As the coronavirus pandemic rattles the globe, companies that focus on protection or recovery from biological threats could become part of an exchange-traded fund.

Pacer ETFs is planning to launch a fund that tracks an index of companies offering products, technologies and services that are currently in high demand. Those stocks range from businesses that could identify or combat diseases to those enabling social distancing and working from home, according to a filing to the Securities and Exchange Commission.

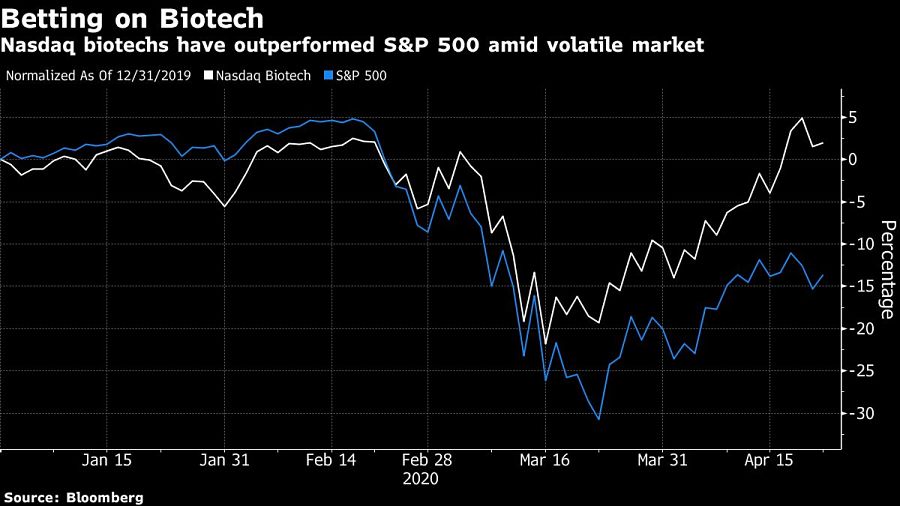

With millions of people around the world stuck in their home offices to help contain the coronavirus outbreak, companies that specialize in remote-working products are becoming a hot spot. And while biotechnology shares haven’t been immune to the huge volatility, they’ve been withstanding it better than the broader market. Developing new drugs isn’t easy, and making bets in biotech comes with the risk of failure. Yet the potential payoff for investors can also be enormous when a new medicine succeeds.

“There is likely to be demand for a thematic diversified strategy seeking to combat biotechnology threats as COVID-19 has reshaped global economies,“ said Todd Rosenbluth, head of ETF and mutual fund research at CFRA. “However, many of these likely constituents will be in early stages of growth and profitability, while perhaps also trading at a premium due to investor optimism.”

Pacer plans to track the performance of the BioShares BioThreat Index. It seeks to include companies with at least $1 billion in market capitalization and a minimum average daily value traded of at least $2 million for the last six months.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.