Advisers are feeling a bit more optimistic than they were three months ago.

When InvestmentNews Research took the industry’s temperature heading into the third quarter, 87% of advisers surveyed believed it was at least somewhat likely that the COVID-19 pandemic would trigger another significant market decline of 10% or more.

Heading into the fourth quarter, advisers are feeling more confident about financial markets, their businesses and the overall economy than they were in our last survey.

The survey, consisting of a sample of 106 financial advisers, was fielded in the first half of October and focused on plans for the coming quarter and sentiment about the year ahead.

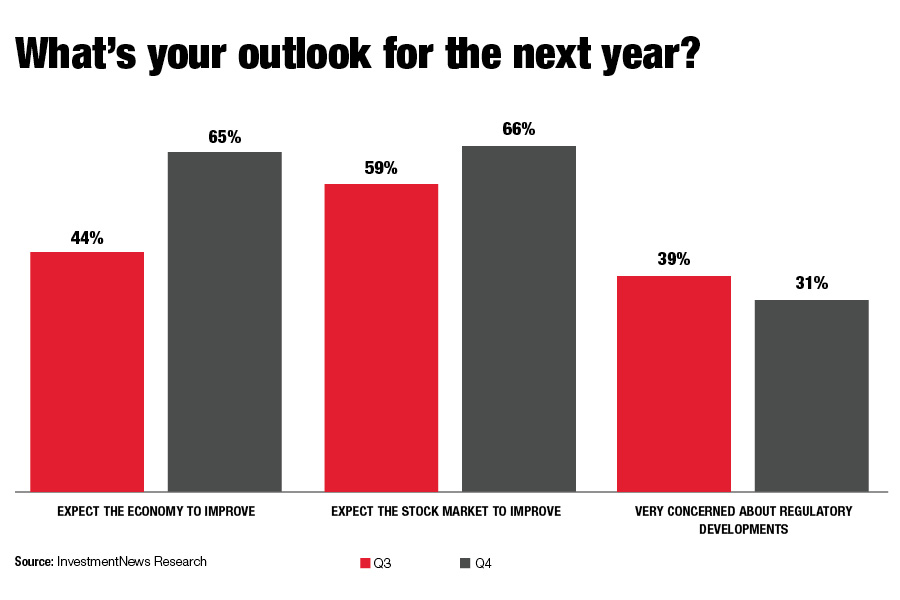

Adviser expectations for the overall U.S. economy were the most notable change from the third to fourth quarters, shifting from a negative to positive outlook. In the most recent survey, 65% of advisers expected economic growth over the next year, compared with 44% who felt similarly in the third quarter. Fewer than 25% of advisers surveyed this quarter anticipated a deterioration in economic conditions.

The rosier outlook was also reflected in views on financial markets. About two-thirds of advisers expected an improvement in the S&P 500, and the bulls were more bullish: Among advisers expecting growth in the index, the median projection rose from 7% to 9%.

Notably, advisers were also less concerned about adverse regulatory developments. Despite the approach of a presidential election, the share of advisers very worried that regulatory and political shifts would hurt their business declined from 39% to 31%.

This survey was fielded by InvestmentNews Research. For more information on IN’s research offerings, visit our data store or contact [email protected].

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.