As of June 6, 2024, the total debt of the U.S. government was $34.67 trillion, up from $32 trillion only a year ago. In fact, the federal government spent $658 billion on net interest costs on the national debt in 2023, or about 2.4% of GDP. This was the largest amount ever spent on interest in the budget, reflecting a 38% increase from 2022.

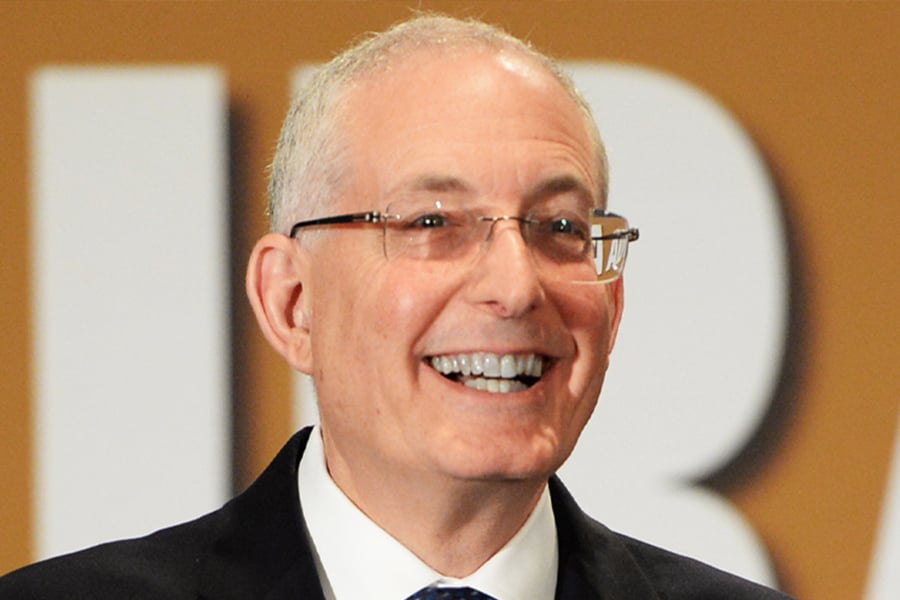

All this borrowing by Uncle Sam eventually needs to be paid for. And that means higher taxes ahead - or look out below, says IRA expert Ed Slott, author of the newly released The Retirement Savings Time Bomb Ticks Louder.

“It's a ticking time bomb,” said Slott. “It's the tax in your IRAs and 401Ks. That money has not yet been taxed. It's tax deferred, not tax free. And with taxes probably going up very soon, a lot of that could be lost when you need the money the most in retirement.”

Slott’s latest book is the sequel to his 2021 bestseller The New Retirement Savings Time Bomb, which helped readers take control of their financial lives by avoiding unnecessary taxes, primarily in their retirement accounts. Slott felt the need to update that book after Congress made a number of changes in the retirement space in the Secure 2.0 Act, even as it continued to dig a deeper hole in terms of its debt obligations.

In Slott’s view, those taxes on retirement savings accounts are going to have to be paid eventually, so savers should pay them now while tax rates are still at all-time lows. That means opening up - or converting to - a Roth IRA, which will allow savers to contribute after-tax dollars and withdraw them tax-free and penalty-free after the age of 59 and a half.

“Roth IRAs offer more opportunities,” said Slott. “You have the Roth 401Ks, you have even 529 to Roth, Roth Sep, Roth Simple, Roth matching, Roth catch-up. Congress went Roth crazy. Why? Because they need the revenue. They get the money upfront. So let's take advantage of their shortsightedness.”

The elimination of the Stretch IRA in the Secure Act was also an impetus for Slott to revamp his book. The Stretch IRA was an estate planning strategy that allowed IRA distributions to be extended over multiple generations. But with its removal, that money has to come out quicker, according to Slott.

“The money has to come out by the end of the 10th year after death, so they've shortened the window where all of this money will be taxed. That's going to lead to a heavier tax bill. And nobody wants the uncertainty of what future higher taxes can do to their standard of living in retirement,” said Slott, who offers strategies for saving money in his new book.

Penalties for pulling money out of retirement accounts prematurely have also grown steeper. And while there are some exceptions in hardship cases, Slott maintains this should be the last resort.

“That money is for retirement. If you tap it now, what are you going to have later? But life gets in the way. Things happen. So there are ways to get it out without the 10% penalty. But you still pay the tax,” said Slott.

As for the most common tax trap people fall into, Slott says its waiting too long to take their money out of a taxable retirement account.

“Everybody likes to see their accounts build and build and build, but it's building parts for Uncle Sam too. He is a partner in that account,” said Slot.

Added Slott: “The key to this whole book is to get that balance down while rates are low and move it to tax free vehicles like Roth IRAs or use charity or even permanent life insurance. Anything where you keep more of your hard-earned money.”

Most firms place a limit on advisors’ sales of alternative investments to clients in the neighborhood of 10% a customer’s net worth.

Those jumping ship include women advisors and breakaways.

Firms in New York and Arizona are the latest additions to the mega-RIA.

The agent, Todd Bernstein, 67, has been charged with four counts of insurance fraud linked to allegedly switching clients from one set of annuities to another.

“While harm certainly occurred, it was not the cataclysmic harm that can justify a nearly half billion-dollar award to the State,” Justice Peter Moulton wrote, while Trump will face limits in his ability to do business in New York.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.