Janus Henderson Group’s client exodus is getting worse, giving activist investor Nelson Peltz — its largest shareholder — more leverage to push for sweeping changes at the embattled asset manager.

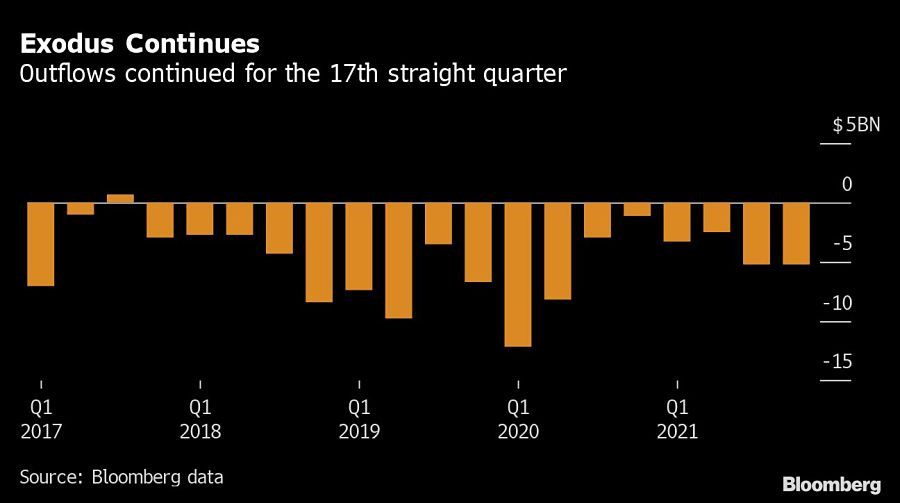

The company saw $5.2 billion of net outflows in the fourth quarter, according to a statement Thursday, which was more than analyst estimates and capped the 17th straight quarter of outflows for the asset manager.

The streak is likely to continue, with Janus Henderson executives telling analysts that they expect $2.2 billion of outflows in the first quarter from one client alone. Janus Henderson shares fell 1.3% at 9:49 a.m. in New York.

“We certainly have some challenges that we’re working on,” Janus Henderson Chief Executive Dick Weil, who is retiring next month, told analysts on Thursday. “I’m proud of the progress that we’ve made although frustrated that we haven’t delivered the consistent organic growth which we’ve aspired to.”

Peltz and Ed Garden, co-founders of Trian Fund Management, joined the fund firm’s board recently, a move that gives them more say over how Janus Henderson is run. Trian, which owns almost 17% of Janus Henderson and is its biggest shareholder, started to press for change more than a year ago.

Janus Henderson said it planned to sell its quantitative equities business Intech Investment Management to a consortium of Intech’s management and other unnamed investors. The unit managed 29 billion pounds ($39.3 billion) in assets as of the end of September, according to its website.

The merger that formed Janus Henderson in 2017 was intended to provide scale as investors shifted out of the actively managed funds it specializes in and into cheaper, index-tracking products.

At the time of the merger between Henderson Group and Janus Capital Group, assets under management totaled about $330 billion. On Thursday, the firm said that figure had risen to $432 billion.

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.