Equity exchange-traded funds have overtaken their fixed-income peers when it comes to inflows this year thanks to November’s epic stock rally.

After lagging bond funds for most of 2020, ETFs tracking equities lured a record $81 billion last month, bringing their total haul for the year to $196 billion, according to data compiled by Bloomberg. That catapulted them ahead of fixed-income funds, which attracted $17 billion and have a tally of $192 billion.

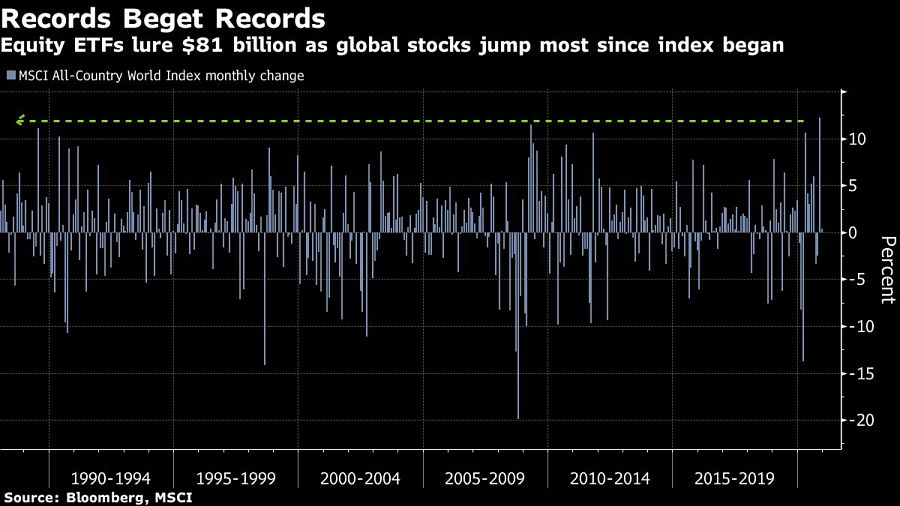

Investors are redeploying cash into stocks following a series of breakthroughs in the race for a COVID-19 vaccine and amid mounting optimism on economic growth. Beaten-down areas of the market have benefited the most, with small caps and energy shares posting their strongest months on record in November. Global equities notched their largest monthly gain since at least 1988, while multiple major benchmarks are at or near all-time highs.

“The prospect of multiple COVID-19 vaccines on the horizon, combined with diminished uncertainty over the presidential transition, boosted investor appetite for stocks. Equity ETFs reflected that,” said Nate Geraci, president of investment advisory firm the ETF Store. “Given that November was a historic month for stocks and with some investors questioning the risk-reward profile of bonds, it’s no surprise to see equity ETF inflows surpass bond ETFs.”

About 95% of stock funds posted gains last month, with around two-thirds of them beating the S&P 500.

The clear winner from the renewed appetite has been Vanguard Group thanks to its line-up of low-cost products. The $189 billion Vanguard Total Stock Market ETF (VTI) has seen the most inflows this year at $27.2 billion, followed by the $177 billion Vanguard S&P 500 ETF (VOO), which has absorbed $26.7 billion.

They may have been overtaken for flows, but it remains a banner year for fixed-income ETFs.

After a violent selloff created a liquidity crunch across bond markets, the Federal Reserve announced in March that it would buy ETFs for the first time. Billions poured into credit funds in the aftermath, curing deep discounts and putting them on track for a record 12 months.

The Fed has only purchased about $8.7 billion worth of corporate bond ETFs in total, but the central bank’s presence has been enough to give the products a stamp of approval. BlackRock Inc.’s $58.6 billion iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) has attracted $18.3 billion so far this year, putting it in third place behind VTI and VOO.

Total assets in U.S. bond ETFs stand at roughly $1.1 trillion, while their stock counterparts hold $4 trillion. If the equity rally gains further steam, that gap could grow even bigger.

“Flows follow performance,” said Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors. “Investor confidence over the past couple months has also benefited greatly from positive vaccine news.”

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.