A fresh slate of Wall Street firms agreed to collectively pay tens of millions of dollars to U.S. regulators over their employees’ use of unmonitored communication channels on the job.

The Securities and Exchange Commission said Friday that the firms, including Interactive Brokers Group Inc. and Robert W. Baird & Co. Inc., had broken rules that require employees’ business communications to be saved. In all, the companies agreed to pay $79 million in SEC penalties, according to the regulator.

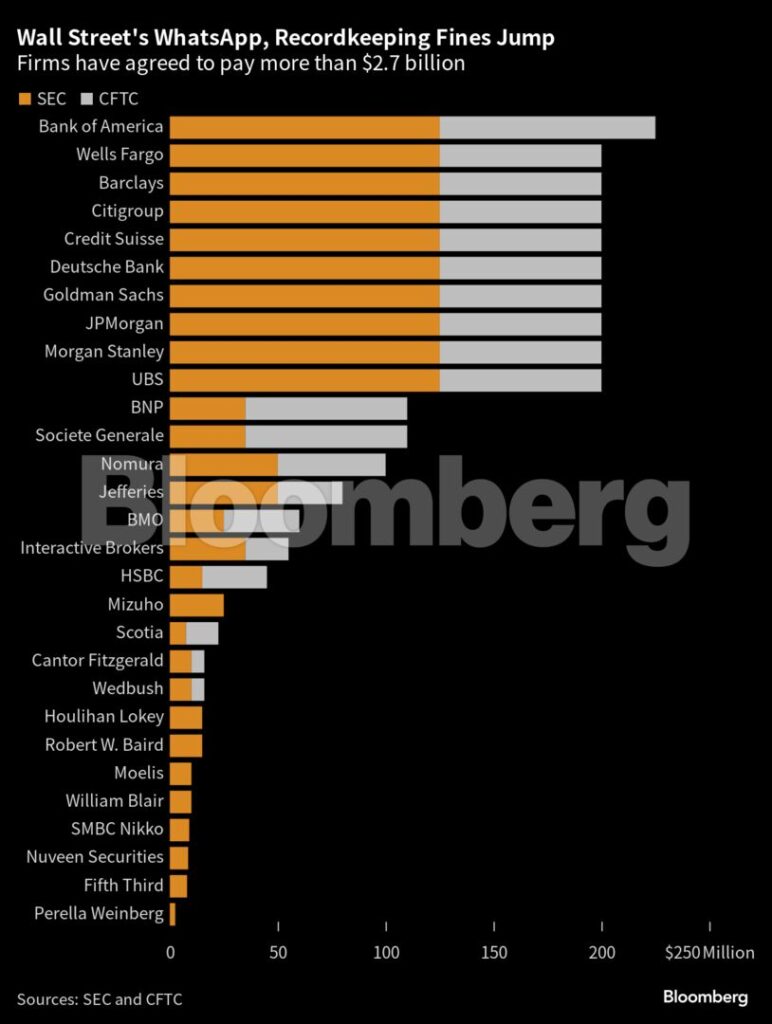

Financial firms are required to monitor and save communications involving their business to head off improper conduct. Friday’s penalties add to to the more than $2.5 billion that big banks previously agreed to pay the SEC and the Commodity Futures Trading Commission to settle similar investigations into use of text messages on personal phones and WhatsApp.

Regulators say it is significantly harder to investigate wrongdoing when firms fail to save records. Gurbir Grewal, the SEC’s enforcement director, has made companies’ record-keeping lapses a priority since he took office in 2021.

In the two largest SEC fines announced Friday, Interactive Brokers and an affiliate will pay $35 million, while Baird will pay $15 million, the SEC said. William Blair & Co., Nuveen, Fifth Third Bancorp, and Perella Weinberg Partners also agreed to pay smaller multimillion-dollar fines.

Interactive Brokers also agreed to pay the CFTC $20 million to resolve the futures regulator’s probe into its communication practices.

“It was well known within these institutions that their internal policies were being flagrantly violated in practice. But no one stopped it,” Christy Goldsmith Romero, a Democratic CFTC commissioner, said in a statement.

Interactive Brokers, William Blair, Fifth Third, and Perella Weinberg declined to comment. Nuveen said it was pleased to have resolved the matter.

Angela Taylor, a Baird spokesperson, said the firm was disappointed with the findings, but pleased to have resolved the case. “We have made enhancements to our compliance procedures in recent years related to this issue,” she added.

At 10:05 a.m. in New York on Friday, Interactive Brokers shares were up 0.2%, Fifth Third advanced 1.2% and Perella Weinberg rose 1.1%.

Bond rating companies Kroll Bond Rating Agency and DBRS Ltd. also agreed to pay SEC fines for their use of unmonitored communications Friday. DBRS declined to comment, while a representative for Kroll didn’t immediately respond to a request for one.

What began as scrutiny of trading desks’ use of chat apps has expanded to include all of finance’s use of any communication tool that doesn’t save records appropriately. Hedge funds and private equity firms are also under investigation for their use of personal communication apps.

Though dozens of firms have agreed to settle, Citadel is preparing to push back if the SEC proceeds with an enforcement action against the hedge fund giant, Bloomberg News has reported.

A Texas-based bank selects Raymond James for a $605 million program, while an OSJ with Osaic lures a storied institution in Ohio from LPL.

The Treasury Secretary's suggestion that Trump Savings Accounts could be used as a "backdoor" drew sharp criticisms from AARP and Democratic lawmakers.

Changes in legislation or additional laws historically have created opportunities for the alternative investment marketplace to expand.

Wealth managers highlight strategies for clients trying to retire before 65 without running out of money.

Shares of the online brokerage jumped as it reported a surge in trading, counting crypto transactions, though analysts remained largely unmoved.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.