This feature is part of InvestmentNews’ April financial literacy series in observance of National Financial Capability Month.

Our world has drastically changed over the last few weeks as the coronavirus disrupted the economy. That just makes the work of improving Americans' financial awareness and financial literacy all the more important as we approach National Financial Literacy Month in April.

As you may know, 10,000 Americans reach age 65 daily, and many are on track to run out of money long before the end of their lives. Many families are burdened with large amounts of student loans or other forms of debt, and more than half of U.S. adults do not have or understand why they need an up-to-date financial, estate and gift plan to protect themselves and their families

This creates a significant opportunity for you to advance your business by attracting motivated clients, while helping to grow a stronger, financially sound, domestic and international economy.

The master plan

Managing personal finances today is more complicated and time-consuming, yet more important than ever. We are living longer, but saving proportionately less. We feel less secure in our jobs, homes and overall outlooks than previous generations did. We watch helplessly as our money evaporates as a result of the exorbitant costs of housing, taxes, education, health care and life’s too many unexpected events. Many clients and prospects worry about the future. Or unfortunately, in many cases they simply try not to think about it.

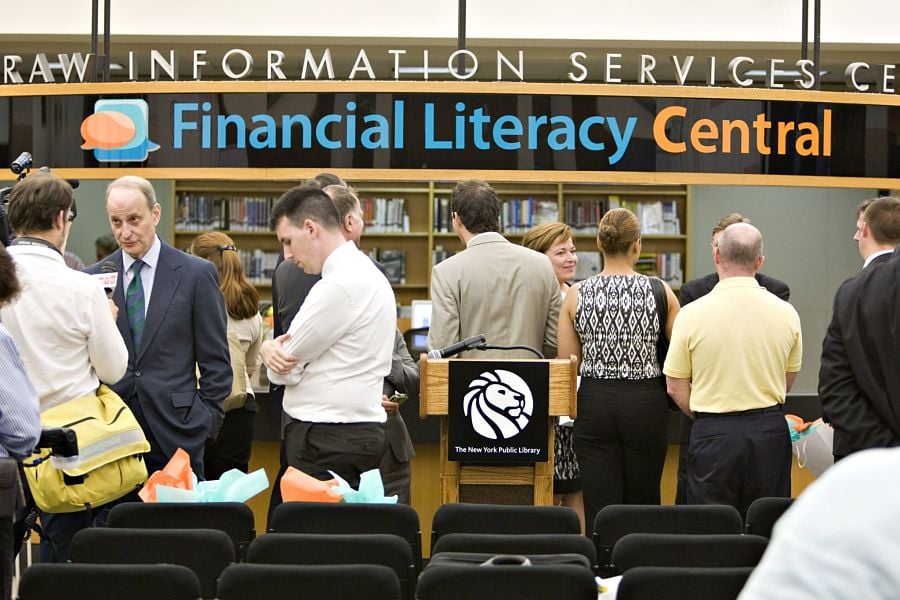

To address this epidemic of financial illiteracy, 12 years ago we began taking an active leadership role to recognize organizations and their management, as well as individuals, championing improving financial awareness and financial literacy. We unite them with other associations, organizations, nonprofits, educational institutions, municipalities, employers and the news media to focus these vast community resources into the Improving Financial Awareness & Financial Literacy Movement, which works to create semiannual personal finance content media blitzes around two strategic campaigns: Financial Literacy Month in April and, six months later, Estate & Gift Planning Awareness Month in October.

The plan is to touch everyone at least twice a year through these campaigns with educational and motivating content, reminders and tools for making informed lifelong financial decisions, as well as getting and keeping your financial house in order by having current financial, estate and gift plans.

Promote your business while boosting financial literacy

We’ve assembled the following collection of tools to assist you in supporting and actively participating in the movement.

• Give clients a financial literacy quiz.

• Place editorial content about financial, estate and gift planning and investments on your website, get it into newsletters and your chapter's local newspaper, and promote it via social media and radio, TV and web-based shows and ads in support of Financial Literacy Month in April and Estate & Gift Planning Awareness Month in October.

• Add an ‘Improving Financial Awareness & Financial Literacy Page’ to your website.

• Host, present or participate in webinars or seminars built around investing, and financial, estate and gift planning during the months of April and October.

• Circulate materials on the movement to improve financial awareness to your colleagues and encourage them to support and actively participate in these important events.

Who benefits?

Everyone benefits from a stronger, financially sound economy. Significantly improving financial awareness and financial literacy will have a major positive impact on health care, education, agriculture and food supply, economic empowerment and jobs, while encouraging peace, reduced violence and so much more.

Valentino Sabuco is executive director of The Financial Awareness Foundation, a 501(c)(3) nonprofit whose mission is to help solve the financial illiteracy epidemic.

Most firms place a limit on advisors’ sales of alternative investments to clients in the neighborhood of 10% a customer’s net worth.

Those jumping ship include women advisors and breakaways.

Firms in New York and Arizona are the latest additions to the mega-RIA.

The agent, Todd Bernstein, 67, has been charged with four counts of insurance fraud linked to allegedly switching clients from one set of annuities to another.

“While harm certainly occurred, it was not the cataclysmic harm that can justify a nearly half billion-dollar award to the State,” Justice Peter Moulton wrote, while Trump will face limits in his ability to do business in New York.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.