When advisers at wirehouses or independent broker-dealers look to launch their own firm, the main question on their minds is, “How will I recreate the products and services I’ve always offered my clients throughout my career, as an employee of my current firm?”

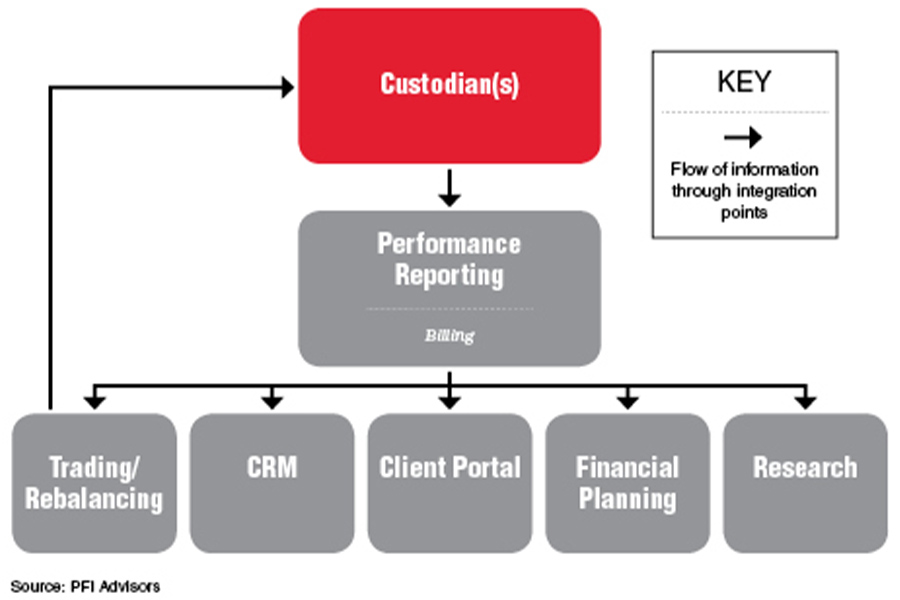

As they start to think through their technology stack, we advise them to choose a custodian first and a reporting provider second. The reporting provider will act as the “hub” through which all data flow across the rest of a registered investment adviser's back-office infrastructure.

For advisers moving to the RIA channel, reporting technology offers the first chance to provide clients with a holistic picture of their total net worth, including assets held outside of the adviser’s purview.

Custodial statements provide account owners with balances and transaction history. These statements are broken down by account number and act as an efficient way for clients to verify, through a third party, the assets they have invested under the RIA’s purview.

These statements do not, however, provide any performance numbers at the account, household, asset class or security level. The custodial statements provide no commentary on the direction of the markets or the specific investment strategy the client is invested in.

If the adviser wants to paint a picture of the client’s financial standing, he or she will need to utilize performance reporting software. With this technology, advisers can create customized and dynamic reports, usually through a drag-and-drop interface, to group accounts within the household in the most logical way for the client to understand.

Reporting provider technology also includes a client portal and a billing module, both essential components of an RIA’s business. Because this technology is so essential to an RIA’s infrastructure, here are four industry-leading reporting solutions for RIAs.

Advisers looking to move to the independent channel would be well-advised to learn more about these technology solutions, as they act as the engines that drive RIA business across the country (and globe).

Matt Sonnen is founder and CEO of PFI Advisors, an operations and technology consulting firm for RIAs, which recently published a report, “The Importance of Reporting Provider Technology for RIAs.” Follow him on Twitter @mattsonnen_pfi.

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.