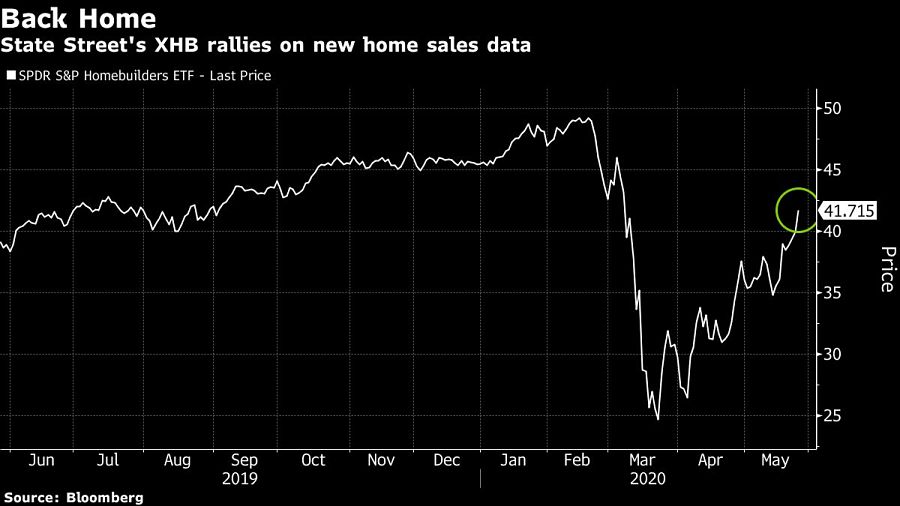

The largest homebuilder ETF surged to pre-crisis levels Tuesday on data showing a surprise increase in sales of new houses last month.

State Street’s SPDR S&P Homebuilders exchange-traded fund (XHB) rallied as much as 4.6% to the highest level since March 6. Purchases of single-family houses in the U.S. unexpectedly climbed in April after sales dropped the most since 2013 in March, when much of the U.S. economy shut down to stem the spread of coronavirus.

Since tumbling to a more than seven-year low on March 23, XHB has soared 68%, compared with a 34% increase in the S&P 500. While the latest homebuilder data suggest the housing market is starting to stabilize, the industry rebound will depend on how quickly the rest of the economy bounces back. High levels of unemployment could serve as a headwind to the recovery.

“The housing market could be one of the brighter spots,” said Emily Roland, co-chief investment strategist at John Hancock Investment Management. “We’ve probably seen the worst of the data in the month of April, but it may take some time for the economy to recover from here.”

Government data also showed that the median sale price of homes in April fell 8.6% from a year earlier, to $309,900. And the S&P CoreLogic Case-Shiller National Home Price index rose 4.35% year-over-year in March after climbing 4.16% in prior month.

“Home prices are still relatively stable and are not showing any sign of a housing bubble bust like that which occurred in the Great Recession over a decade ago,” said Chris Rupkey, chief financial economist at MUFG Union Bank.

Plus, a $400 million Commonwealth team departs to launch an independent family-run RIA in the East Bay area.

The collaboration will focus initially on strategies within collective investment trusts in DC plans, with plans to expand to other retirement-focused private investment solutions.

“I respectfully request that all recruiters for other BDs discontinue their efforts to contact me," writes Thomas Bartholomew.

Wealth tech veteran Aaron Klein speaks out against the "misery" of client meetings, why advisors' communication skills don't always help, and AI's potential to make bad meetings "100 times better."

The proposed $120 million settlement would close the book on a legal challenge alleging the Wall Street banks failed to disclose crucial conflicts of interest to investors.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.