Exchange-traded funds designed to protect against inflation are staring down a record exodus after faltering in the face of still sticky price pressure.

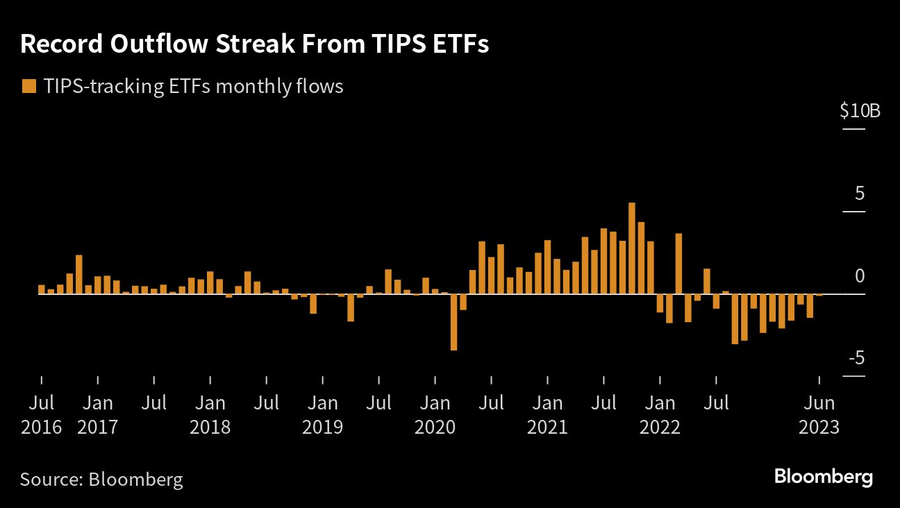

Nearly $17 billion has exited from Treasury-inflation securities ETFs over 10 consecutive months of outflows, an unprecedented streak in data going back to 2016, Bloomberg Intelligence data show.

The biggest such fund, the $21.6 billion iShares TIPS Bond ETF (TIP), is on track to bleed another $1.5 billion this year after investors pulled nearly $10 billion in 2022.

That rush to the exits follows a bruising stretch of underperformance for the asset designed to protect against inflation. While TIPS weather against price erosion, real yields — which strip out the impact of inflation — have soared over the past year, shredding returns even as price pressures remain stubbornly high. That’s soured the appetite of investors who piled into TIP and similar ETFs to curb inflation.

“You got killed and, in many cases, underperformed nominal Treasuries of similar maturities by owning TIPS,” Laird Landmann, TCW Group co-director of fixed income, said on Bloomberg Television’s Real Yield. “So it really has been a bad ride and it’s not surprising the retail side of the equation bailing out of the ETF at this point.”

The $11.5 billion Schwab U.S. TIPS ETF (SCHP) is leading outflows this year with a $2.6 billion loss, followed by the $14.4 billion Vanguard Short-Term Inflation-Protected Securities ETF (VTIP)’s $2 billion loss. SCHP has fallen about 2.4% on a total return basis over the past year, compared to a 1.5% drop for the $29 billion iShares 7-10 Year Treasury Bond ETF (IEF), which holds similarly dated debt.

The distaste for TIPS-tracking ETFs contrasts with reignited demand for the securities in the primary market. Investors snatched up about 96% of the $19 billion in Treasury Inflation Protected Securities auctioned last week, leaving less than 4% to firms authorized as primary dealers.

JPMorgan Asset Management is among the firms eschewing TIPS at the moment. The duration risk in TIPS — a security’s sensitivity to interest-rate changes — dims their appeal with the Federal Reserve poised to keep rates on hold after the most aggressive hiking cycle in decades.

“TIPS do not really represent tremendous opportunity in our opinion because the duration — and they do tend to be longer-duration instruments — tends to dominate the risk there,” JPMorgan Asset Management Head of Market Strategy Oksana Aronov said on Bloomberg Television’s Real Yield. “To the extent that we believe the Fed is going to continue to either be on that pause or even hike further, these aren’t going to be immune to that interest-rate risk.”

Since Vis Raghavan took over the reins last year, several have jumped ship.

Chasing productivity is one thing, but when you're cutting corners, missing details, and making mistakes, it's time to take a step back.

It is not clear how many employees will be affected, but none of the private partnership's 20,000 financial advisors will see their jobs at risk.

The historic summer sitting saw a roughly two-thirds pass rate, with most CFP hopefuls falling in the under-40 age group.

"The greed and deception of this Ponzi scheme has resulted in the same way they have throughout history," said Daniel Brubaker, U.S. Postal Inspection Service inspector in charge.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning