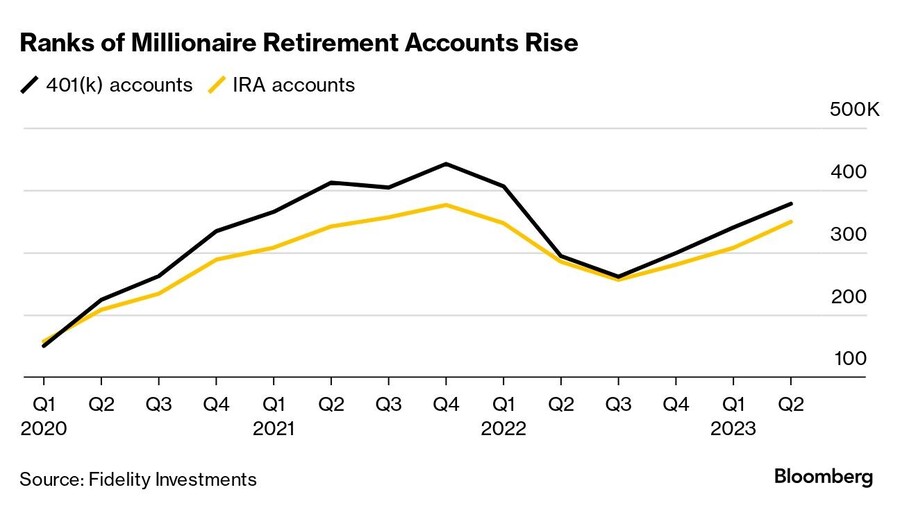

IRA and 401(k) millionaires are staging a comeback, with the number of seven-figure retirement accounts at Fidelity Investments inching back toward a 2021 high.

The tally of such accounts rose by more than 12% in the second quarter to 727,104, according to an analysis released by Fidelity Thursday. That’s the highest since the first three months of 2022 and within striking distance of a record.

This year’s double-digit gains in the benchmark S&P 500 have helped swell retirement balances for a third quarter in a row following a plunge that tracked the stock market last year.

“The average tenure of our millionaire 401(k) savers is 26 years, showing that staying in-plan and continuing to invest over the long term can pay huge dividends over time, particularly during positive turns in the market,” said Michael Shamrell, vice president of thought leadership at Fidelity Workplace Investing.

And while younger savers haven’t had decades in the market to amass large balances, Fidelity data show that many borrowers used the federal student loan payment pause to funnel money into retirement accounts. Close to three-quarters of student loan borrowers put at least 5% of their pretax salaries into 401(k)s during the period when payments were paused. That compares with 63% before the pause.

The average 401(k) balance at Fidelity is $112,400

Meanwhile, an experienced Connecticut advisor has cut ties with Edelman Financial Engines, and Raymond James' independent division welcomes a Washington-based duo.

Oregon-based Eagle Wealth Management and Idaho-based West Oak Capital give Mercer 11 acquisitions in 2025, matching last year's total. “We think there's a great opportunity in the Pacific Northwest,” Mercer's Martine Lellis told InvestmentNews.

Osaic has now paid $17.2 million to settle claims involving former clients of Jim Walesa.

Osaic-owned CW Advisors has added more than $500 million to reach $14.5 billion in AUM, while Apella's latest deal brings more than $1 billion in new client assets.

The up-and-coming Los Angeles-based RIA is looking to tap Merchant's resources to strengthen its alts distribution, advisor recruitment, and family office services.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.