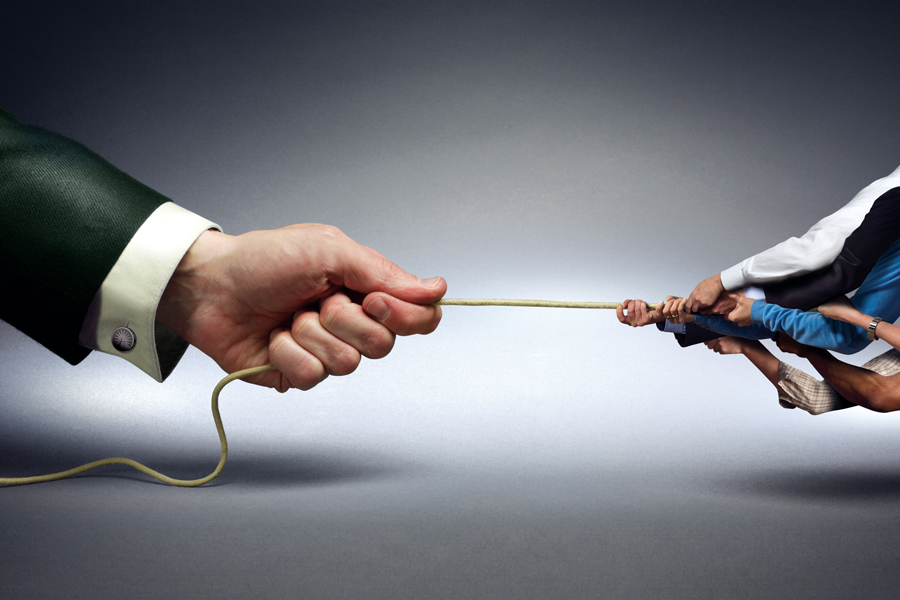

Crises like the COVID-19 pandemic seem to accelerate trends already in motion, as well as creating new ones. While an estimated 50% of defined-contribution plans like 401(k)s are managed by more than 100,000 wealth managers who do not specialize in DC plans and earn less than 50% of their revenue from such plans, it’s getting harder for them to dabble in an industry littered with regulatory and legal land mines.

Most generalist financial advisers stumbled into the few DC plans they manage because a client or colleague asked them to help out. Some wrongly predicted that the Department of Labor’s former, ill-fated fiduciary rule would result in a mass exodus of advisers. But relationships matter, especially with smaller companies. And though many DC plan sponsors are waking up, it's just the beginning of a decade-long evolution.

As once-small 401(k)s grow in assets, they get picked off by retirement plan advisers. Not only does that jeopardize the generalist adviser’s revenue from those plans, but also the lucrative wealth management opportunities and relationships that brought them the plan in the first place.

Yet there are opportunities for wealth managers to serve participants and leverage the inherent trust and access RPAs have with DC plan participants. That includes:

Generalists have viable options, none of which include doing nothing, such as:

Either hire someone to focus on DC plans or train an employee while looking for more opportunities.

Rely on a broker-dealer, record keeper or institutional partner, many of whom are creating pooled employer plans under the SECURE Act, taking on all fiduciary responsibility and most of the work of deploying a very simple plan design.

Work with an RPA specialist to take over the committee-level services. The RPA can be the named fiduciary, allowing the generalist to maintain the plan sponsor relationship and mine the participants.

Find an RPA specialist that wants to buy the plans. That could be lucrative for both entities, because the generalist’s revenue may equate to 90% profit for those that have staff and infrastructure. Such a deal could allow the generalist to continue to work with participants.

The ideal RPA partner may be one that does not work with participants. They may also be willing to refer participants in their plans to the generalist partners. While participants’ engagement might need to be local, committee-level services do not.

Record keepers like Fidelity, Vanguard, Schwab and now Empower realize the value of working with participants. Generalists either need to have a competitive set of services, such as Captrust has built, or concede the opportunities.

Partnering, selling and even stepping up seem more appealing.

The level of trust between advisers has never been high, so partnering or selling while retaining access to participant opportunities requires a tight legal agreement with teeth, which likely would require a third party to enforce. There’s no right answer, but the wrong answer is to do nothing, putting your head in the sand while wealth managers decide whether to mine DC opportunities or avoid the land mines.

Fred Barstein is founder and CEO of The Retirement Advisor University and The Plan Sponsor University. He is also a contributing editor for InvestmentNews’ Retirement Plan Adviser newsletter.

Wealth management unit sees inflows of $23 billion.

Deal will give US investment bank a foothold in lucrative European market.

New report examines the impact that the initiative has had on philanthropy.

Few feel confident that they will meet their retirement goals.

Catch-up contributions, required minimum distributions, and 529 plans are just some of the areas the Biden-ratified legislation touches.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.