The surge in coronavirus cases has bond ETF investors dumping their riskier holdings in favor of the safety of U.S. government debt.

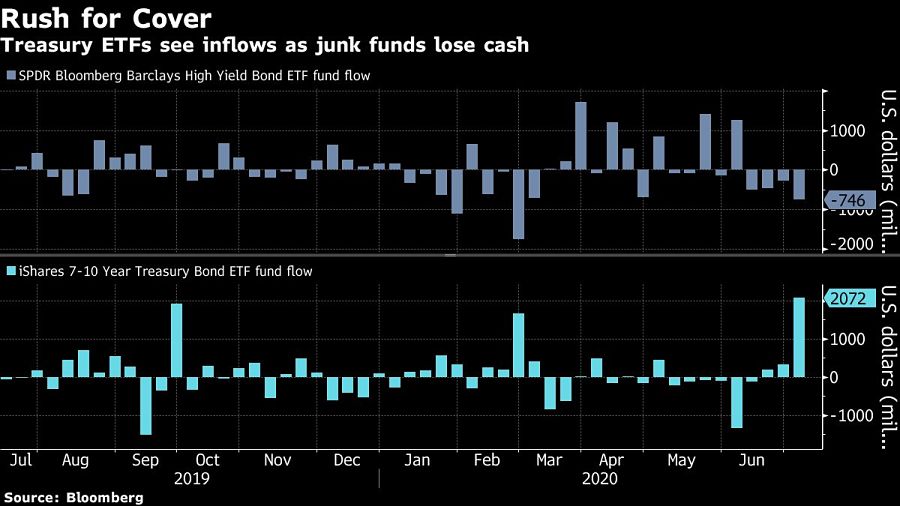

Over $2.6 billion exited from junk-bond exchange-traded funds last week, in addition to the $5.6 billion that fled from high-yield mutual funds. The $11 billion SPDR Bloomberg Barclays High Yield Bond ETF (JNK) led the way with a $746 million outflow, followed by a $609 million withdrawal from the $27 billion iShares iBoxx High Yield Corporate Bond ETF (HYG).

On the other end of the risk spectrum, Treasury-focused funds were a clear beneficiary of the renewed safe-haven demand. BlackRock Inc.’s $22 billion iShares 7-10 Year Treasury Bond ETF (IEF) posted a weekly inflow of over $2 billion -- the largest since January 2019 -- while the $4.2 billion SPDR Portfolio Intermediate Term Treasury ETF (SPTI) absorbed $1.8 billion.

The rotation into higher-quality debt shows investors are taking a “pause for breath” as policy makers grapple with a balance between containing the spreading virus and resuming economic activity, according to Principal Global Investors.

“In that environment, many investors would prefer to be out of riskier assets and find more solace in investment grade and sovereign debt, and will wait for a good opportunity to rebuild their risk positions at a better price,” said Seema Shah, Principal’s chief strategist.

Even as stocks rally, fixed-income investors are reassessing the outlook for the riskier parts of the bond markets amid the resurgence after the Federal Reserve sparked the asset class’s best returns in a decade.

The central bank said in early April that it would begin buying high-yield ETFs to keep credit flowing, spurring billions in front-running flows.

But now that the Fed is shifting its purchases from credit ETFs to individual corporate bonds, others think the junk-bond ETF outflows may be more mechanical. The Fed has less need to buy funds like JNK and HYG now, which means that the dealers facilitating those trades have less need to hold them, according to Mizuho International Plc.

“To initially facilitate the Fed’s flow, dealers would have gone long ETF inventory,” said Peter Chatwell, Mizuho’s head of multi-asset strategy. “Then, when the Fed’s flow moved into single-name bonds, it would have made more sense to hold bond inventory instead.”

For service-focused financial advisors who might take their well-being for granted, regular check-ins and active listening from the top can provide a powerful recharge.

With Parkworth Wealth Management and its Silicon Valley tech industry client base now onboard, Savant accelerates its vision of housing 10 to 12 specialty practices under its national RIA.

Meanwhile, $34 billion independent First Manhattan welcomed New Jersey-based Roanoke Asset Management, an RIA firm with more than 40 years of history.

Most notably, two chief compliance officers have also recently left the firm.

The latest team to join Cetera, led by a 29-year veteran professional, arrives with roughly $380 million in AUA from OSJ Private Advisor Group.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.