Progressive lawmakers want to implement a wealth tax to reduce economic inequality, but financial advisors doubt that levying taxes based on assets would work.

Just before Congress left Washington last week for its summer recess, several Democratic lawmakers introduced the Oppose Limitless Inequality Growth and Reverse Community Harm Act. The measure would impose tax brackets ranging from 2% to 8% on wealth that is 1,000 to 1 million times the median household wealth. The tax would amount to roughly 2% on $100 million to 8% on $120 billion, assuming median household income is $120,000.

The bill’s sponsors — Democratic Reps. Summer Lee of Pennsylvania, Barbara Lee of California, Jamaal Bowman of New York and Rashida Tlaib of Michigan — said that wealth disparity in the U.S. is growing and that those with greater means also have much more political influence than people in lower economic strata.

“Inequality in the United States is worse in 2023 than it was during the Gilded Age,” Rep. Barbara Lee said in a statement. “It is unacceptable that millions of hardworking people remain impoverished, while the top 0.1% hold over 20% of the nation’s wealth. The Oligarch Act is the solution we need to close the exorbitant wealth gap in America and create a tax system where everyone pays their fair share.”

The bill reignites a debate about taxing wealth rather than income to generate more revenue from individuals and families with massive financial assets. That conversation also is occurring at the state level, where legislators introduced several wealth-tax bills earlier this year.

But financial advisors expressed doubt that the approach is viable.

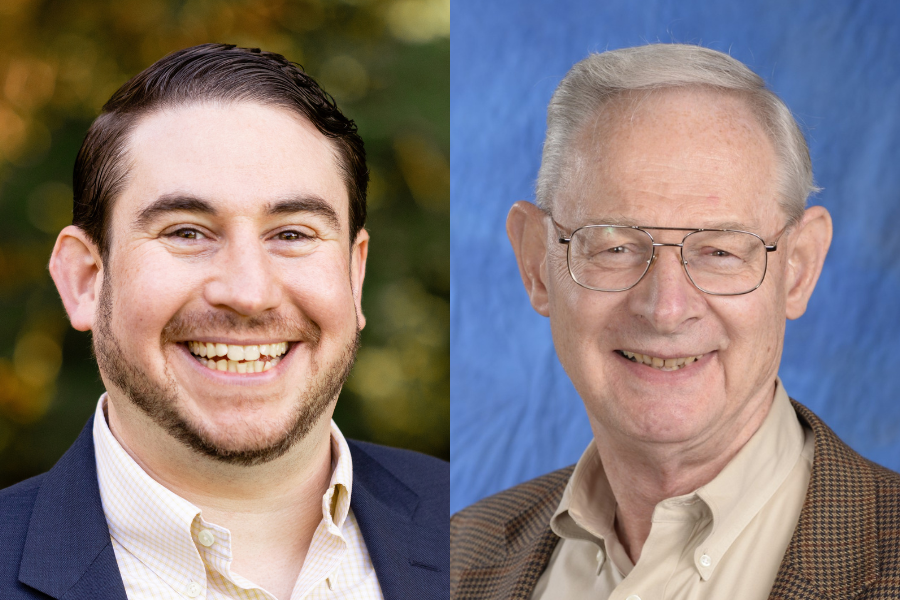

“It’s almost impossible to administer,” said Dick Power, owner of Power Plans, an investment advisory firm. “It doesn’t make any sense. It sounds lovely. As a practical matter, it’s wrong.”

One of the challenges is that wealth is determined by many different kinds of assets, which might be difficult to assess and value.

“You can’t calculate how much someone is worth,” Power said.

Jeremy Bohne, founder of Paceline Wealth Management, cautioned against adopting a fundamentally different approach to taxation — taxing wealth — when the current income tax code is fairly straightforward.

“Enforcing existing tax rules would be the easiest way to raise revenue without painful changes to taxes,” Bohne said. “In our current system, taxes arise from naturally occurring economic activity or life events, which are easily identified.”

If tax reform is the goal, Power also favors zeroing in on the current tax code rather than implementing a fundamentally different approach to taxation.

“It would be much better to address the tax loopholes people use to recognizing income,” he said.

The arguments in favor of a wealth tax that the authors of the tax bill made did resonate with one advisor.

“I’m all for anything that democratizes political power and reduces stratification,” Landon Tan, an advisor at Query Capital Financial Guidance, wrote in an email. “Perhaps, in the unlikely event that this passed, this legislation would make a dent in the inequality we see.”

The doubts that Tan has about the legislative viability of the bill are well-founded. It’s unlikely to be taken up at the committee level by the Republican-controlled House.

Democrats hold a slim majority in the Senate, but the party’s power there is heavily influenced by moderates who may not be as enthusiastic about a wealth tax bill or President Biden’s proposal to impose a minimum 25% tax on billionaires.

“They’re just playing political games,” Power said. “In my estimation, it won’t go anywhere.”

Summit Financial unveiled a suite of eight new tools, including AI lead gen and digital marketing software, while MassMutual forges a new partnership with Orion.

A new analysis shows the number of actions plummeting over a six-month period, potentially due to changing priorities and staffing reductions at the agency.

The strategic merger of equals with the $27 billion RIA firm in Los Angeles marks what could be the largest unification of the summer 2025 M&A season.

Report highlights lack of options for those faced with emergency expenses.

However, Raymond James has had success recruiting Commonwealth advisors.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.