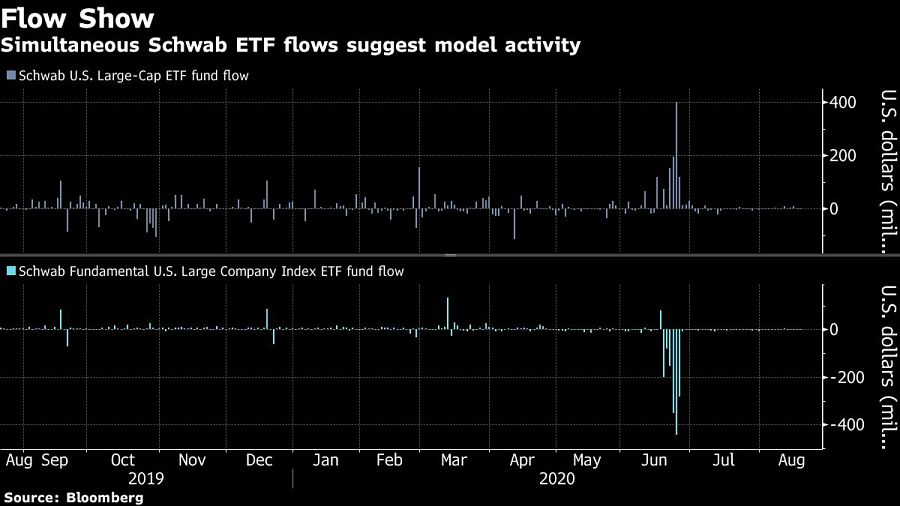

Model rebalancing has been suspected in a series of dramatic flows recently, including record activity across a suite of Schwab funds in a single week in June. Industry participants also guessed they were behind huge flows in several BlackRock products and in one of Vanguard’s major stock ETFs.

“The liquidity and general flexibility of the ETF wrapper allows model managers to make sizable trades without disrupting the underlying markets -- in most instances,” said Ben Johnson, director of global ETF research at Morningstar Inc. “As ETF model portfolios grow larger, their influence on individual ETFs’ flows will grow commensurately.”

The boom is a reflection of an increasingly competitive world for both financial advisers and asset managers.

By promoting their own prepackaged strategies to financial advisers, big money managers exercise more sway over which funds are recommended and where assets flow. And advisers can spend more time on areas of the business like client retention because they’re saved the headache of allocation.

“A lot of the ingredients have become ubiquitous,” said Leon LaBrecque, chief growth officer at Sequoia Financial Group. “It’s silly to try to beat the market.”

The prefabricated portfolios can take any shape, so there are options for every need -- from equity-focused strategies to multi-asset packages to bundles optimizing tax efficiency or following so-called factors.

Historically, a model portfolio would typically have been created in-house at an advisory firm using a package of mutual funds. Strategies created by advisers still make up 53% of the market, according to Broadridge’s July report.

But more than 400 new portfolios have launched since 2018, according to a Morningstar analysis published this month. And financial advisers are increasingly drawn to third-party models because they help offload risk, according to Jillian DelSignore, principal at Lakefront Advisory and former head of ETF distribution for JPMorgan Asset Management.

“It allows them to spend more time managing client relationships, forging new client relationships,” she said. “And at the end of the day, it allows them to fire someone if something goes sideways in terms of performance.”

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.