As the regional bank turmoil continues and markets digest the Federal Reserve’s latest rate hike, investors and executives are turning to the next big question: What if lawmakers fail to resolve the standoff around the U.S. debt ceiling?

That scenario — though considered unlikely by many — is attracting attention as the outlook for the economy darkens. With ongoing pressures on smaller lenders, slowing growth and rising financing costs, the wrangling over increasing the $31.4 trillion statutory limit could roil markets further.

President Joe Biden has invited congressional leaders for a May 9 meeting after Treasury Secretary Janet Yellen suggested that the so-called X-date, after which the U.S. might exhaust its options to fund itself, could come as early as June 1 — less than a month away.

Bank analysts and ratings firms are forecasting a substantial hit to credit markets, depending on how long the political standoff lasts, and how it ends.

Bank of America Corp. analysts expect market stress around the borrowing limit to build in the coming weeks, potentially resulting in risk-off sentiment among investors. Treasury bill markets are already showing significant signs of worry around the potential for nonpayment of U.S. debts in early June.

“The bill curve now shows a more pronounced ‘hump’ the first week of June,” Bank of America analysts Mark Cabana, Katie Craig and Ralph Axel wrote in a May 4 note to clients.

Market participants will likely revise their forecasts and models in the coming weeks as the date nears. Traders are weighing a range of scenarios, including a suspension or a temporary extension of the limit.

But, even if there is an agreement to raise the ceiling before the cutoff date, there will be an impact on vulnerable issuers, especially if there are cuts to government spending, Moody’s Investors Service said.

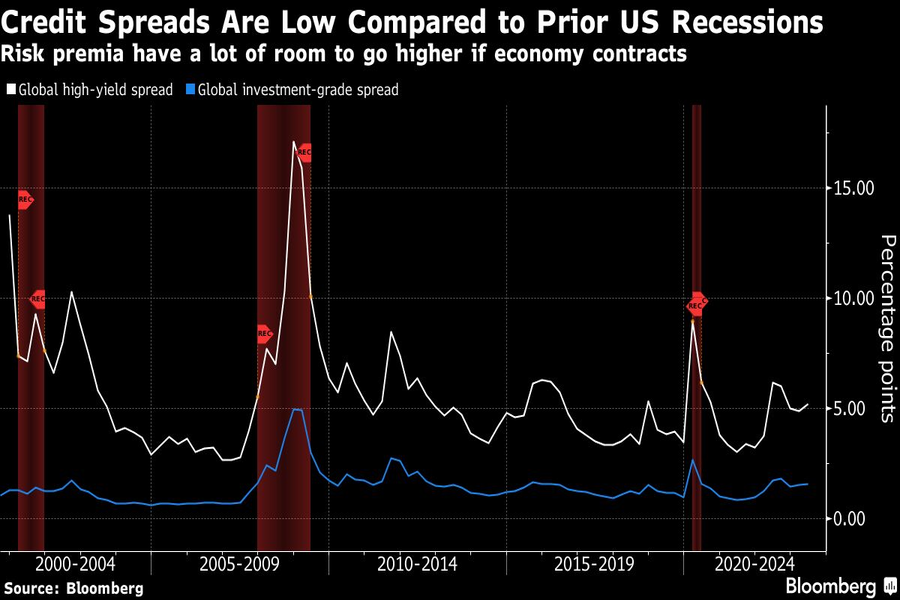

“We see the debt ceiling as a tactical risk to our more bullish call on spreads,” analysts at CreditSights Inc. wrote, pointing to previous standoffs that caused spreads to widen even after they were resolved.

Asset owners already appear to be preparing for spreads to move out. U.S. junk-bond funds saw $1.58 billion in outflows during the week ended May 3, while investment-grade funds added $321.6 million, according to Refinitiv Lipper.

A missed interest payment in a no-deal scenario would cause a downgrade in the U.S. AAA rating and have widespread rating impacts on government-sponsored enterprises such as Fannie Mae, Freddie Mac and the Federal Home Loan Banks system, as well as not-for-profit hospitals and public entities, Moody’s said.

Wider knock-on effects on banks, insurers, clearing houses, bond funds and money markets are also expected, the ratings firm said, pointing to the risk of elevated redemptions, which would put pressure on liquidity.

High quality investment-grade rated bonds, however, could become more appealing compared with other asset classes, as investors seek safe havens. Those names will likely see little to no credit impact, according to Moody’s. Investment-grade credit spreads stood at 146 basis points more than Treasuries on Friday — up from 138 basis points on May 1 — while high-yield spreads rose to 471 basis points, up from 439 basis points on May 1.

Corporate executives so far have said they remain confident that lawmakers will figure out a solution for the issue around the debt ceiling. “I do think it will resolve itself, but there’ll be a lot of noise up until that occurs,” said Kevan Krysler, the finance chief of Pure Storage Inc., a data storage firm, echoing comments from other company leaders.

The move to charge data aggregators fees totaling hundreds of millions of dollars threatens to upend business models across the industry.

The latest snapshot report reveals large firms overwhelmingly account for branches and registrants as trend of net exits from FINRA continues.

Siding with the primary contact in a marriage might make sense at first, but having both parties' interests at heart could open a better way forward.

With more than $13 billion in assets, American Portfolios Advisors closed last October.

Robert D. Kendall brings decades of experience, including roles at DWS Americas and a former investment unit within Morgan Stanley, as he steps into a global leadership position.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.