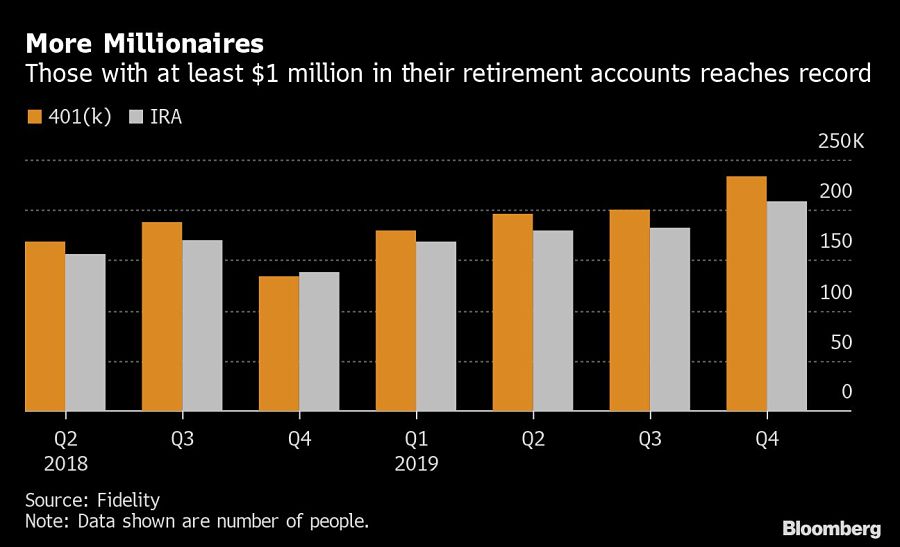

The bull market is minting plenty of millionaires — at least when it comes to retirement accounts.

The number of people with $1 million or more in their 401(k) or individual retirement account on the Fidelity Investments platform reached record levels last quarter, fueled by higher savings rates along with market appreciation, the fund company said in a report Thursday.

Some 233,000 savers held seven-figure 401(k)s as of Dec. 31, up about 17% from the prior quarter. Among IRA holders, 208,000 people made the club, a 14% increase. Investor savings rates have been trending higher in part because employers are automatically increasing their contributions.

Fidelity said the average 401(k) account balance at the end of last year was $112,300, which is also a record high and up 7% from the third-quarter balance of $105,200. The average balance in individual retirement accounts hit a record $115,400, up 5% from the third quarter.

"Im glad to see that from a regulatory perspective, we're going to get the ability to show we're responsible [...] we'll have a little bit more freedom to innovate," Farther co-founder Brad Genser told InvestmentNews.

Former advisor Isaiah Williams allegedly used the stolen funds from ex-Dolphins defensive safety Reshad Jones for numerous personal expenses, according to police and court records.

Taking a systematic approach to three key practice areas can help advisors gain confidence, get back time, and increase their opportunities.

Meanwhile, Osaic lures a high-net-worth advisor from Commonwealth in the Pacific Northwest.

The deals, which include its first stake in Ohio, push the national women-led firm up to $47 billion in assets.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.