Earlier this year, psychiatrist and author Gregory Scott Brown published an article on meaningful living. He shared research showing that people who were more optimistic for the future and focused on fulfillment instead of happiness were better off than others whose emotions were tied to day-to-day events. In his view, feeling grateful for today while learning to adapt for tomorrow can generate a more positive sense of well-being.

I wholeheartedly agree with this perspective. In my experience, people who ground their feelings in gratitude and informed optimism for tomorrow have always demonstrated the grace and grit that’s needed to live a happier and healthier life. The natural next question is where people can turn to get started on a journey towards greater fulfillment. One hundred experts will offer 100 different answers, but I have a somewhat surprising suggestion that’s rooted in research for individuals to consider: A financial advisor.

I know what you’re thinking: “Why would someone turn to a financial advisor for personal fulfillment?” While I’m not suggesting that a financial advisor is the equivalent of the local life coach or pastor, our research demonstrates this idea is not as outlandish as you might think.

According to Northwestern Mutual’s 2023 Planning & Progress Study, people who work with an advisor have significantly higher levels of confidence across a range of areas, including being prepared for unplanned expenses (31 percentage points higher), being able to retire when the time comes (29 percentage points higher) and achieving long-term financial security (28 percentage points higher).

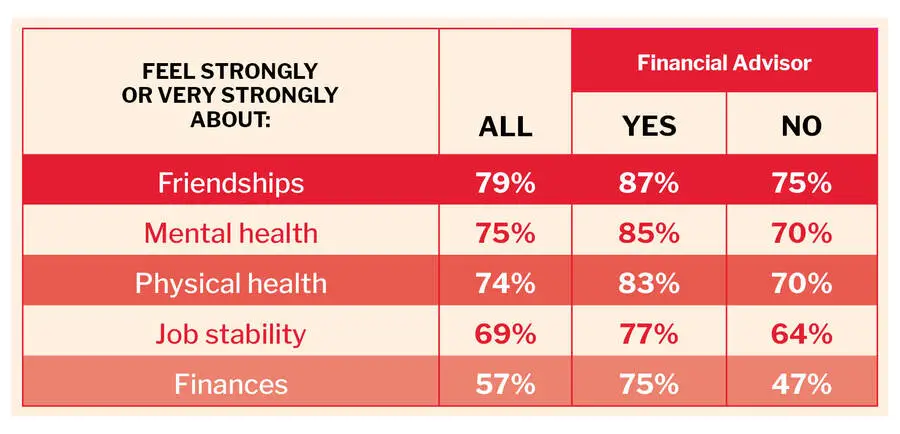

But the benefits of planning extend beyond the financial realm. Americans with advisors expressed greater confidence in their friendships (12 percentage points higher), mental health (15 points higher), physical health (13 points higher) and job stability (13 points higher).

The research shows that people with an advisor can gain the assurance to feel confident that they are on the right path and can reach their financial goals. That sense of financial certainty and optimism helps to free people from anxiety and enables them to focus more attention on their own wellness as well as that of their loved ones.

Today, financial uncertainty is rampant. Two in three Americans think their financial plans need improvement — and for millennials and Gen Z, that number is even higher. Many people are worried about the impact that inflation, a potential recession, market volatility and international conflicts may have on their financial lives.

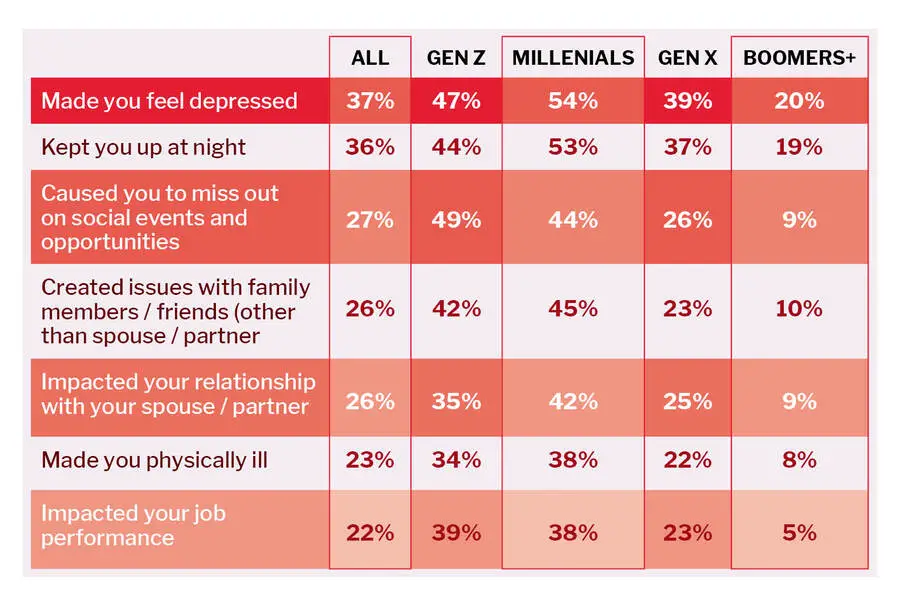

For some, their emotional distress has physical consequences. More than one-third of Americans (36%) say that financial uncertainty keeps them up at night at least once per month. According to our research, the arc of anxiety peaks with millennials, who report the highest incidence of side effects caused by their financial worries.

Financial uncertainty causes the following issues across generations at least once a month:

When we think about the trajectory of our lives, there are a lot of unknowns when people are getting started in their careers. This is certainly the case for millennials, who are starting to hit financial milestones and think more seriously about their futures.

When people ground their financial futures in plans that are custom-built with expert advisors — instead of being paralyzed by worry — their confidence can increase tremendously, and their improved financial outcomes can be just as significant. In fact, people who work with an advisor have significantly higher levels of confidence across a range of areas.

For many, fall feels like the start of a new year. Kids head back to school, and millions of Americans look to create a fresh start with new goals for their overall wellness. As they do, I highly encourage them to consider seeking the counsel of a financial advisor to add value to their lives. The data makes clear the many financial and nonfinancial emotional, relational and physical benefits that clients report enjoying.

Today, when financial uncertainty has many people looking for the assurance that things will be all right, a vital way to gain that optimism and feel more grounded and financially confident is to connect with an advisor to help them on their financial journey.

Tim Gerend is chief distribution officer and executive vice president at Northwestern Mutual.

After a two-year period of inversion, the muni yield curve is back in a more natural position – and poised to create opportunities for long-term investors.

Meanwhile, an experienced Connecticut advisor has cut ties with Edelman Financial Engines, and Raymond James' independent division welcomes a Washington-based duo.

Osaic has now paid $17.2 million to settle claims involving former clients of Jim Walesa.

Oregon-based Eagle Wealth Management and Idaho-based West Oak Capital give Mercer 11 acquisitions in 2025, matching last year's total. “We think there's a great opportunity in the Pacific Northwest,” Mercer's Martine Lellis told InvestmentNews.

Osaic-owned CW Advisors has added more than $500 million to reach $14.5 billion in AUM, while Apella's latest deal brings more than $1 billion in new client assets.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.