President Donald Trump’s decision to extend a student-loan freeze will take away a financial risk for tens of millions of U.S. households that now won’t have to resume paying back about $1.2 trillion of debt until at least 2021.

The measure, one of four executive actions Trump took Saturday, keeps both repayments and the accumulation of interest on hold through the end of this year. An earlier waiver, approved by Congress in March as part of the government’s main pandemic relief bill, had been set to expire at the end of September.

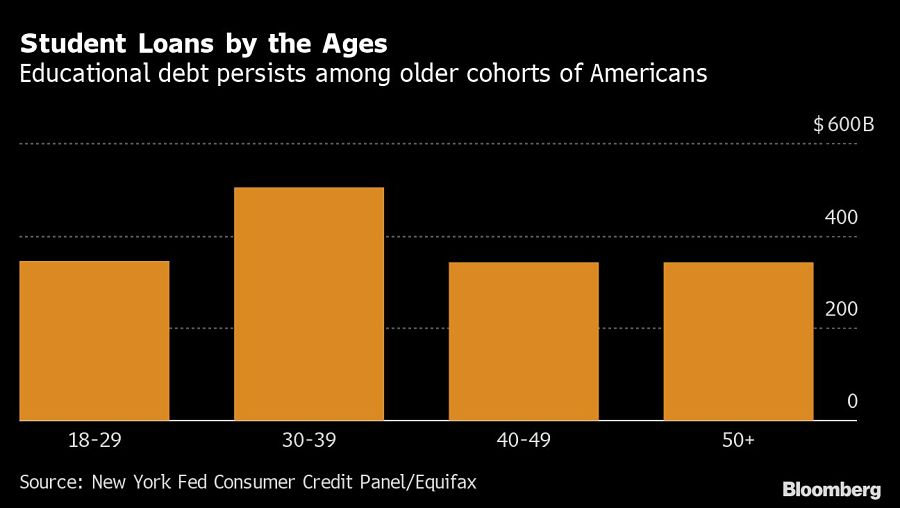

The order applies to loans held by the federal government, which make up some three-quarters of the country’s $1.54 trillion in student debt. The burden is spread across age groups, since millions of older Americans took loans to help out family members.

A Federal Reserve study in 2019 found that the typical amount of education debt was between $20,000 and $25,000, carrying a monthly payment of between $200 and $300. The New York Fed estimated earlier this year that Americans would save a total of about $7 billion a month while the freeze was in place.

Student debt has turned into a hot-button political issue, especially among younger voters, as it has increased by about $1 trillion since 2007 to become the second-largest slice of household obligations after mortgages.

Some 43 million people, about one in eight of the population, hold student loans. Roughly 20% were behind on payments before the pandemic struck, and the rate was proportionally higher among Black and Hispanic borrowers.

The reprieve doesn’t apply to those who have private student loans, about a quarter of the total. But some of those borrowers may have reached forbearance arrangements too, according to the New York Fed. In a report last week it said 88% of student-loan borrowers had a scheduled payment of zero in June.

The waiver also shields borrowers by effectively resetting credit scores, with delinquent loans now being reported as current. As a result, the average credit score of all student loan borrowers rose to 656 in June from 647 in March, according to the Fed.

Chasing productivity is one thing, but when you're cutting corners, missing details, and making mistakes, it's time to take a step back.

It is not clear how many employees will be affected, but none of the private partnership’s 20,000 financial advisors will see their jobs at risk.

The historic summer sitting saw a roughly two-thirds pass rate, with most CFP hopefuls falling in the under-40 age group.

"The greed and deception of this Ponzi scheme has resulted in the same way they have throughout history," said Daniel Brubaker, U.S. Postal Inspection Service inspector in charge.

Elsewhere, an advisor formerly with a Commonwealth affiliate firm is launching her own independent practice with an Osaic OSJ.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning