A combination of factors, including the ability to trade stocks cheaply and in small quantities, as well as pandemic-driven market dips, caused both beginning and experienced retail investors to flock to the stock market last year, according to research by the Finra Investor Education Foundation and NORC at the University of Chicago.

Among survey respondents who opened new accounts in 2020, investing for retirement was the most frequently cited reason for opening the account, despite the study’s focus on taxable investing.

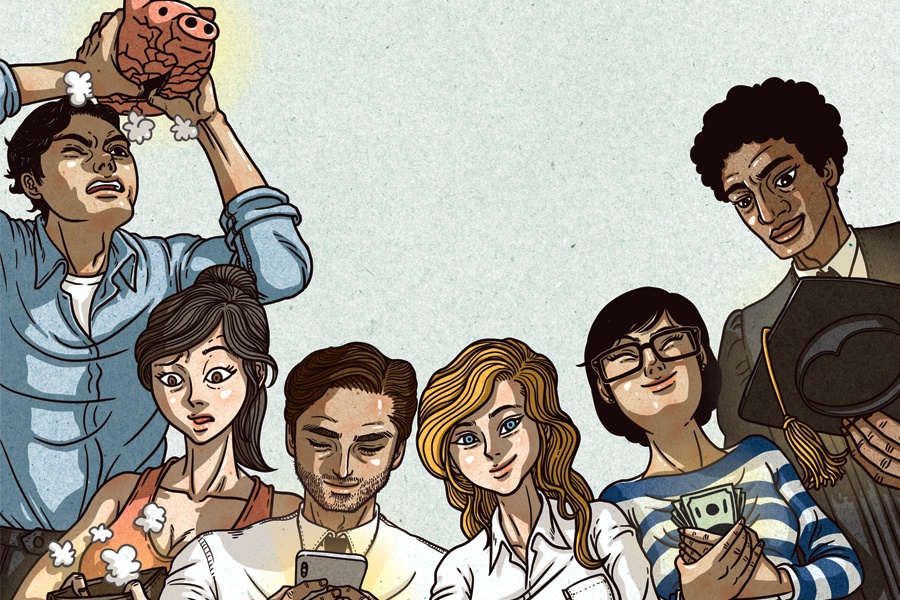

The study, Investing 2020: New Accounts and the People Who Opened Them, found that the majority of new investors — defined as those who opened a non-retirement investment account for the first time during 2020 — were under age 45 and had lower incomes than investors who already owned taxable investment accounts. New investors also were more likely to be racially or ethnically diverse.

Respondents from 1,300 surveyed households were grouped into three categories: new investors,who opened one or more non-retirement investment accounts during 2020 and did not own a taxable investment account at any time before 2020 (accounting for 38% of the total); experienced entrants, who opened a taxable investment account during 2020 and also owned an existing taxable investment account opened before 2020 (19%); and holdover account owners, who maintained a taxable investment account that was opened before 2020 but did not open a new account during 2020 (43%).

The survey found that the largest portion of African American investors (17%) were new investors, and the largest shares of Hispanic/Latino investors were new investors (15%) and experienced entrants (17%). New investors held smaller balances in their taxable accounts when compared to other investors, with 23% of female investors reporting balances under $500, compared to 15% of male investors.

While all investors reported relying on a variety of information sources when making financial decisions, holdover account owners more frequently relied on financial professionals, while experienced entrants more frequently conducted their own personal research. New investors more frequently relied on the advice of friends and family.

The survey found that investment knowledge was low among all groups, and particularly low for new investors.

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.