Behind the scenes of the latest rebound in stocks is a growing penchant for steady income streams as risk appetite runs hot and cold this year.

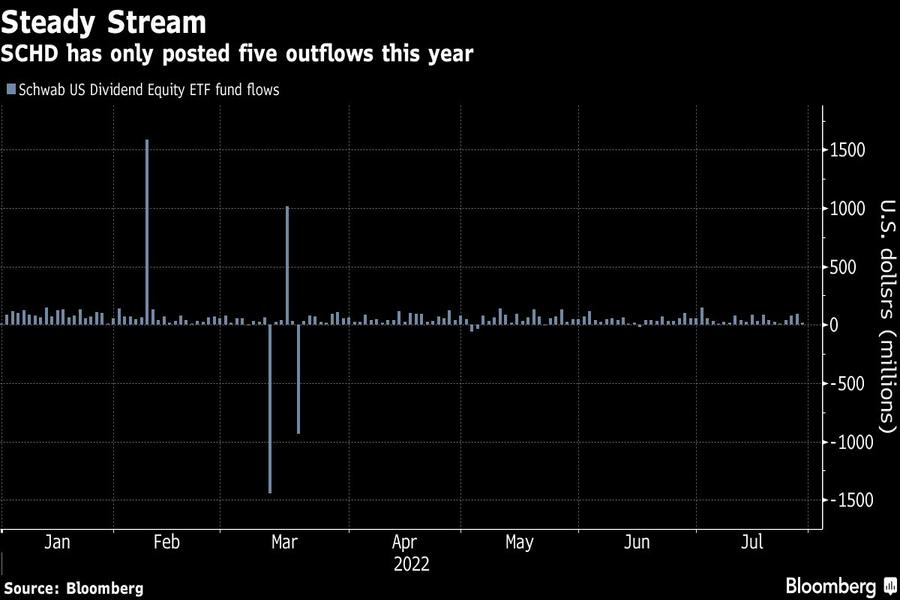

In the $6.6 trillion exchange-traded fund arena, three dividend-focused ETFs rank among the top 10 in terms of equity inflows, according to data compiled by Bloomberg. The leader, the $36.5 billion Schwab U.S. Dividend Equity ETF (SCHD), has only posted five outflows this year.

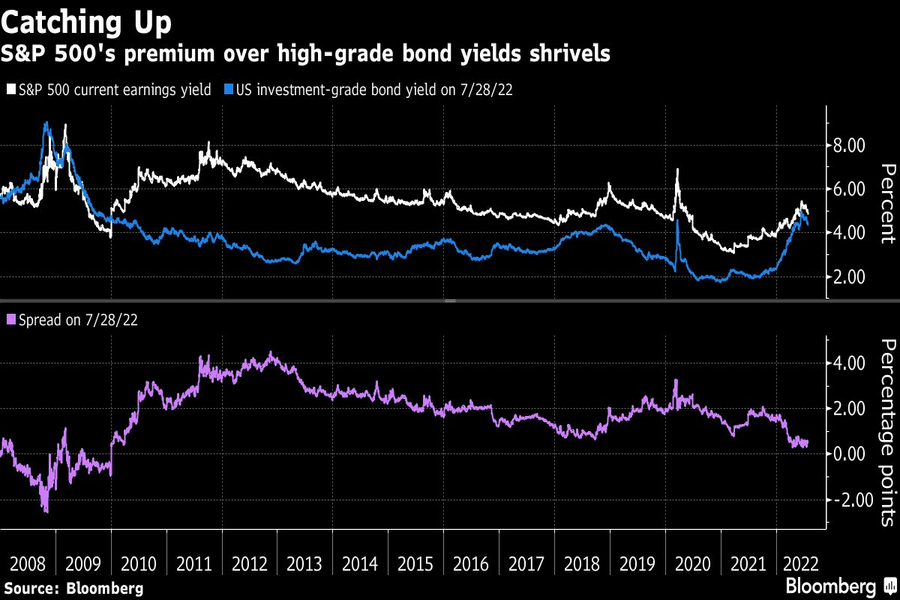

In the bond market, a mix of dip-buying behavior and growth concerns has sparked a fierce rally in Treasuries after benchmark yields hit multiyear highs last month. Billions have been funneled into corporate debt, with the S&P 500’s earnings yield holding the slimmest advantage to the average yield on blue-chip bonds in over a decade.

The demand for coupon-clipping and reliable payouts casts a cautious light on the biggest two-day rally on record following the Federal Reserve’s rate decision. While Fed Chair Jerome Powell last Wednesday raised the potential for smaller rate hikes in the future, skeptics warn that still-high inflation will prevent a pivot and send the economy into a recession. Against that backdrop, it makes sense to play it safe, according to AlphaTrAI’s Max Gokhman.

“The common denominator is defense,” said Gokhman, the firm’s chief investment officer. “High-quality corporate debt and buying stocks of companies with resilient balance sheets that can afford to pay a consistent dividend without worrying about excess leverage or margin pressure makes sense.”

While the S&P 500 has soared 9% in July, on track for its biggest month of gains since November 2020, the index is still down 13% this year. Strong earnings have recently reassured traders, but uncertainty around a U.S. recession and the path of the Fed’s rate hikes has kept traders on their toes.

The back-and-forth nature of stocks has made bonds more appealing to some investors. The average yield on investment-grade bonds is currently 4.35% while the S&P 500 “pays out” about 4.8% in earnings. That’s close to the smallest gap since 2010.

“Really where we’re starting to see opportunity is credit markets,” Russ Koesterich, portfolio manager of BlackRock’s global allocation fund, said on Bloomberg Television. “If we’re going to be in an environment where equity is going to be choppy over the next few months, one of the things you can do in your portfolio is you can add carry. You can add income.”

Relatively high yields on investment-grade bonds means unlike much of the past decade, investors don’t even have to “dive down” in quality for worthwhile returns, according to Karissa McDonough of Community Bank Trust Services. That’s an attractive proposition with recession fears on high alert.

“In corporate bonds, especially high-quality corporates, we’re seeing over 5% yields in some of those areas, which we haven’t seen in a long time,” McDonough, a fixed-income strategist, said in a Bloomberg Television interview. “That’s real money, real income and a good opportunity as long as you’re selective.”

Similarly, a volatile stock market this year has pushed investors toward ETFs that somewhat guarantee a stable income. SCHD, which has garnered nearly $8.3 billion this year, is on track to surpass 2021’s record $9.8 billion haul. And more than $6.3 billion has flowed into the $11.5 billion JPMorgan Equity Premium Income ETF (JEPI) year-to-date, while the $46.1 billion Vanguard High Dividend Yield ETF (VYM) has taken in $6 billion in 2022 — a record.

ETF issuers have also been quick to try and capitalize on the trend. Launches and applications for income-oriented funds have multiplied this year, with strategies ranging from buying stocks of dividend-paying companies to selling call options on the S&P 500.

But the hunt for income isn’t as simple as chasing the stocks with the highest payouts, according to Richard Bernstein Advisors’s Dan Suzuki, whose firm has been adding high-quality dividend stocks and long-duration bonds in recent weeks.

“High-dividend payers are like high-yield bonds — there’s a risk priced in that the dividend gets cut,” said Suzuki, the firm’s deputy chief investment officer. But longer-dated Treasuries and higher-quality dividend stocks are “both an attractive way to get defensive in the portfolio.”

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.