Joe Biden issued the first veto of his presidency, rejecting legislation that would thwart a rule allowing retirement portfolio managers to weigh climate change and other environmental, social and governance issues in their investment decisions.

“I just vetoed my first bill. This bill would risk your retirement savings by making it illegal to consider risk factors MAGA House Republicans don’t like,” Biden said in a tweet on Monday. “Your plan manager should be able to protect your hard-earned savings — whether Representative Marjorie Taylor Greene likes it or not,” he added, referring to the Republican lawmaker from Georgia.

The tweet included a video, where Biden said he “just signed this veto because legislation passed by the Congress would put at risk the retirement savings of individuals across the country. They couldn’t take into consideration investments that would be impacted by climate, impacted by overpaying executives. And that’s why I decided to veto it, it makes sense to veto it.”

The Department of Labor rule was created to undo a Trump-era requirement mandating that workplace retirement-plans focus purely on financial gains. So-called ESG factors — short-hand for environment, social and governance — have grown in popularity in the finance sphere.

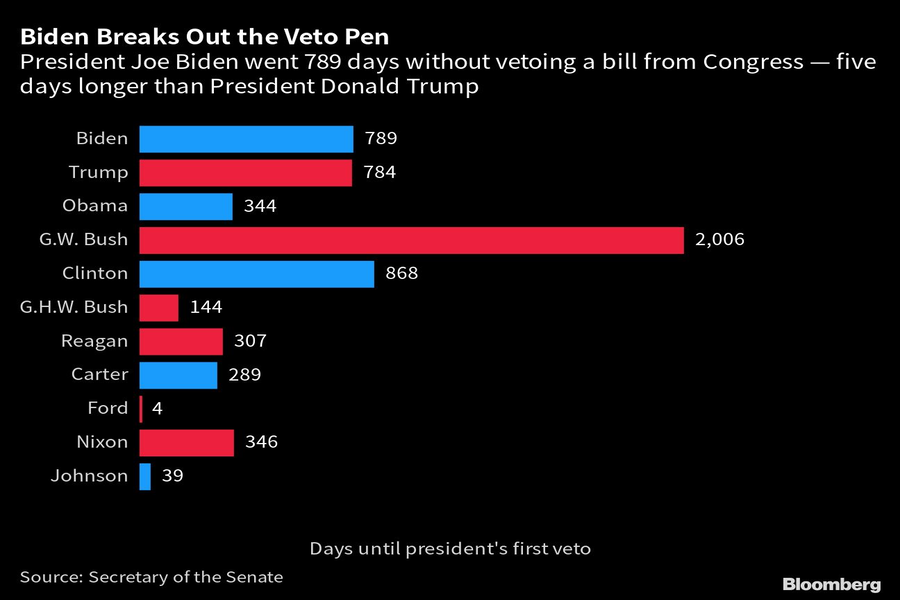

With Democrats in control of both the House and Senate during his first two years in office, Biden has been spared having to exercise his veto power until now. The move portends more confrontations to come with Republicans, who took control of the House in January.

The measure blocking the rule passed 50-46 in the Senate earlier this month, with two Democrats — Joe Manchin of West Virginia and Jon Tester of Montana — joining with Republicans. Three Democratic senators were absent for the vote, contributing to a rare loss for Democrats, who have the ability to stave off Republican-led bills with a 51-49 majority in the chamber.

The Republican-led House had voted 216-204 to clear its version, and the vote tally in both chambers indicates that Congress lacks the two-thirds majority needed to override a Biden veto.

Still, passage marked a victory for Republicans’ crusade against “woke” capitalism: They’re attacking ESG as an attempt to push climate-change politics into Americans’ financial planning.

Republicans have only ramped up their attacks on ESG investing following the collapse of Silicon Valley Bank this month, saying politically driven investment decisions were partly responsible for the banking crisis.

“They were one of the most woke banks in their quest for the ESG-type policy and investing,” Representative James Comer, chairman of the House Oversight Committee, told Fox News.

Florida Governor Ron DeSantis and Virgina Governor Glenn Youngkin — two potential 2024 GOP presidential aspirants — are among the chief critics of ESG-based investing.

Former Presidents George W. Bush and Barack Obama each used their veto pen a dozen times during their two-term tenures, while Donald Trump vetoed 10 Congressional bills, according to government data.

Elsewhere in Utah, Raymond James also welcomed another experienced advisor from D.A. Davidson.

A federal appeals court says UBS can’t force arbitration in a trustee lawsuit over alleged fiduciary breaches involving millions in charitable assets.

NorthRock Partners' second deal of 2025 expands its Bay Area presence with a planning practice for tech professionals, entrepreneurs, and business owners.

Rather than big projects and ambitious revamps, a few small but consequential tweaks could make all the difference while still leaving time for well-deserved days off.

Hadley, whose time at Goldman included working with newly appointed CEO Larry Restieri, will lead the firm's efforts at advisor engagement, growth initiatives, and practice management support.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.