Judge backs claw back demand from bankruptcy trustee, also gives greenlight to trial; team's basic salary $90M

The New York Mets owners have to give up as much as $83 million in illegal profits from Bernard Madoff’s Ponzi scheme and face a trial over another $303 million of their own money to determine if they acted in bad faith, a judge ruled.

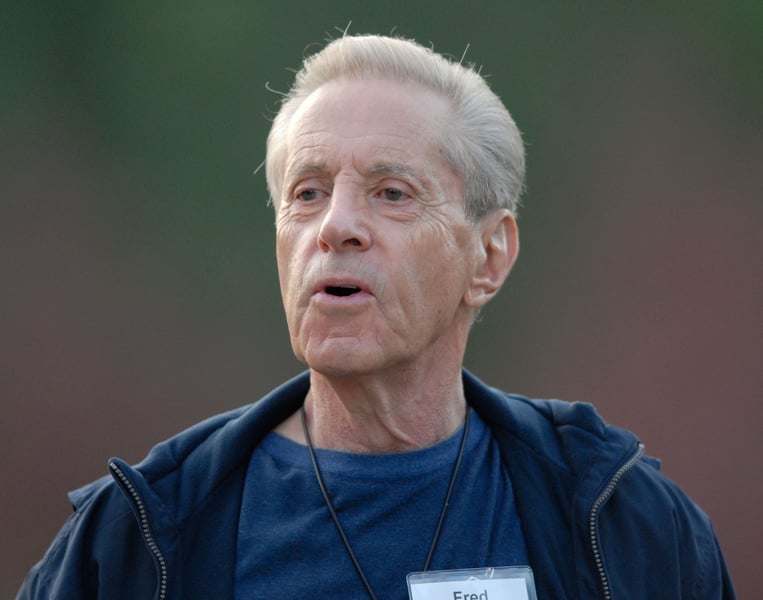

U.S. District Judge Jed Rakoff refused today to dismiss the suit as baseball team owners Fred Wilpon and Saul Katz had asked. Rakoff ruled that Madoff trustee Irving Picard can claim as much as $83.3 million without a trial. Picard seeks another $303 million, and must prove to a jury that the Mets owners and other defendants were “wilfully blind” to the fraud.

“The court remains skeptical that the trustee can ultimately rebut the defendants’ showing of good faith, let along impute bad faith to all the defendants,” Rakoff said in his ruling in U.S. District Court in Manhattan. “The principal issue remaining for trial is whether the defendants acted in good faith when they invested in Madoff securities in the two years prior to bankruptcy or whether, by contrast, they wilfully blinded themselves to Madoff’s Ponzi scheme.”

The trial is set to start March 19 in Manhattan court. The fraud cost investors an estimated $20 billion in principal, Picard has said.

Chance of Winning

“If Judge Rakoff is correct in his prognostication of the outcome of the trial, then the Mets may get away with paying no more than $83 million,” said Chip Bowles, a bankruptcy lawyer and baseball fan in Louisville, Kentucky. “They have a very good chance of winning within the parameters of proof Rakoff has imposed.”

The Mets owners, after losing $500 million in the Ponzi scheme, have cut the team’s basic payroll to about $90 million this season, from $140 million. They also have sold seven minority ownership shares in the team, Wilpon said last month. His target is to sell a total of 10, $20 million shares, each representing about 4 percent of the franchise.

In his suit, Picard tried to show the Mets owners blinded themselves to Madoff’s fraud because it benefited their businesses, ranging from the team to real estate. Wilpon and Katz countered by saying they trusted their money manager. Both sides presented conclusions disguised as facts, Rakoff said.

“Conclusions are no substitute for facts, and too much of what the parties characterized as bombshells proved to be nothing but bombast,” he said in the ruling.

Withdrawn Principal

The jury will be asked to decide whether Picard can take back principal the defendants withdrew from Madoff’s firm over two years or transferred to others, and what the status of their claims against the Madoff estate should be, Rakoff said.

David Sheehan, a lawyer for Picard, told Rakoff last month that he believed a jury would see the Mets owners as having been willfully blind.

Rakoff last year threw out most of Picard’s $1 billion lawsuit against the owners, saying Picard could pursue only $386 million at trial. Today he said Picard he would rule later on how much of the $83.3 million Picard can claim without trial. The sum represents fictitious profit got from the Ponzi scheme in the two years before the con man’s 2008 arrest.

David Newman, a Mets spokesman, didn’t immediately respond to an e-mail asking if the team owners would appeal Rakoff’s eventual decision on the profit. Amanda Remus, a Picard spokeswoman, didn’t immediately respond to an e-mail seeking comment on the ruling.

Madoff, 73, pleaded guilty in 2009 to orchestrating what prosecutors called the biggest Ponzi scheme in history, and is serving a 150-year sentence in a federal prison in North Carolina. Picard and his law firm, Baker & Hostetler LLP, have charged about $273 million in fees for liquidating the Madoff firm since it collapsed in December 2008.

--Bloomberg News--