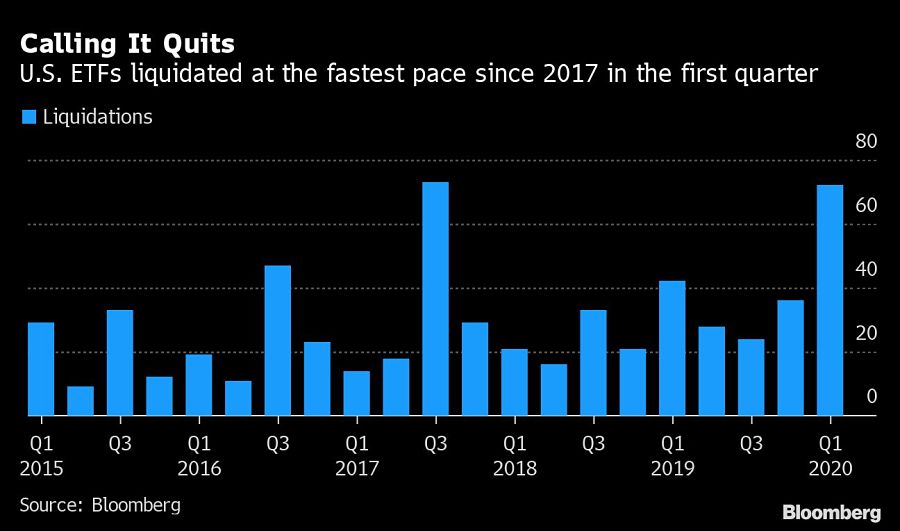

The tumultuous start to 2020 saw exchange-traded funds shutter at the fastest pace in almost three years.

A total of 72 ETFs with $1.4 billion in assets shut down and returned their money to investors in the first quarter as the coronavirus outbreak roiled markets, according to data compiled by Bloomberg. That’s the most since the third quarter of 2017, when 73 funds closed.

The liquidations came as the economic fallout from the virus unleashed volatility across asset classes, sending the S&P 500 Index into a bear market at the fastest pace on record.

That degree of turbulence sparked a reckoning for the myriad niche funds populating the nearly $4 trillion ETF market, according to WallachBeth Capital.

“With huge market movements, investors are going to flock to broad-based funds to hedge out risk, rather than smaller niche products,” said Mohit Bajaj, WallachBeth’s director of ETFs. “It was hard enough when the market was at its peak to get market share, even harder when the S&P is down over 20%.”

Invesco led the liquidations, shutting a total of 42 ETFs as part of plans to consolidate the company’s offerings after it bought OppenheimerFunds Inc. in 2019. ProShares and Direxion closed several leveraged ETFs, which use derivatives to amplify returns of the securities they track.

The still-elevated level of volatility has slowed the pace of ETF debuts as well. Just four funds started trading in March, the lowest monthly total since August and a steep drop from the 29 ETFs that came online in February.

By listening for what truly matters and where clients want to make a difference, advisors can avoid politics and help build more personal strategies.

JPMorgan and RBC have also welcomed ex-UBS advisors in Texas, while Steward Partners and SpirePoint make new additions in the Sun Belt.

Counsel representing Lisa Cook argued the president's pattern of publicly blasting the Fed calls the foundation for her firing into question.

The two firms violated the Advisers Act and Reg BI by making misleading statements and failing to disclose conflicts to retail and retirement plan investors, according to the regulator.

Elsewhere, two breakaway teams from Morgan Stanley and Merrill unite to form a $2 billion RIA, while a Texas-based independent merges with a Bay Area advisory practice.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.