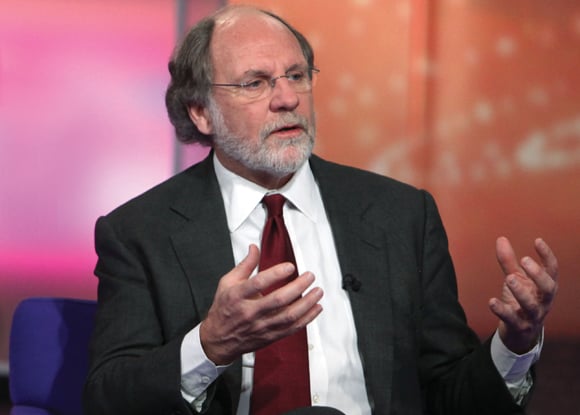

A pair of former MF Global Holdings employees have filed a class action lawsuit against former CEO Jon Corzine and 11 other senior executives and directors over misleading them about the condition of the company.

Monica Rodriguez and Cyrille Guillaume yesterday filed a class action against former MF Global Holdings Ltd. CEO Jon Corzine and 11 other senior executives and directors of the company. The suit was filed on behalf of all MF Global employees who purchased shares in the firm through company-sponsored plans.

“Jon Corzine and the board breached their fiduciary duty to their employees and destroyed their careers and retirement savings,” said Jacob Zamansky, counsel for the plaintiffs, and head of Zamansky & Associates. “They need to be held accountable.”

Mr. Corzine's lawyer, Andrew Levander of Dechert LLP, did not return a call for comment. A spokesman for Davis Polk & Wardwell LLP, which is representing the independent directors of MF Global, declined to comment.

The class includes all employees who purchased stock through the plans between May 20, 2010 — two months after Mr. Corzine joined the firm — and Nov. 3, 2011.

Ms. Rodriguez was the New York-based head of credit for the firm, while Mr. Guillaume was a London-based managing director. Both were terminated by the firm Nov. 11. MF Global had close to 2,900 employees when it filed for bankruptcy protection Oct. 31.

Under MF Global's employee stock purchase plan, employees could use up to 15% of their compensation to purchase shares in the firm at a 15% discount to the market price. The firm also had a long-term incentive plan that provided grants of stock options and share-related awards as part of some employees' compensation.

The suit alleges that Mr. Corzine, former head of The Goldman Sachs Group Inc., and other MF Global executives made false and misleading statements about the company's financial condition in public financial filings during the period.

“If employees had known MF Global's true financial condition, they could have refused to buy in or insisted on compensation arrangements that were all cash,” Mr. Zamansky said.

Mr. Corzine and eight of the other defendants were directors on the board of MF Global and “in a unique position to determine whether continued investment in MF Global stock was reasonable and prudent under the plans,” according to the complaint.

Notably absent from the list of defendants is Michael Roseman, MF Global's former chief risk officer, who resigned from the firm last March. Mr. Roseman reportedly raised numerous objections to the growing risks being assumed by Mr. Corzine and the firm, and warned about the consequences of a credit downgrade for the company.

“We think he may be very useful for the case,” Mr. Zamansky said. “We plan on getting his e-mails, as they could have telling information in them.”

Mr. Corzine is expected to testify before the House Agriculture Committee on Thursday in Washington about the firm's collapse and alleged missing customer funds of as much as $1 billion.