Franklin Templeton is transforming two of its mutual funds into exchange-traded vehicles as the conversion trend gathers speed.

The $1.4 trillion asset manager expects to complete the process of flipping two mutual funds with roughly $250 million of assets into ETFs by the third or fourth quarter of next year, the company said in a statement Tuesday. The plan emerged on the same week that Motley Fool Asset Management finalized a nearly $1 billion switch.

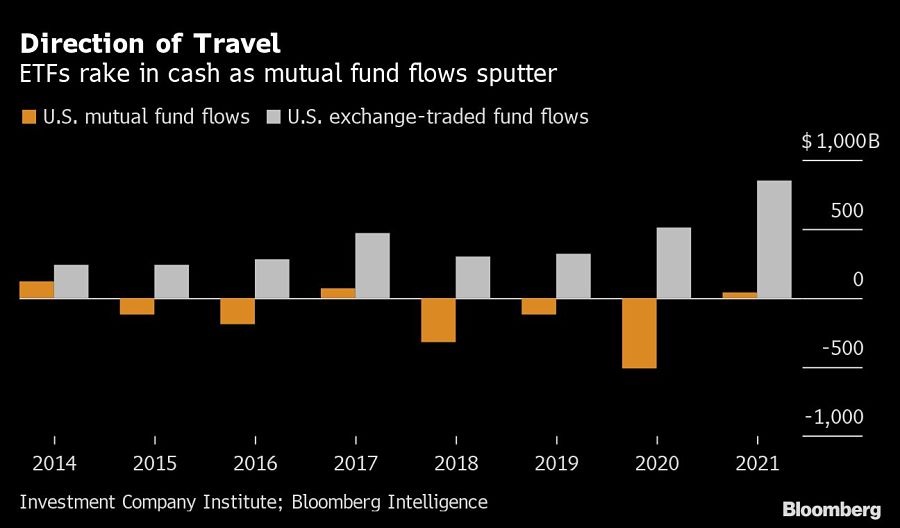

Conversions are gaining popularity as billions of dollars exit mutual funds each year, heading seemingly straight to lower-cost, tax-efficient ETFs. While Investment Company Institute data show that mutual funds are on track for $44 billion in inflowd this year, that pales in comparison with the nearly $850 billion absorbed by ETFs.

That clear investor preference for ETFs will drive more asset managers to do the same, according to Bloomberg Intelligence.

“It’s not big asset-wise, but it’s big symbolically because it’s yet another big-time name from the mutual fund world,” BI senior ETF analyst Eric Balchunas said of the Franklin Templeton conversions. “ETFs will take in close to $1 trillion in the U.S. this year. There’s no way that’s not on the mind of many mutual fund CEOs.”

Dimensional Fund Advisors has embraced conversions, flipping nearly $40 billion of assets this year alone and becoming one of the largest U.S. ETF issuers in the process. In August, JPMorgan Asset Management said it will reorganize $10 billion worth of assets next year.

Converting the BrandywineGLOBAL – Dynamic US Large Cap Value Fund and the Martin Currie International Sustainable Equity Fund will bring Franklin Templeton’s actively managed ETF lineup to 24 products, according to the release.

Citigroup Inc. expects that conversions will be one of several factors fueling a $21 trillion shift from mutual funds to ETFs over the next decade. Meanwhile, Bloomberg Intelligence forecasts that $1 trillion in conversions alone will take place over the next 10 years -- but with a couple years of lead time.

“These are massive, old companies and so many people internally have to sign off. There’s all kinds of legal logistics and hoops to jump through,” Balchunas said. “So while it will likely be a big trend, it will take time.”

Summit Financial unveiled a suite of eight new tools, including AI lead gen and digital marketing software, while MassMutual forges a new partnership with Orion.

A new analysis shows the number of actions plummeting over a six-month period, potentially due to changing priorities and staffing reductions at the agency.

The strategic merger of equals with the $27 billion RIA firm in Los Angeles marks what could be the largest unification of the summer 2025 M&A season.

Report highlights lack of options for those faced with emergency expenses.

However, Raymond James has had success recruiting Commonwealth advisors.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.