Fidelity Investments and Vanguard announced a rare collaborative effort Wednesday to help employees keep their retirement savings in tax-advantaged accounts like 401(k)s when they switch jobs.

The two retirement giants, along with benefits administrator Alight Solutions, created a jointly owned consortium to automate the transfer of millions of 401(k) accounts with balances below $5,000 when workers change employers. An estimated $92 billion is taken out of retirement savings each year due to cash-outs, according to the Employee Benefit Research Institute.

Auto-portability of workplace retirement plans is an idea that’s been talked about for years but requires scale to make much of a difference. EBRI estimates that if auto-portability is widely adopted, it would keep an additional $1.5 trillion in retirement plans over 40 years, with Black and minority workers saving an additional $619 billion and women saving $365 billion more.

The cash-out problem is likely to worsen as people switch jobs more frequently. Workers who have less than $5,000 saved tend to be lower-income, women and minorities, according to Alison Borland, executive vice president of Wealth Solutions at Alight, who said the effort “is meant to be a low-cost way to preserve savings for those who need it most.”

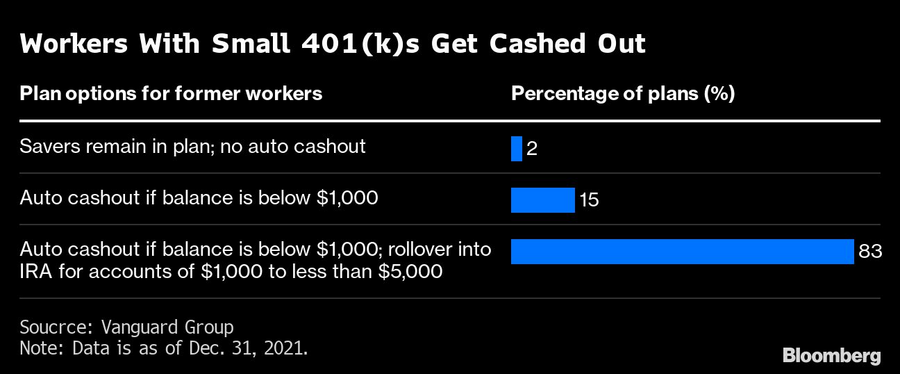

It isn’t always the employee who does the cashing out — balances of less than $1,000 may be cashed out by the former employer and sent via check to the worker. If that check isn’t rolled into a new 401(k) plan or individual retirement account fairly quickly, workers pay tax and a 10% penalty if they’re younger than 59½.

An employer may also roll an old employee’s 401(k) of less than $5,000 into an IRA, a practice that has drawn criticism if the money sits in a money market fund being eaten away by fees.

Retirement Clearinghouse, which developed an auto-portability service, will be the digital hub used to locate and match employees. The fees charged to plan participants will be standard, with accounts below $50 transferred for free and a maximum fee of $30.

“We are very intentionally setting the price at the lowest possible cost, and any excess of operating needs we intend to put back into future price decreases,” said Kevin Barry, president of the workplace investing division of Fidelity Investments. “This is not about record-keepers trying to make money on this population.”

For employers, the service solves the sometimes clunky process of rolling over 401(k)s, along with keeping track of and servicing the accounts of ex-employees with low balances.

“Workers should not have to move mountains to move their retirement savings to a new employer,” said John James, managing director and head of Vanguard Institutional Investor Group. Vanguard announced its plan to use the service earlier this year.

Chasing productivity is one thing, but when you're cutting corners, missing details, and making mistakes, it's time to take a step back.

It is not clear how many employees will be affected, but none of the private partnership’s 20,000 financial advisors will see their jobs at risk.

The historic summer sitting saw a roughly two-thirds pass rate, with most CFP hopefuls falling in the under-40 age group.

"The greed and deception of this Ponzi scheme has resulted in the same way they have throughout history," said Daniel Brubaker, U.S. Postal Inspection Service inspector in charge.

Elsewhere, an advisor formerly with a Commonwealth affiliate firm is launching her own independent practice with an Osaic OSJ.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning