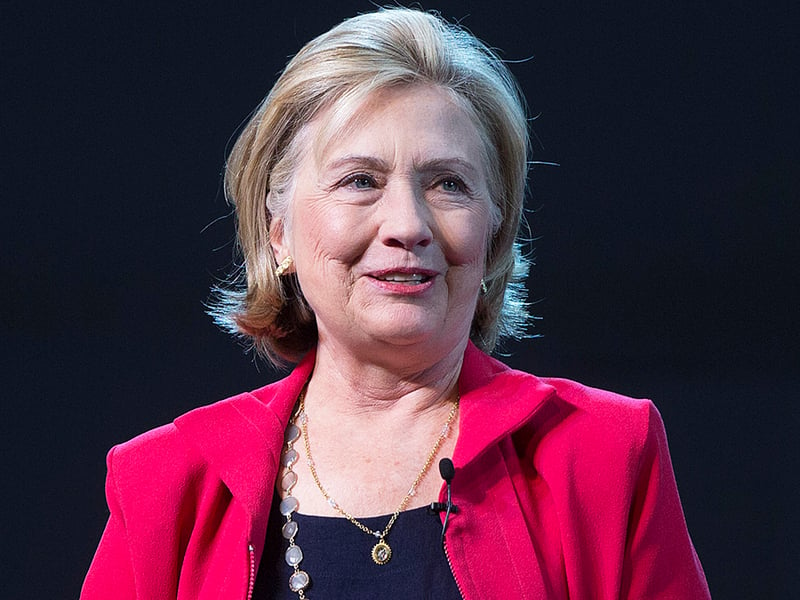

It wasn't quite as interminable as the wait for Godot, but Hillary Rodham Clinton is finally arriving on the presidential election scene. At least, if the scuttlebutt today is true: that she's going to announce her candidacy Sunday. What a Hillary presidency — if she were to make it all the way to the Oval Office — would mean for investment advisers and brokers will take a while longer to answer.

When the former secretary of state, New York senator and first lady launches her campaign, one question for investment advice professionals will be whether she will listen to Sen. Elizabeth Warren, D-Mass., or to Wall Street on the topic of fiduciary duty.

Ms. Warren has embraced raising investment-advice standards for brokers, becoming a champion of a pending Department of Labor rule that would require brokers to act in the best interest of clients when working with retirement accounts. A prominent figure at

an event at AARP in February where President Barack Obama endorsed the DOL rule, Ms. Warren has galvanized the progressive — once known as liberal — wing of the Democratic Party on financial regulation and other issues.

Ms. Clinton must inspire, or at least corral, Ms. Warren's faction of the party if she wants to keep the primary field to herself and build a foundation for victory in the general election. Given that the White House has made the best-interest standard a pillar of what Mr. Obama calls “middle-class economics,” we'll see if his former cabinet member uses the same playbook.

“Since this administration has shined a light on the fiduciary standard, I think there's a much higher chance it will come up [in the campaign] than if they hadn't,” said Karen Nystrom, director of advocacy at the Financial Planning Association. “I hope any presidential candidate would make this a priority, because it would help American savers overall.”

But having been a New York senator from 2001-2009, one of Ms. Clinton's most important constituencies, and sources of funding, was the financial services industry. Many in it have expressed opposition to a DOL fiduciary duty as well as skepticism toward a

related regulation the Securities and Exchange Commission is considering for retail investment advice.

On tax and fiscal policy, Ms. Clinton has a more moderate approach than the faction of the party led by Ms. Warren, said Paul Auslander, director of financial planning at ProVise Management Group.

“I think she'll be a hell of a lot better than Elizabeth Warren,” said Mr. Auslander, who is involved in Florida Democratic politics. “Elizabeth Warren has this great disdain for big business and Wall Street. Hillary Clinton has learned that you can be a Democrat and pro-business. That's the important distinction.”

When it comes to the SEC budget, Barbara Roper, director of investor protection at the Consumer Federation of America, anticipates Ms. Clinton's approach will be similar to the Obama administration's. The White House has consistently

sought to give the SEC a big funding boost, which the agency has said it would devote in part to strengthening adviser oversight.

“I would expect support for full funding,” Ms. Roper said. “As a senator from New York, she was certainly sensitive to Wall Street's concerns, but she believes in the role of government in policing the markets, I think.”

But there's a long road ahead. And although she's the prohibitive favorite to win the Democratic nomination, Mr. Auslander said Ms. Clinton will have a big fight on her hands to reclaim her White House residence. His fellow Floridian, former Republican Gov. Jeb Bush, for instance, could be a formidable competitor.

“I don't think she's pre-ordained,” Mr. Auslander said.