During the endless battle over investment advice standards, one thing has remained fairly consistent: Investment advisers hold the high ground.

They are elevated as the paragon of care because they must meet a fiduciary standard and act in the best interests of their clients.

Brokers are held to a suitability standard that often is described as less stringent because it allows them more leeway to recommend high-fee products that put money into their own pockets.

"Sometimes in the debate, to simplify it, you hear: Advisers good — brokers bad," Ira Hammerman, executive vice president and general counsel at the Securities Industry and Financial Markets Association, told members of the Securities and Exchange Commission's Investor Advisory Committee on

June 14 in Atlanta.

The IAC's agenda was dominated by the SEC's investment advice reform proposal, which is

open for public comment until Aug. 7. Among other things, the proposal seeks to raise advice standards for brokers by requiring them to act in their clients' best interests.

Investor

advocates at the meeting asserted that the so-called Regulation Best Interest would not put brokers on the same exalted regulatory plane as advisers because it's not a fiduciary standard — in fact, the word "fiduciary" is not used to describe the SEC's broker proposal.

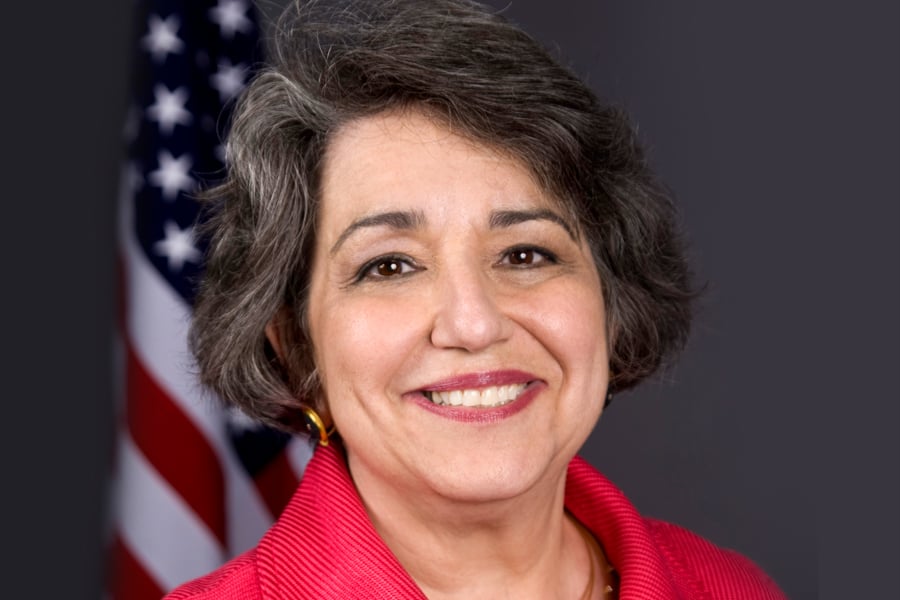

But a former SEC chairwoman threw cold water — not holy water — on acolytes who suggested advisers reside in an ethereal state when carrying out their standard of care.

Elisse Walter, vice chairwoman of the IAC, said courts have implied that the fiduciary duty attached to the Investment Advisers Act of 1940 has to do with preventing fraud and that the SEC has only enforced the duty as it applies to fraud. That has put an emphasis on advisers disclosing conflicts of interest rather than eliminating them.

"In the end, what that means is that disclosure can cure virtually any fiduciary problem under the Advisers Act," Ms. Walter said at the IAC meeting. "I think that needs to be fixed. It's time to acknowledge that the emperor has no clothes."

Karen Barr, president and chief executive of the Investment Adviser Association, interprets the common law surrounding the Advisers Act, as well as SEC statements about it, differently. In response to Ms. Walter, she said advisers must go further than telling clients about their conflicts — they also must do what's best for their clients.

"We do not believe advisers can disclose away their conflicts of interest," Ms. Barr said.

Ms. Walter agreed that that's the adviser standard in principle — but not in practice.

"When the only enforcement is limited to fraud, it's not the case, and, in fact, I think it's time to stop pretending that it is," Ms. Walter said.

A recent SEC enforcement effort showed the agency zeros in on disclosure when it comes to investment advisers.

Last week, the

Share Class Disclosure Initiative concluded. Its objective was to encourage advisers to turn themselves in if they failed to tell clients they recommended a high-fee share class when a less-expensive one in the same fund was available.

"The numerous self-reports we've received again make clear the scope of the issue and importance of the initiative as a means to return money quickly to impacted investors," C. Dabney O'Riordan, co-chief of the SEC Enforcement Division's Asset Management Unit, said in a June 14 statement.

The SEC says investment advisers' failure to disclose receiving 12b-1 fees to sell funds is rampant. The agency didn't dwell on the fact that advisers were taking the fees in the first place, which some would call a violation of fiduciary duty.

Of course, as Micah Hauptman, financial services counsel at the Consumer Federation of America, pointed out to the IAC, when clients buy funds that have 12b-1 fees in brokerage accounts, it's not a one-off transaction. Those fees continue to line the pockets of brokers.

Perhaps the only conclusion we'll reach about differing standards of care is that conflicts can be rife in either one. Take it from a former SEC chairwoman.