A mere 14% of American voters currently believe that their financial situation has improved since President Joe Biden took office, raising concerns about the potential repercussions for his re-election prospects. A recent poll reveals that approximately 70% of voters perceive the president's economic policies as either detrimental to the U.S. economy or having no impact at all, with 33% expressing the view that these policies have "hurt the economy significantly." In contrast, only 26% of respondents believe that Biden's policies have been beneficial.

The monthly poll, conducted jointly by the Financial Times and the University of Michigan's Ross School of Business, aims to monitor how economic sentiment influences the upcoming presidential race. Drawing parallels to Ronald Reagan's famous question in 1980, "Are you better off than you were four years ago?" this poll could shape the narrative for Biden's reelection bid.

Comparing this sentiment to the situation four years ago, a similar poll conducted for the FT indicated that most Americans did not feel they had improved their financial status under then-President Donald Trump, although their pessimism was less pronounced. In November 2019, only 35% of voters believed they were better off under Trump, while 31% believed they were worse off.

These new poll results underscore the challenge the president faces in persuading voters of the merits of "Bidenomics," his strategy to revitalize the nation's industrial sector and address years of middle-class wage stagnation.

Over the summer, Biden and his senior officials embarked on an extensive nationwide tour labeled "Investing in America" to spotlight and explain their policies, with the aim of garnering greater support for his administration's agenda.

However, there are scant indications that these efforts bore fruit.

The latest Reuters/Ipsos poll reveals that President Biden's approval rating remains at approximately 40%, which is perilously close to the lowest point of his presidency. Additionally, he consistently receives poor ratings for his management of the economy, partly fueled by public dissatisfaction with rising food and energy costs.

"All I know is what I see in the polls and there are huge majorities of people in this country who think that the president is too old and I don't know if they are able to look beyond that and see, you know, the increase in manufacturing jobs and other aspects," Democratic political strategist James Carville told Reuters. "Thus far, they have not."

When respondents were asked about the primary source of their financial stress, a staggering 82%. cited rising prices. Three-quarters of those polled also considered rising prices as the most significant threat to the U.S. economy in the next six months.

Erik Gordon, a professor at Michigan's Ross School, noted, "Every group — Democrats, Republicans, and independents — lists rising prices as by far the biggest economic threat and the biggest source of financial stress. That is bad news for Biden, especially considering how limited his options are for reversing this perception before election day."

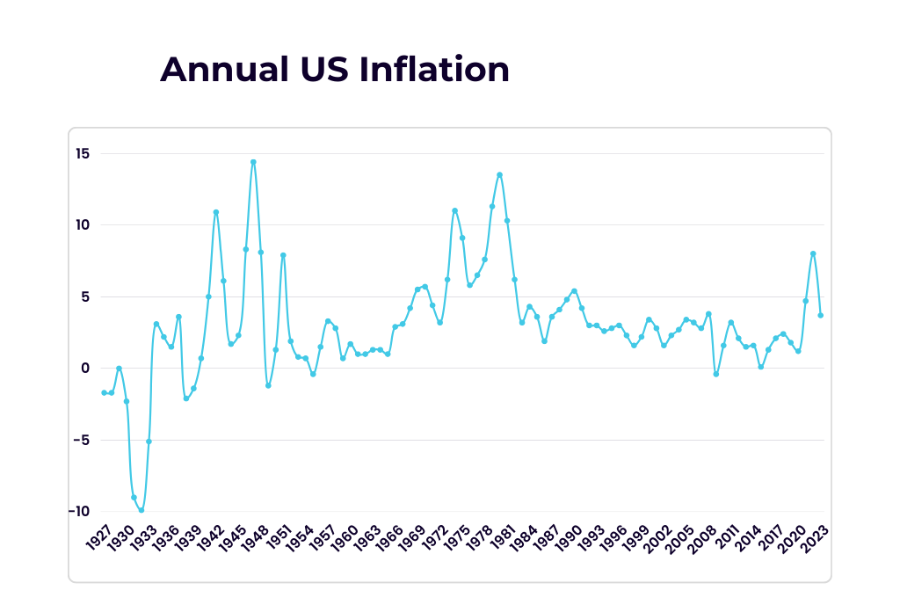

Rising prices have persisted during Biden's three years in office, and although inflation has eased from last year's peak of 9.1%, recent official figures show a 3.7% increase in the consumer price index in September compared to the previous year, well above the Federal Reserve's 2% target.

In response to inflationary pressures, 65% of voters reported cutting back on nonessential spending, such as vacations and dining out, while 52% said they had reduced spending on food and other everyday necessities.

Despite record job growth and nearly three years of economic expansion under President Biden, the negative perception of his economic record prevails. His political allies remain hopeful that as the campaign intensifies and more Americans scrutinize his achievements, they can still win over voters.

Surprisingly, over half of the poll's respondents (52%) indicated that they had heard "a little" or "nothing" about the president's efforts to improve the economy.

The FT-Michigan Ross poll echoes the findings of several other national surveys that suggest Biden would lose to former President Trump in a hypothetical general election match-up. Consequently, some Democrats are beginning to question whether Biden should be their presidential nominee, despite recent victories in high-profile off-year elections in Kentucky, Virginia, and Ohio.

The poll, conducted online by Democratic strategists Global Strategy Group and Republican polling firm North Star Opinion Research between Nov. 2-7, reflects the opinions of 1,004 registered voters nationwide, with a margin of error of plus or minus 3.1 percentage points.

To help fund the proposal, the governor and Florida's finance chief are probing municipal finances on a "local government accountability tour" to uncover potential waste.

Edward Jones’ job cuts and overall realignment internally are contributing to higher costs for the company, it said in its recent quarterly report.

Meanwhile, Fifth Third's RIA arm adds a former billion-dollar BNY trio in Boulder, Colorado, while a hybrid RIA opens a new North Carolina location with a former Raymond James-affiliated team.

Analysis highlights swelling out-of-pocket costs and wasted time on paperwork, with an outsized toll on businesses and around crypto transactions.

The appointment to its investment management arm comes roughly a year after the firm first announced plans to launch its own exchange-traded fund platform.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.