Most international investors say a tax break allowing private equity and hedge-fund executives to pay lower tax rates than many average Americans isn't warranted, according to a Bloomberg survey.

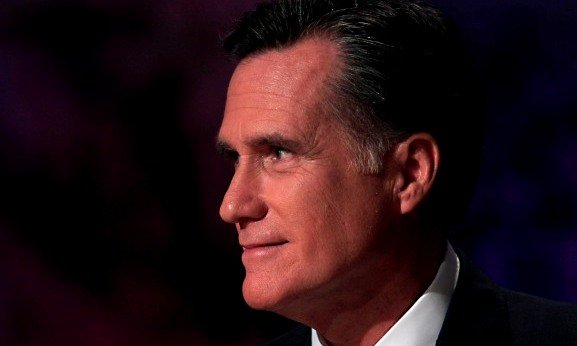

As the release of Republican presidential candidate Mitt Romney's 2010 tax return heats up debate over a 15 percent top rate on so-called carried interest, two-thirds of those surveyed in the Bloomberg Global Poll say the tax break is unjustified. The lower levy helped Romney, former head of

Bain Capital LLC, pay an effective rate of 13.9 percent on $21.6 million of income, when the top income tax rate is 35 percent.

Jonathan Sadowsky, chief investment officer at Vaca Creek Asset Management LLC in San Francisco, said he favors eliminating the break because he's concerned about government deficit spending.

“I'm extremely worried about the debt,” he said. “Somewhere down the line, people are going to stop lending us money.”

About $7.4 million, more than one-third of Romney's 2010 income, was from carried interest, which is the share of profits that make up most of the compensation for partners in private equity firms, hedge funds and real estate developments. Those fees are taxed as capital gains rather than ordinary income.

Sixty-six percent of poll respondents worldwide said the break isn't justified, compared with 21 percent who said it is and 13 percent who said they had “no idea.” Among those living in the U.S., 67 percent said the lower rate isn't justified, versus 27 percent who said it is. The Jan. 23-24 poll of 1,209 investors, analysts and traders from around the world has a margin of error of plus or minus 2.8 percentage points.

Economic Fairness

The survey bolsters the position of Democrats who have pushed for years to eliminate the special treatment of carried interest. Romney's use of the break has renewed scrutiny as President Barack Obama makes economic fairness a theme in his re-election campaign and studies show that income inequality has grown dramatically over the past quarter-century.

Democrats have won high-profile allies on the issue, including billionaire Warren Buffett,

Blackstone Group LP co- founder Pete Peterson and New York City Mayor Michael Bloomberg, founder and majority owner of Bloomberg News parent Bloomberg LP. Obama invited Buffett's secretary to the Jan. 24 State of the Union address to highlight the Berkshire Hathaway Inc. (BRK/A) chairman's comments that he shouldn't pay a lower tax rate than his employees.

Buffett Rule

In the State of the Union speech, Obama outlined a so- called Buffett Rule that would require people making $1 million or more to pay at least 30 percent in taxes.

Democrats are pushing to use repeal of special treatment for carried interest to help finance a payroll-tax break that expires at the end of next month as well as to prevent $1 trillion in automatic spending cuts set to begin taking effect at the end of the year. Republicans have blocked moves to raise the carried-interest rate, saying it will hurt the recovering economy.

Taxing carried interest as ordinary income would produce about $22 billion over a decade, according to the nonpartisan Congressional Budget Office.

Gerhard Summerer, president of DZ Financial Markets LLC in New York, said the lower rate is nothing more than “welfare for the rich,” saying the “average American citizen” gets no such breaks. “No one is advocating confiscating anyone's possessions, but the fair taxation of income,” he said.

The revenue lost to the Treasury makes it more likely that lawmakers, under pressure to reduce the deficit, will have to cut services to lower-income Americans, said Sadowsky.

‘Misallocation of Capital'

“Who pays for that loss of revenue now that the government is short?” Sadowsky said. “Yup, the lower and middle class. So we have a misallocation of capital and resources from the poor and middle class to the rich.”

The carried interest debate is getting mixed up with an “entirely different” issue of “extremely wealthy people” who are “paying extremely low tax rates, which doesn't exactly sit too well with a struggling economy,” said Andrew Paolillo, a portfolio manager at Rocky Hill Advisors Inc. in Peabody, Massachusetts, who defended the lower tax rate.

“Carried interest from an investment in a fund is more similar to simply buying shares of a stock than receiving a salary,” he said in an e-mail. “It is earning money from money previously invested, instead of earning money for services rendered.”

‘Scream Bloody Murder'

Christian Thwaites, president and chief executive officer of Sentinel Investments in Montpelier, Vermont, scoffed at complaints that a tax increase would be a blow to the private- equity industry.

“I'm sure they'd scream bloody murder and say this is the end of the world, but I just can't believe it,” said Thwaites. “There's plenty of reasons to be in private equity other than just the fact that you get a 20 percent tax improvement.” There are “still going to be pretty decent returns available” even if the tax rate is raised, he said.

Others said they don't think it makes sense to treat carried interest as anything other than income subject to regular rates.

“It is used to pay bonuses to general partners, and I see no reason why bonuses should not be treated as income,” said Don Lindsey, chief investment officer for George Washington University in Washington.

John Boland, co-founder of Maple Capital Management in Montpelier, Vermont, said “if it looks like a duck and quacks, calling it a chicken does not change the fact it is duck, to paraphrase Ronald Reagan.”

--Bloomberg News--